Back

DAMALLA PIYUSH NARAYAN

"Building products, ... • 20d

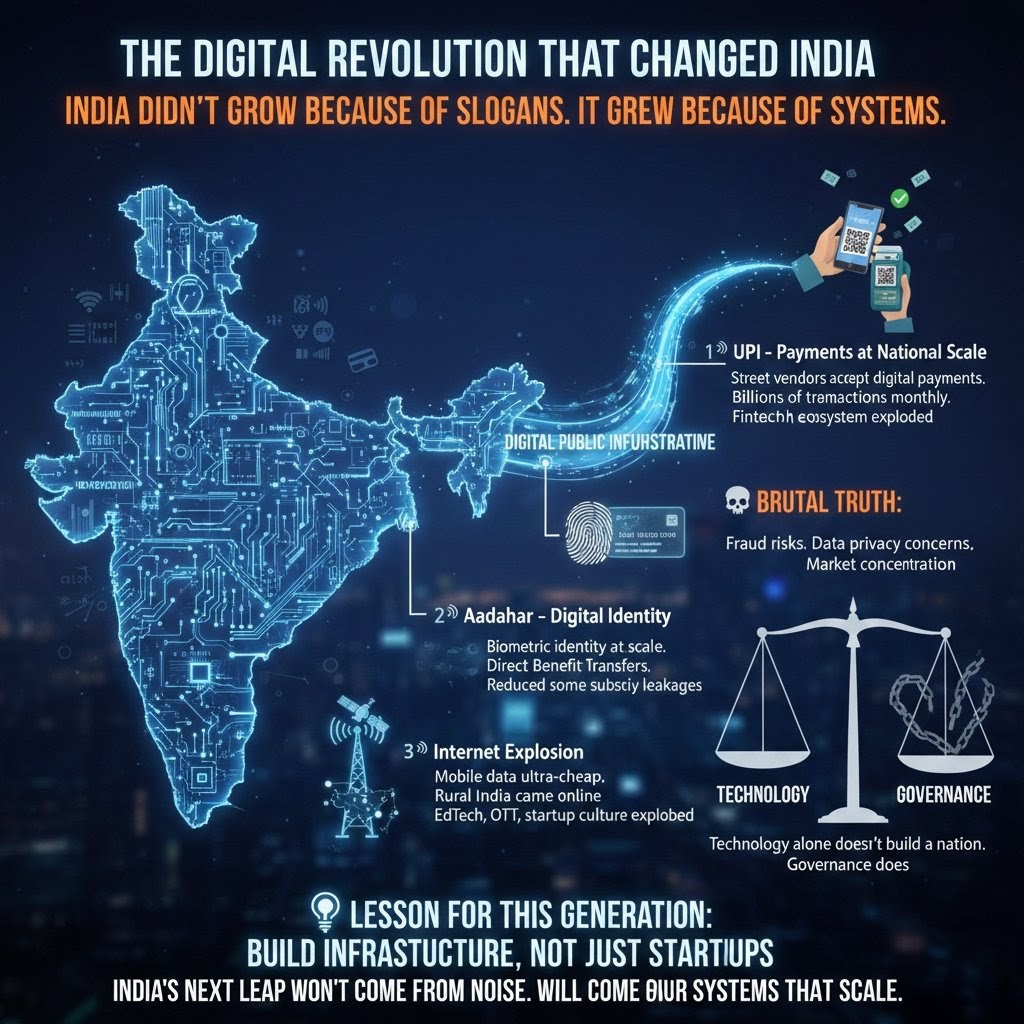

The Digital Revolution That Changed India India didn't grow because of slogans. It grew because of systems. The Big Shift: Digital Public Infrastructure India built something most countries still don't have — a public digital backbone. UPI – Payments at National Scale Built by NPCI, UPI made instant bank transfers free and simple. Street vendors now accept digital payments. Billions of transactions happen monthly. The fintech ecosystem exploded. Aadhaar – Digital Identity UIDAI enabled biometric identity at scale. Direct Benefit Transfers reduced subsidy leakages. Banking onboarding became faster. Internet Explosion Reliance Jio made mobile data ultra-cheap. Rural India came online. EdTech, OTT, and startup culture exploded. Brutal Truth: Digital growth created opportunity. But also fraud risks, data privacy concerns, and market concentration. Technology alone doesn't build a nation. Governance does. If you want to grow India — build infrastructure, not just startups.

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreAshish Singh

Finding my self 😶�... • 9m

🚀#1: India’s Own Social Media – A Vision by Bhavish Aggarwal (Co-Founder & CEO, Ola) Series: “Ideas from India’s Top Founders” >⚡ “India needs a social media platform built on its own Digital Public Infrastructure (DPI). This would give users full

See More

gray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Account Deleted

Hey I am on Medial • 1y

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)