Back

Mahendra Lochhab

Content creator • 11m

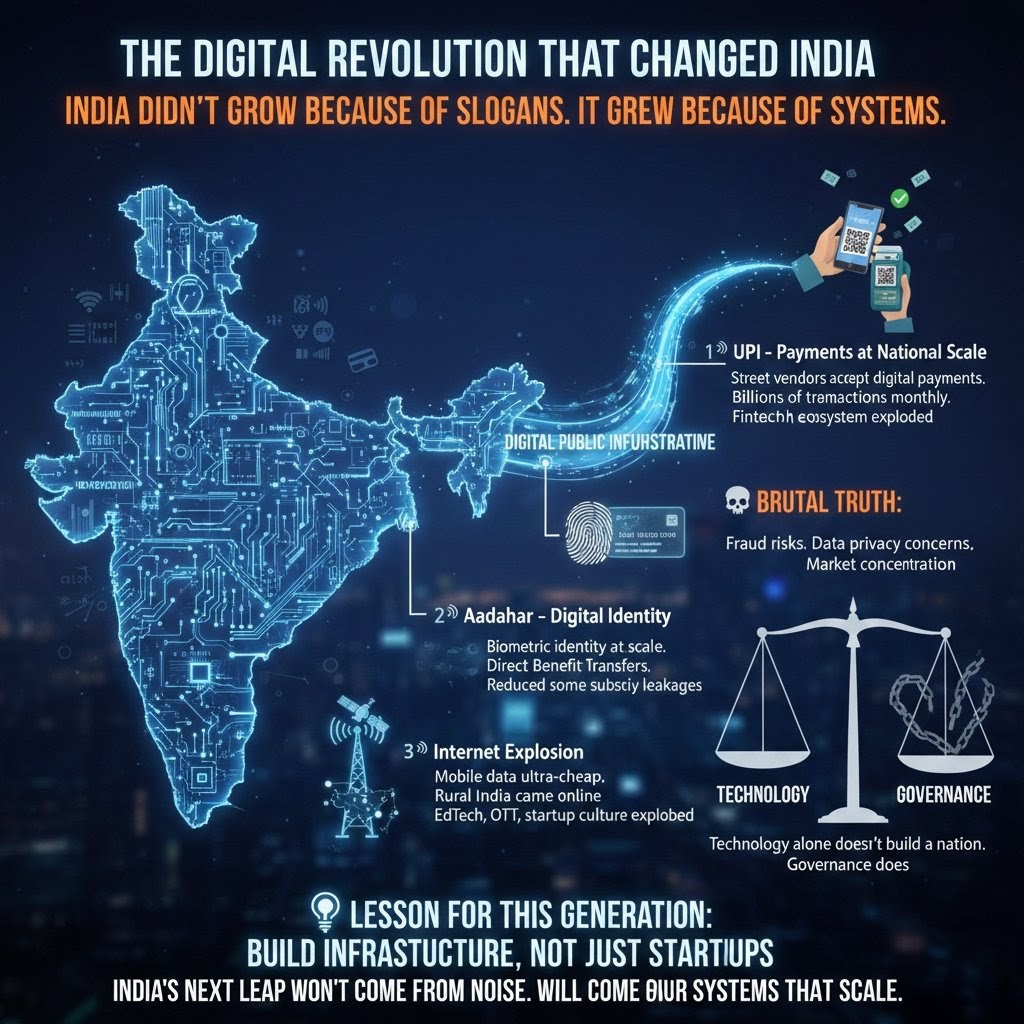

UPI, established by the National Payments Corporation of India (NPCI) in 2016, is the dominant payment platform in India, processing over 75% of the country's retail digital payments.

More like this

Recommendations from Medial

Dr Sarun George Sunny

The Way I See It • 6m

The National Payments Corporation of India (NPCI) is developing UPI 3.0, an upgrade to its UPI that will enable payments through smart devices. The new system will be Internet of Things (loT) -enabled, allowing automated transactions via devices such

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreMr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See MoreGyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)