Back

RV Dhameliya

Student • 8m

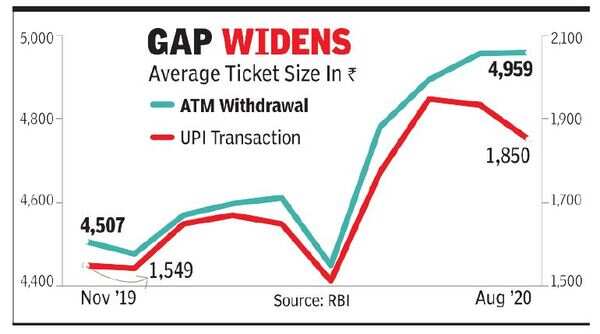

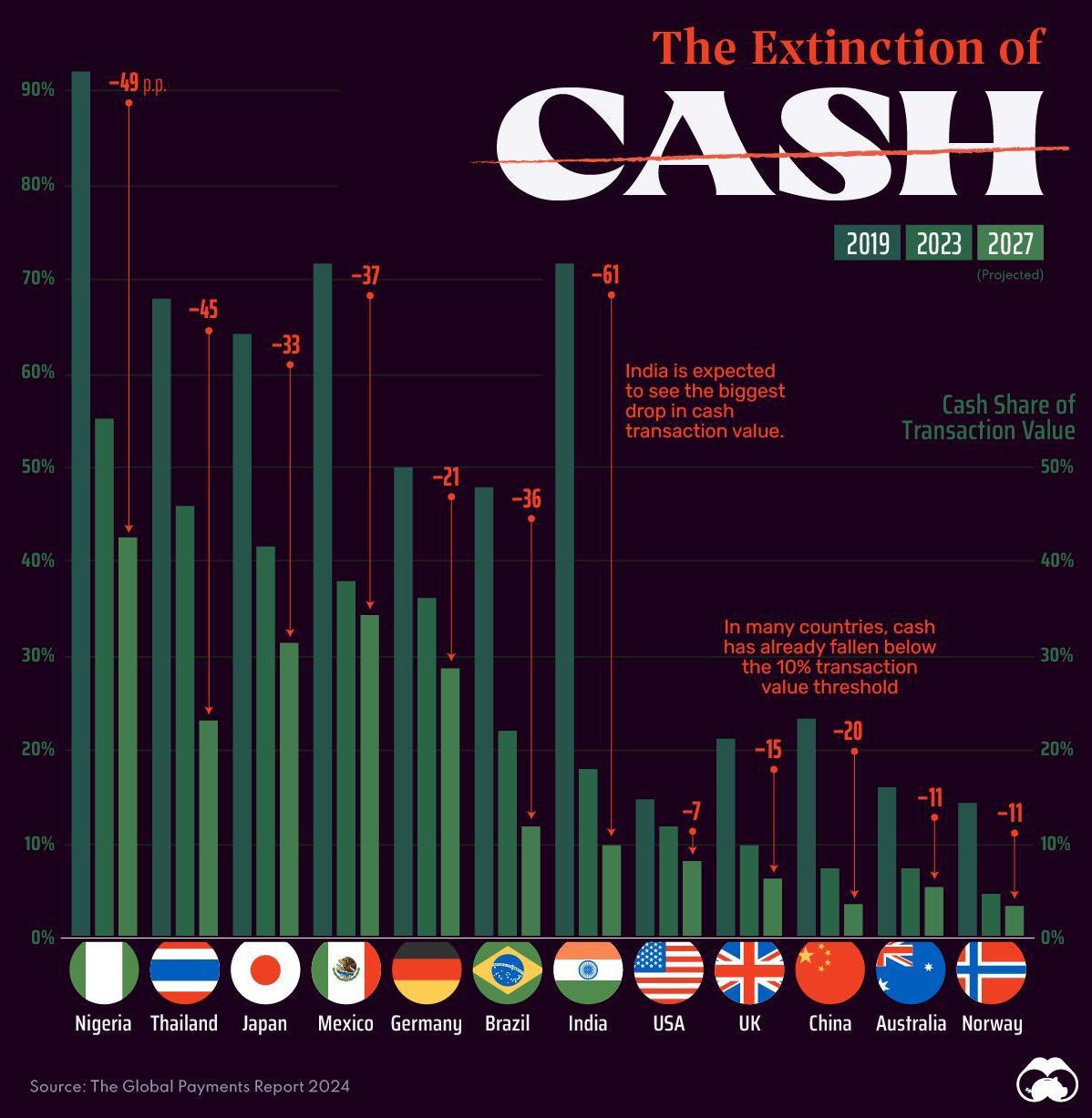

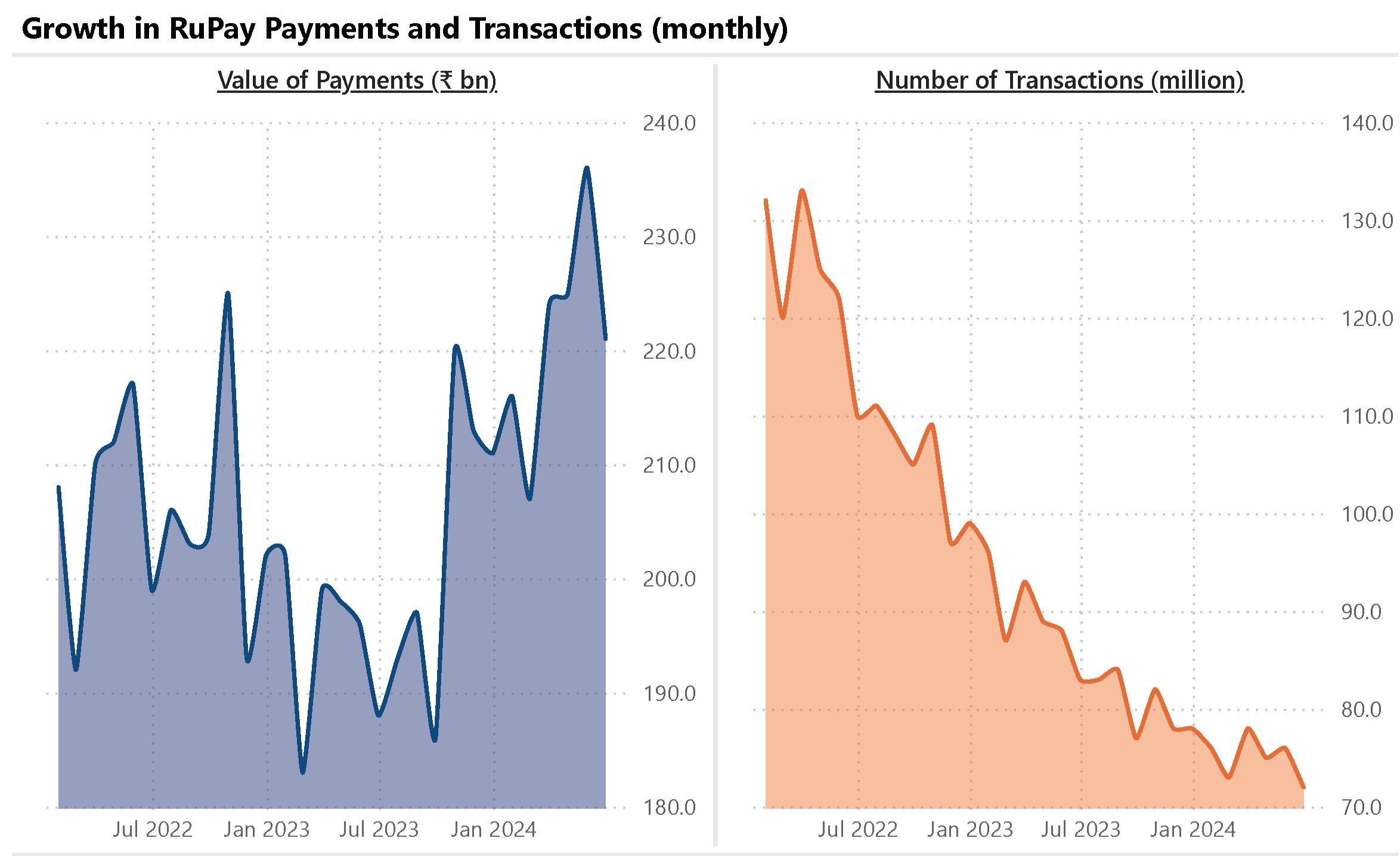

In the last five years, cash withdrawals initially increased but are now declining, while the number of ATMs is steadily decreasing. 1. Cash Withdrawals Growth → Then Fall Growth till 2022–23, now falling. Digital payments like UPI, QR codes, wallets might be replacing cash. 2. ATM Count Slowly Declining ATM numbers fell from 2.16 lakh to 2.11 lakh. Banks are reducing ATM costs due to online banking & mobile payment growth. 3. People Still Use ATMs Frequently Number of transactions is growing every year, even with falling cash withdrawal. Possibly smaller, more frequent transactions. લોકો રોકડ ઉપાડ કરતા ઓછા થયા છે, પણ એટીએમ ટ્રાન્ઝેક્શન વધ્યા છે. ડિજિટલ પેમેન્ટના ઉપયોગમાં વધારો અને એટીએમની સંખ્યા ઘટી રહી છે.

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

How ATMs Make Money – Let's Find Out! 🤑💸 1. Transaction Fees: When you withdraw money from an ATM, you are charged a certain fee. This fee goes to the ATM operator and is a significant source of their income. 2. Balance Inquiry Fees: Checking yo

See MoreEliphaz Yesudas

Helping SaaS and B2C... • 9m

i have an idea of building an app that can show the balance in the ATM(with some extra features ) , so users can go to the ATM that has enough money for the user (used needs ) . my question is 1. is it relevant in this digitalization world where

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)