Back

Laxit Rana

•

Repute • 1y

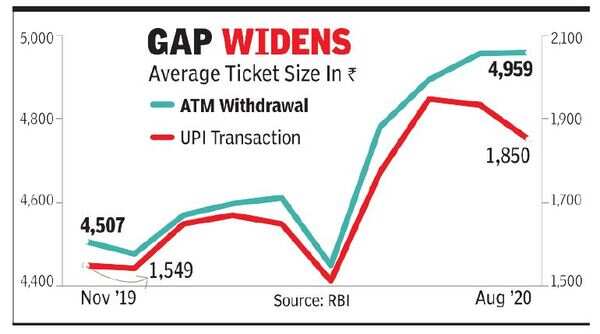

[PART -1 ]UPI is set to phase out debit card, and we will be here witnessing it :- - UPI is to introduce a new feature "UPI Circle" that allows users to delegate payment authority to family members or friends. So it basically enables primary account holder to allow others like children or elderly parents or trusted folks to make transactions using the primary UPI-linked account without needing to share physical debit cards. - UPI is also allowing cardless ATM withdrawals, meaning we can pull out cash from an ATM just by scanning a QR code on the machine with our UPI app, without needing a card or PIN. This makes ATMs cheaper to operate. This might be the most convenient era for users , what are your thoughts on this ?

Replies (2)

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

How ATMs Make Money – Let's Find Out! 🤑💸 1. Transaction Fees: When you withdraw money from an ATM, you are charged a certain fee. This fee goes to the ATM operator and is a significant source of their income. 2. Balance Inquiry Fees: Checking yo

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)