Back

Laxit Rana

•

Repute • 1y

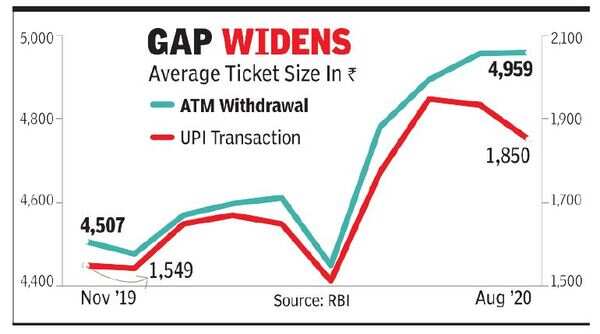

Why Banks are preferring UPI for ATM cash withdrawal instead of traditional Cards No Physical Card Production: Issuing debit cards costs banks money (around Rs 150-200 per card for production, shipping, and activation). UPI eliminates this by working entirely through mobile apps, so there's no need for physical cards. No Card Maintenance: Over the lifetime of a debit card (typically 5-7 years), banks spend additional money on maintaining the card's infrastructure, such as replacing lost cards or supporting features like NFC. UPI transactions only require mobile apps, drastically reducing these operational costs. Cheaper ATM Infrastructure: With UPI-enabled ATMs, there's no need for expensive card readers and PIN pads. Instead, you just need a QR code scanner, which reduces the cost of building and maintaining ATMs.

Replies (6)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)