Back

Dinakar

Nobody • 1y

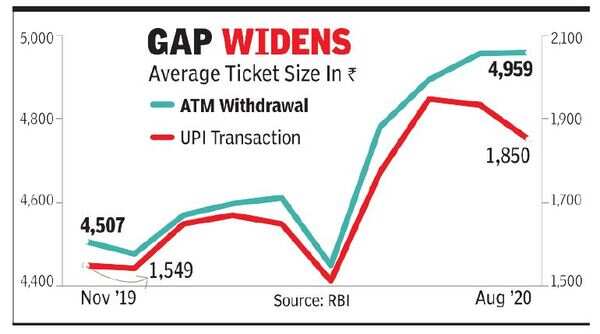

A story on ATMs - Total number of ATMs India had at the end of fy23 was 1.31 lakhs. These are standalone ATMs that aren't inside a bank's branch. This figure is about 1.5% more than last year. This tiny growth isn't driven by banks, but instead by white label ATM operators(WLAOs). WLAOs are private ATM service providers like Indicash, India 1 payments, Tata communication payment solutions. Why are there WLAOs in the ATM business? Why is it that the banks are not the only players in the ATM business? Well, it's because of a simple thing, and it is that ATMs were cutting into the bank's profits. So in 2012 for further expansion of ATMs, RBI allowed private players to hop into It. The number of players has halved since 2012 due to lack of profitability and the remaining ones are demanding for a transaction fee raise. (First time writing here, didn't check the word limit. Unfortunately I can't complete what I wanted to write 🥲.)

Replies (5)

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

How ATMs Make Money – Let's Find Out! 🤑💸 1. Transaction Fees: When you withdraw money from an ATM, you are charged a certain fee. This fee goes to the ATM operator and is a significant source of their income. 2. Balance Inquiry Fees: Checking yo

See MoreEliphaz Yesudas

Helping SaaS and B2C... • 9m

i have an idea of building an app that can show the balance in the ATM(with some extra features ) , so users can go to the ATM that has enough money for the user (used needs ) . my question is 1. is it relevant in this digitalization world where

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

Imagine a bank hiring 500 people, and laying off way more than that next year 📛📛 It’s very very uncommon. And yet here we are! .. What has happened? -> YES BANK has laid off about 500 people with a three-month severance pay, and more layoffs mi

See More

Manish

My name is Manish Vi... • 1y

📉 Just published a new analysis on HDFC Bank's recent stock decline. Curious about the reasons behind it? Head over to for an in-depth look! https://medium.com/@manishvishav/understanding-hdfc-banks-q1-results-and-stock-decline-an-in-depth-analysis

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)