Back

gray man

I'm just a normal gu... • 9m

The Reserve Bank of India has directed banks to ensure that ATMs dispense ₹100 and ₹200 notes. This move aims to make these widely used denominations more accessible to the public.

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 7m

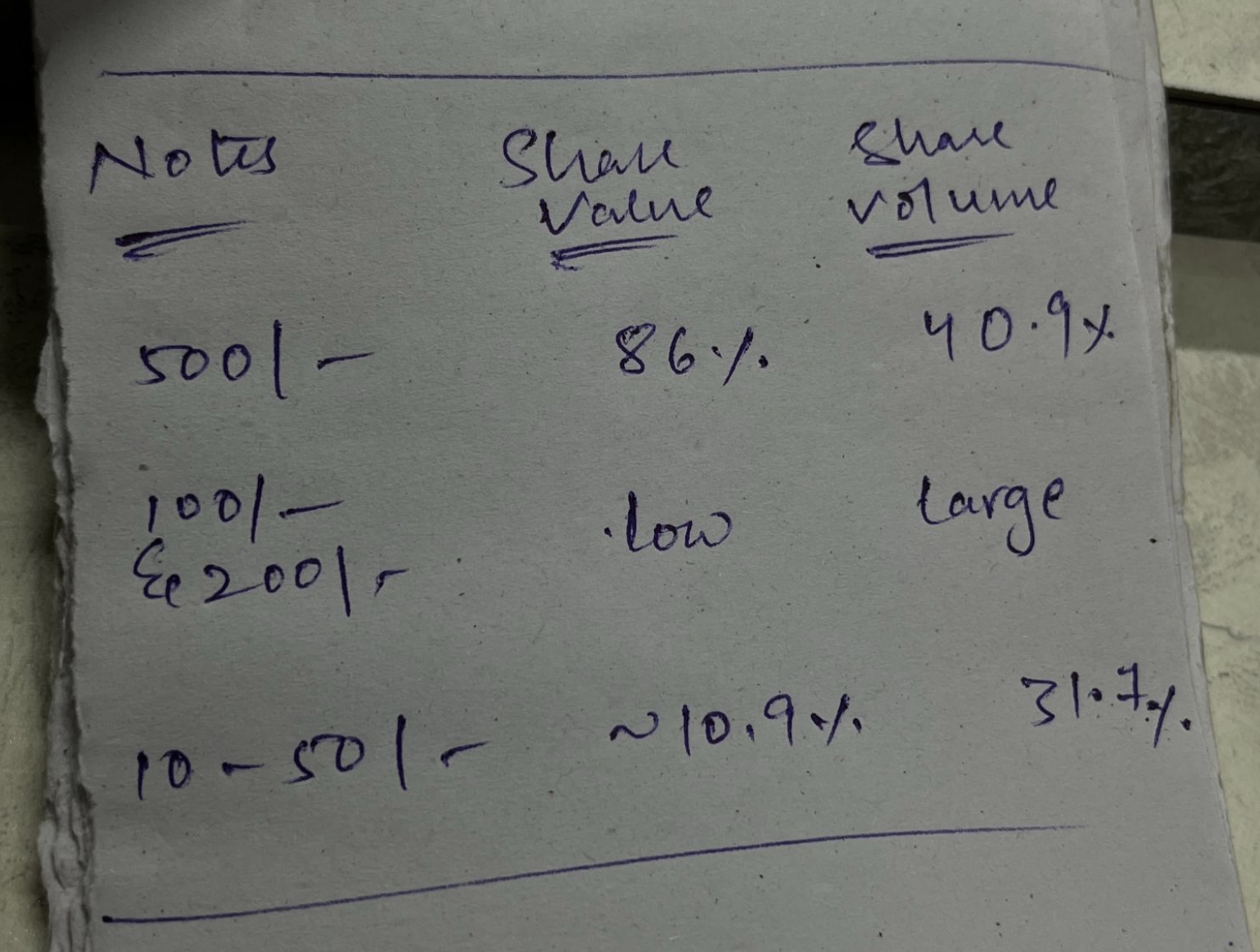

As of 2025, ₹500 notes dominate India’s cash system, making up 86 percent of the total value and 40.9 percent of all notes by volume. But while they’re everywhere, they’re not always practical. For everyday use, smaller denominations like ₹100 and ₹2

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

RBI Increases Gold Purchases The Reserve Bank of India has significantly increased its gold purchases, buying 50 tonnes so far in FY25. This move aims to diversify its foreign exchange reserves and mitigate revaluation risks, as part of efforts to m

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See Moregray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has mandated that all Indian banks must transition their existing websites to the new ‘.bank.in’ domain by October 31, 2025. This move is aimed at enhancing the security and trustworthiness of digital banking platforms

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)