Back

Poosarla Sai Karthik

Tech guy with a busi... • 7m

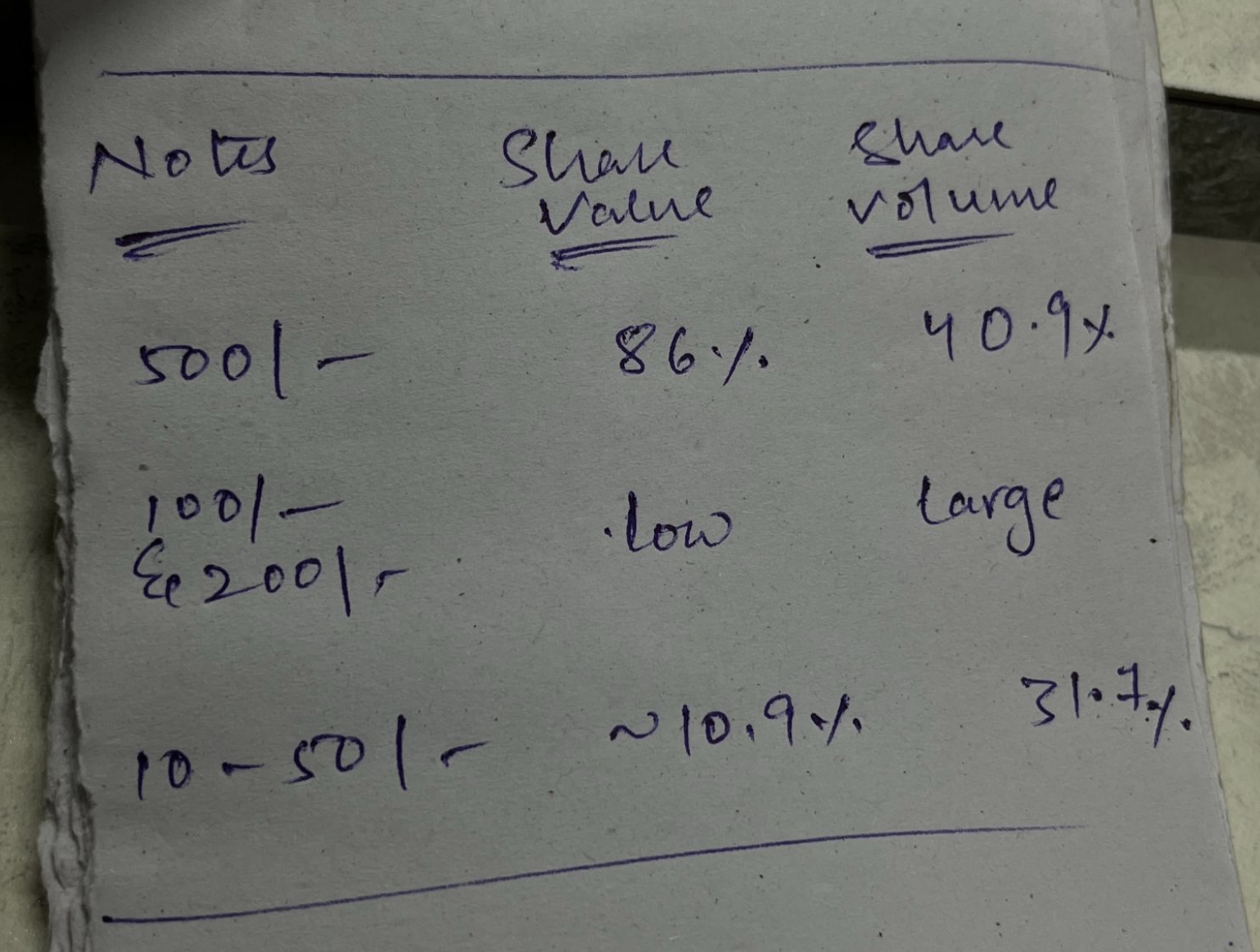

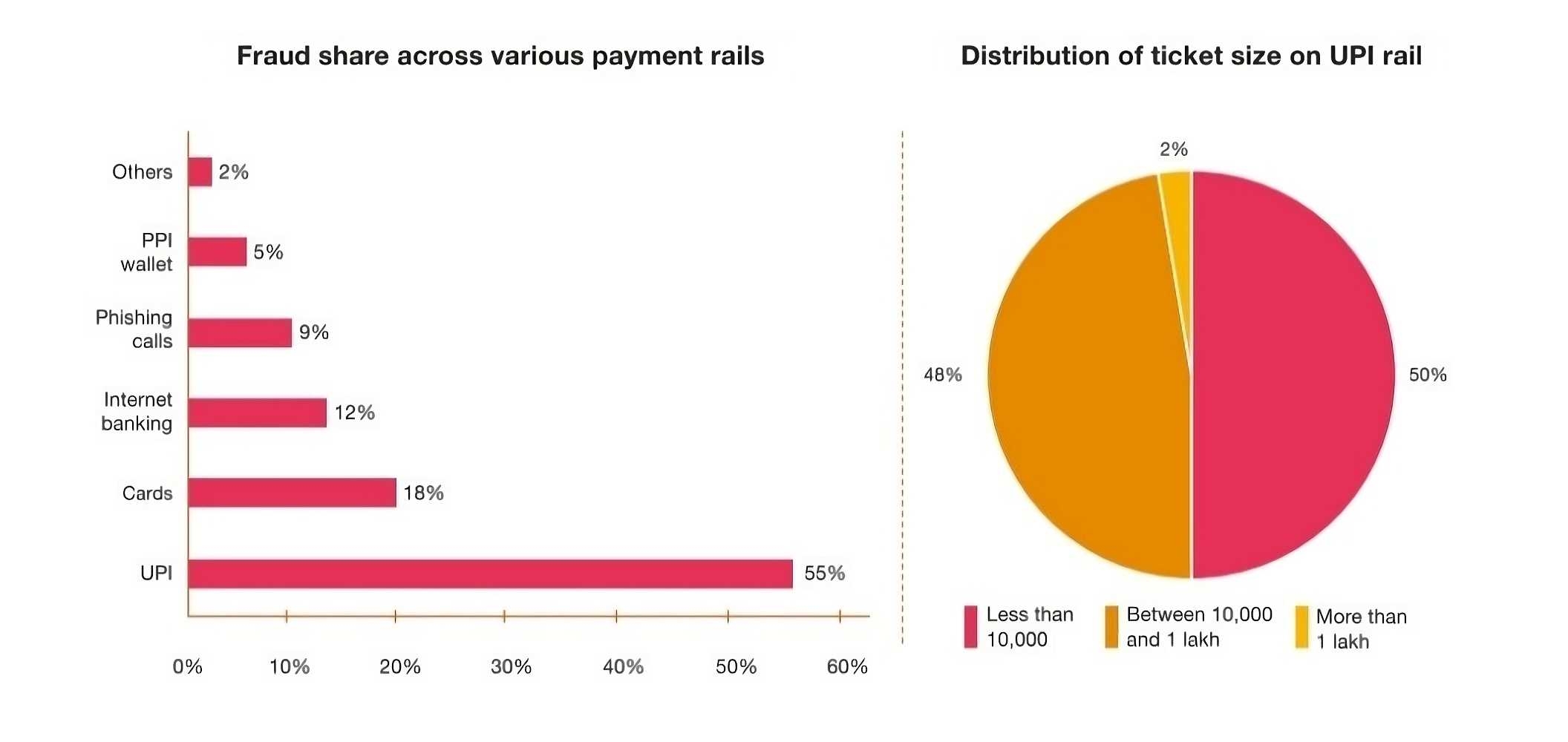

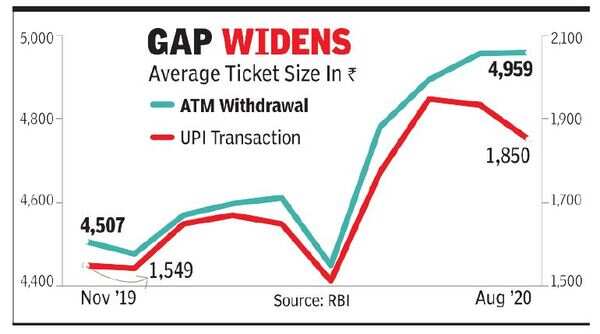

As of 2025, ₹500 notes dominate India’s cash system, making up 86 percent of the total value and 40.9 percent of all notes by volume. But while they’re everywhere, they’re not always practical. For everyday use, smaller denominations like ₹100 and ₹200 are in higher demand but often harder to find in circulation. That’s why the RBI recently instructed banks to recalibrate ATMs. By September 30, 75 percent of them must dispense ₹100 or ₹200 notes. By March 2026, that rises to 90 percent. The aim is not to remove ₹500 notes but to improve access to change, ease daily transactions, and support informal and rural economies. What this means for the economy is a gradual consumption shift. Large notes, though efficient for storing value or making high-ticket payments, slow down small retail activity when change isn’t available. More ₹100 and ₹200 notes in circulation smoothen these transactions, encouraging faster cash turnover and higher micro-consumption. That can support local businesses and help rebalance the cash economy. Meanwhile, UPI usage has exploded, crossing 1,868 crore transactions in May 2025. Still, cash in circulation is at record highs. India is not switching from cash to digital, it is growing both. This dual track model makes sense in a diverse economy. UPI dominates in cities while cash remains strong in smaller towns and unbanked regions. Globally, central banks are watching this hybrid model closely. As digital payment systems expand, they raise new questions. Who controls the rails, how is data used, and how resilient are these systems in crisis. India’s UPI model is now a reference point, but RBI continues to regulate carefully. It monitors large digital transactions, tightens rules for wallets, and is exploring the Digital Rupee as a central bank alternative to private platforms. So the larger shift is not just about payment modes. It is about how money moves, who moves it, and how inclusive the system is. RBI’s recalibration of cash and digital is less about disruption and more about balance.

More like this

Recommendations from Medial

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Rohan Saha

Founder - Burn Inves... • 7m

I really do not get why there is a need to make a big deal out of this Karnataka alone handles around 7.7 percent of the country’s total UPI transactions thanks to this system at least people are keeping their money in banks and it helps track how mu

See More

Mr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See Moregray man

I'm just a normal gu... • 10m

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)