Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Imagine a bank hiring 500 people, and laying off way more than that next year 📛📛 It’s very very uncommon. And yet here we are! .. What has happened? -> YES BANK has laid off about 500 people with a three-month severance pay, and more layoffs might follow -> The bank is looking to reorganise functions and optimise wherever it can reduce manual interventions And thus, the big move to save costs. .. The bank employs some 28k people. -> Thus, this layoff brings down the headcount by at least 2% or so -> And in the following quarters, that could surely be reflected in the bank’s operating margins. Thus, good for the bank, however bad it may be for the families of the affected 📛📛 .. Meanwhile, let’s think of it another way. -> Last year was a landmark year in the history of the Indian banking industry -> The employee headcount of the private sector banks had surpassed that of the public sector banks -> And going by all accounts, the headcount of Govt banks is expected to keep shrinking, while that for private ones keeps growing .. What am I trying to emphasise? The layoffs by Yes Bank are a one-off case and not something one should correlate with private sector banks wholly. Private banks remain net job creators in the industry, while public sector banks, not so much. And the gap between them is only growing! Important to remember that, right?

Replies (1)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Paytm shareholders are ignoring this? 📛📛 The fintech giant was the only UPI app to be making money on UPI. And now that’s no more possible. Here's all you should know! .. The thing is, NPCI (via Govt grants) compensates the banks to up keep the

See MoreRohan Saha

Founder - Burn Inves... • 1y

In the last few years, the returns from the Indian banking sector have not been very impressive. The PE ratio and PB ratio are all below their averages. Currently, the results of HDFC Bank and Kotak Mahindra Bank will decide whether banking stocks or

See MoreKritarth Mittal • Soshals

Founder, Soshals | C... • 2y

Nike is laying off 1,600 people as part of their 3-year cost-cutting plan. Cisco announced a fresh round of layoffs and fired 4,250 employees. According to Layoffs FYI, 32,000 tech workers have already lost their jobs in 2024. Market is awful. Bra

See MoreYash Barnwal

Gareeb Investor • 1y

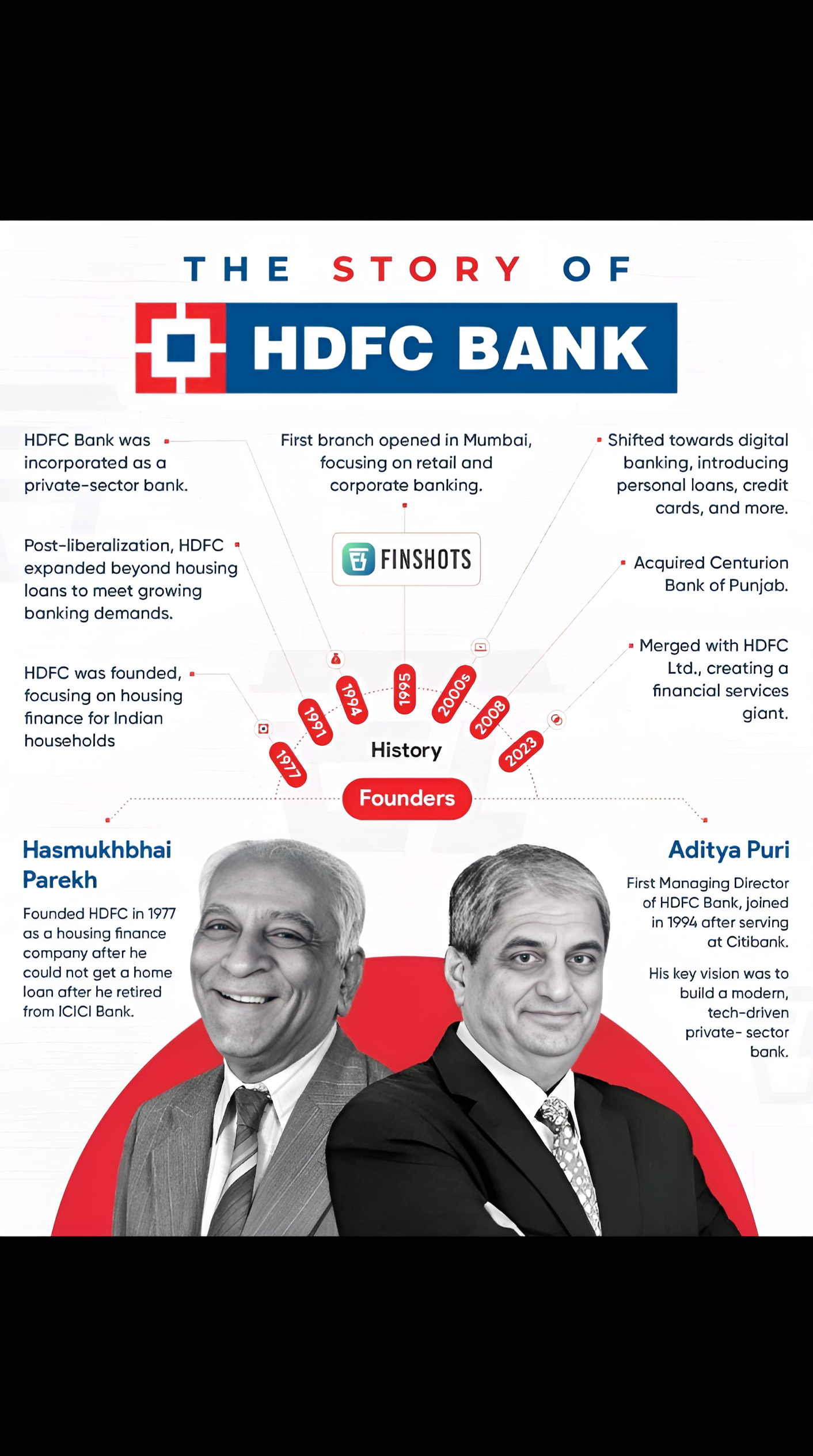

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Infosys' full-year headcount falls for first time in 23 years The full-year headcount of IT services major Infosys fell for the first time in 23 years as the company declared 25,994 lesser employees in FY24. Infosys' headcount of 3.17 lakh in FY24 w

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

We are set to lose our fancied tag of “FASTEST GROWING ECONOMY” this year 📛📛 And we won’t have our media and business world talk about this. Thus, placing it out. Vietnam’s Government is going all out, having publicly announced that it shall “DRA

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Why Private Funding is a Tougher Nut to Crack Than a Bank Loan Often, private funding proves harder to get than a traditional bank loan. Banks are risk-averse and highly regulated, relying on excellent credit, established history, and collateral. Thi

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)