Back

Rohan Saha

Founder - Burn Inves... • 1y

In the last few years, the returns from the Indian banking sector have not been very impressive. The PE ratio and PB ratio are all below their averages. Currently, the results of HDFC Bank and Kotak Mahindra Bank will decide whether banking stocks or the sector will revive from here or remain where they are, because the chances of going further down are low. If it does go down, it will be interesting to see how much. Two days ago, Axis Bank announced its results, which caused a slight bounce in the private banking sector. Now, we are waiting for the results of India’s largest banks.

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 3m

Powering India’s Seas! 🇮🇳 From massive ships to cutting-edge submarines — these companies are the real force behind India’s naval strength! Swipe through the chart to see CMP, PB Ratio & ROE of top shipbuilding giants like L&T, GRSE, Mazagon Dock

See More

Nithin Augustine k

DAY ONE • 1y

STUDENT BANK to teach the young generation the basics of banking, money management, how to save money. It would function for the students of age 14 to 18 . Bank will function in every school students can do all banking transactions like savings and a

See MoreRohan Saha

Founder - Burn Inves... • 7m

Honestly this earnings season I think most companies except for some in tech and banking could actually post pretty decent results. Tech might take a slight hit because of weak demand but sectors like FMCG, infrastructure, defence etc seem well posit

See MoreRohan Saha

Founder - Burn Inves... • 9m

This time, bank results are showing a different pattern. Either a company is delivering good results or poor ones there’s no middle ground. Out of 10, 5 companies are meeting expectations, while the other 5 are not. But I believe that by the next qua

See MoreVIJAY PANJWANI

Learning is a key to... • 4m

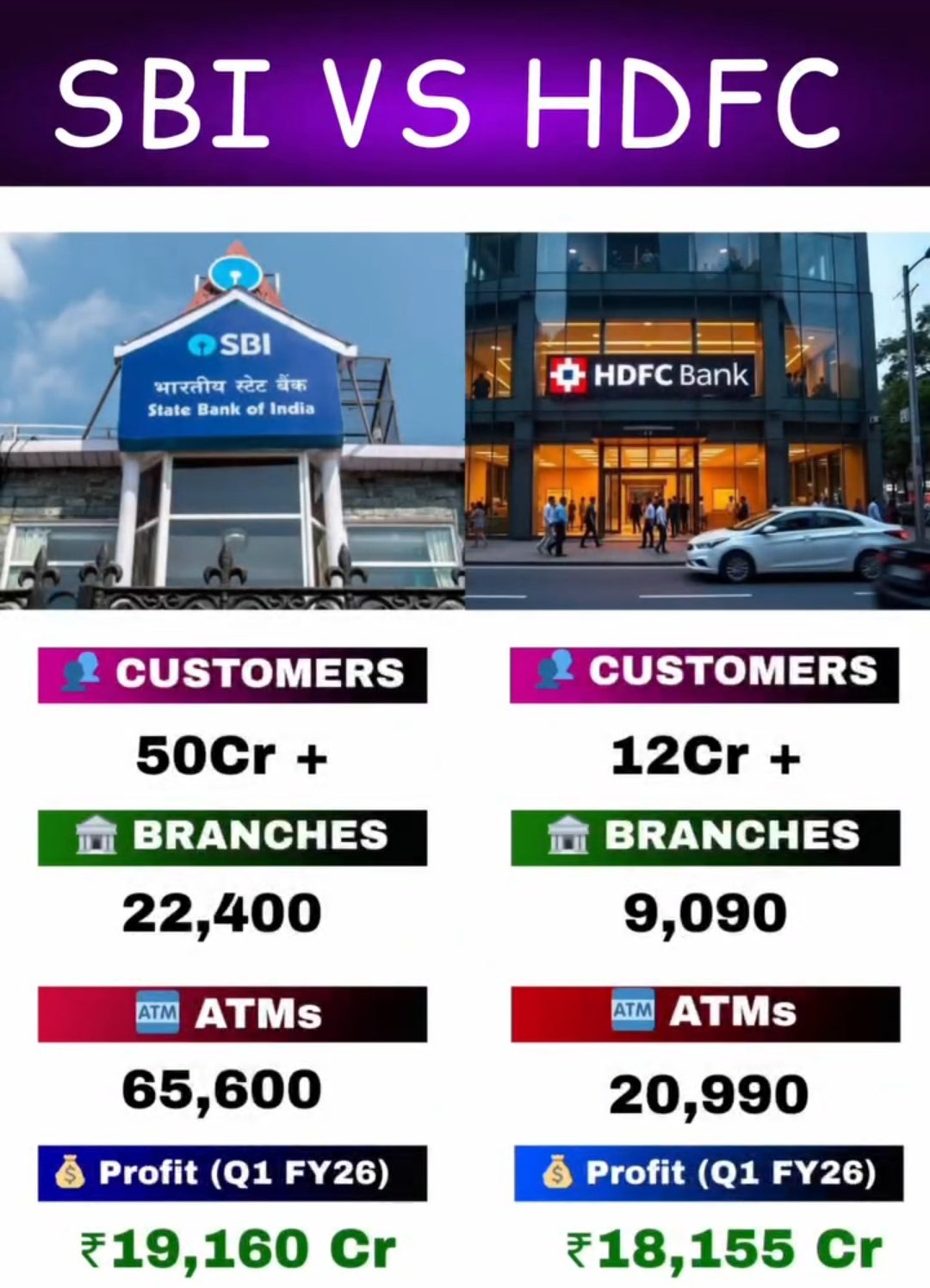

SBI vs HDFC Bank – The Battle of India’s Banking Giants! 🇮🇳 SBI: 50 Cr+ customers | 22,400 branches | ₹19,160 Cr profit 🏦 HDFC Bank: 12 Cr+ customers | 9,090 branches | ₹18,155 Cr profit 👉 Who’s the real king of Indian banking? Comment your o

See More

Yash Barnwal

Gareeb Investor • 1y

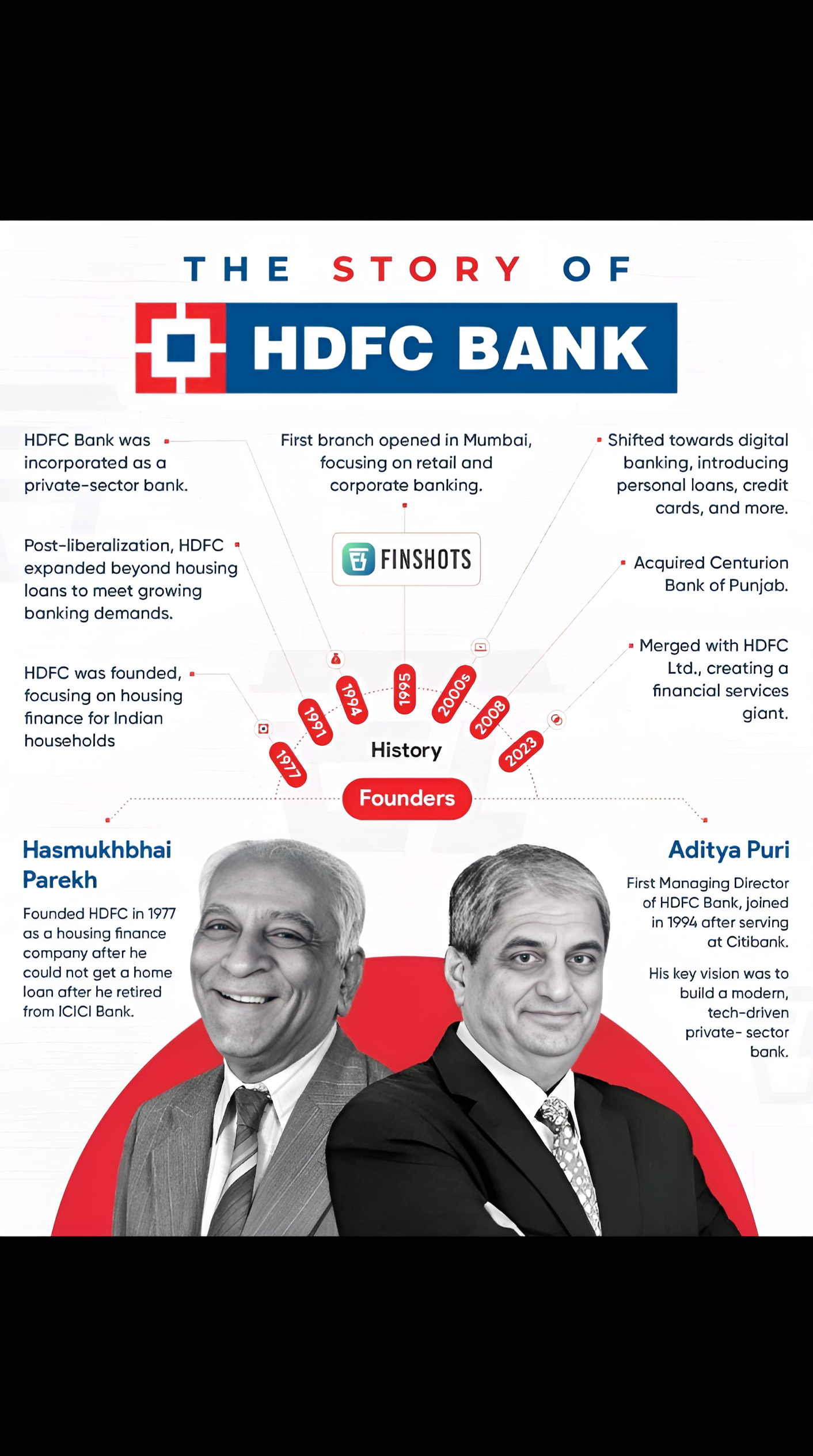

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

D N V S S Ganesh Kumar Murikipudi

Chandigarh Universit... • 1y

Hi Guys I hope your all are doing Great. "As an MBA student specializing in Banking, I'm eager to understand real-life challenges in the banking industry. What key problems do you think the sector currently faces, and in which areas do you believe t

See MoreParvej Rijwan

Founder Of Codebaaj.... • 6d

🇮🇳 Top 3 Companies in India (By Market Capitalization – 2026) Latest available data (January–February 2026) ke hisaab se India ki sabse badi companies market cap ke basis par yeh hain: --- 1️⃣ Reliance Industries Market Cap: ₹21.637 Trillion

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)