Back

Surya

Product • 1y

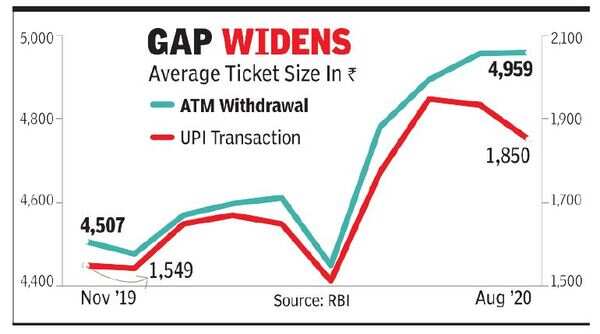

💳 The Future of ATM Withdrawals: QR-Based and Cardless 💳 QR-based, cardless ATM withdrawals are shaking up the traditional cash experience! 📲 With just a scan, no physical card is required, making transactions faster, safer, and contact-free—perfect for the modern, health-conscious world. This tech is especially popular in regions like Asia, with major banks worldwide exploring it to meet digital banking demands and enhance customer security. Curious about how it all works and who's leading the charge? Check out the full article below for a deep dive into this banking innovation!

More like this

Recommendations from Medial

Rishabh Yadav

Hey I am on Medial • 1y

i have a idea about the business. in which there have a QR and we alot that QR to particular person. we have the categories like Zym, vehicle. we store the details based on the category and when a persons have scan the QR FROM THERE movile then th

See MoreOMPRAKASH SINGH

Founder of Writo Edu... • 1y

How ATMs Make Money – Let's Find Out! 🤑💸 1. Transaction Fees: When you withdraw money from an ATM, you are charged a certain fee. This fee goes to the ATM operator and is a significant source of their income. 2. Balance Inquiry Fees: Checking yo

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)