Back

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: PhonePe – India's UPI Leader Founded in 2015, PhonePe dominates India's digital payments landscape. Stats: Users: 350M+ registered Market Share: 40%+ of UPI transactions Business Model: Transactions, financial services, advertising. Revenue: FY18: $7M FY19: $60M FY20: $200M FY21: $400M FY22: $760M (approx.) Valuation: $12B (Dec 2022) Challenges: Increasing monetization Achieving profitability Competition (Paytm, etc.) Regulatory changes Conclusion: PhonePe growth exemplifies UPI's impact. Future success depends on monetization, profitability, and navigating the competitive and regulatory landscape.

Replies (16)

More like this

Recommendations from Medial

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: Paytm – India's Payments Pioneer Founded in 2010, Paytm revolutionized India's digital payments landscape. Stats: Users: 330M+ active Merchants: 21M+ partners Business Model: Payments, financial services, e-commerce. Revenue: FY18: $

See More

Kimiko

Startups | AI | info... • 9m

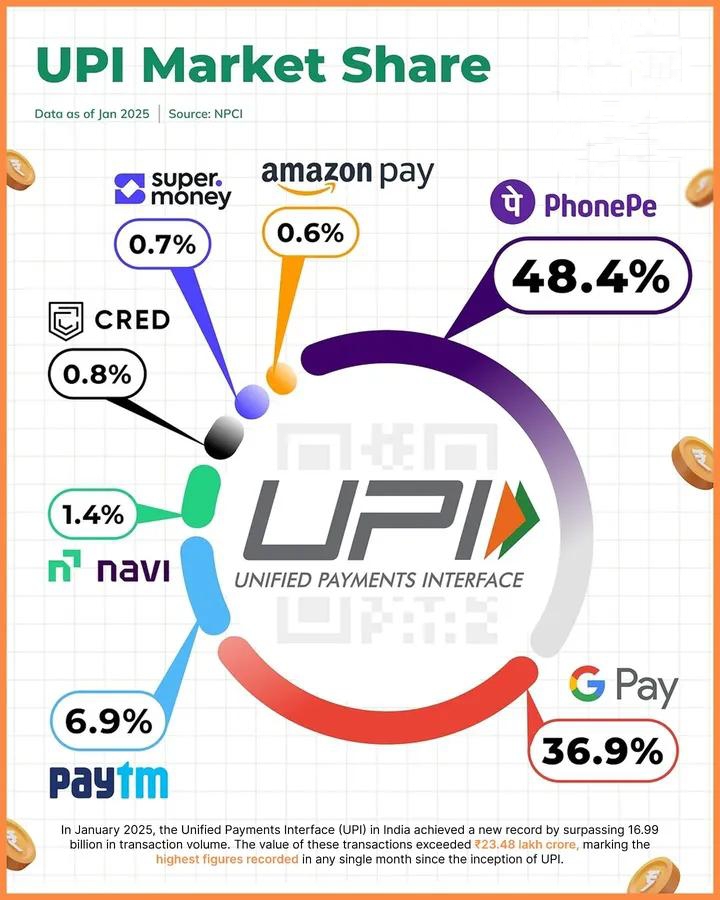

🚀 UPI hits historic highs in January 2025! PhonePe leads with 48.4%, Google Pay follows at 36.9%, and Paytm holds 6.9%. 📊 Over 16.99 billion transactions worth ₹23.48 lakh crore — marking the highest figures recorded in any single month since UPI's

See More

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

boAt: Riding the Audio Wave (with a Recent Setback) Company: boAt (founded 2016) Industry: Consumer Electronics (Audio) Challenge: Stand out in a crowded audio market. Solution: Stylish, budget-friendly audio for young consumers. Results: Growt

See More

Ashish Singh

Finding my self 😶�... • 1y

PhonePe is set to launch its IPO, showcasing impressive revenue growth of 74% year-on-year, reaching INR 5,064 crore in FY24. With a 50% market share in India's UPI transactions, it faces competition from Google Pay and Paytm. While the company's lea

See MoreGyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

VCGuy

Believe me, it’s not... • 1y

A few days ago, Flipkart introduced its new UPI service, Supermoney. ⏮️The interesting part: Let's go back a few years - Dec, 2015: 3 former Flipkart exec's start PhonePe. Apr, 2016: Flipkart acquires PhonePe for $20 M. Aug, 2018: Walmart acquires

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)