Back

CA Kakul Gupta

Chartered Accountant... • 10m

The Government of India has revised the investment and turnover limits for MSME classification. As per the latest notification, the new limits are: Investment criteria ✅ Micro Enterprises: Up to ₹2.5 crore (earlier ₹1 crore) ✅ Small Enterprises: Up to ₹25 crore (earlier ₹10 crore) ✅ Medium Enterprises: Up to ₹125 crore (earlier ₹50 crore) Turnover criteria Micro Enterprises: Up to ₹10 crore (earlier ₹5 crore) ✅ Small Enterprises: Up to ₹100 crore (earlier ₹50 crore) ✅ Medium Enterprises: Up to ₹500 crore (earlier ₹250 crore) These changes will be effective from April 1, 2025. For any clarifications or assistance, feel free to reach out to us. Oneness Compliance Consulting INDIA MSME | Compliance | Government Update | Business Growth | Oneness Compliance

Replies (1)

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreONENESS COMPLIANCE CONSULTING

Hey I am on Medial • 1y

Founded in 2022, Oneness Compliance Consulting (OCC India) is a forward-thinking consultancy offering personalized, cost-effective solutions in taxation, finance, and compliance. Our seasoned team specializes in crafting tailored strategies to help b

See MoreSai Vishnu

Income Tax & GST Con... • 12m

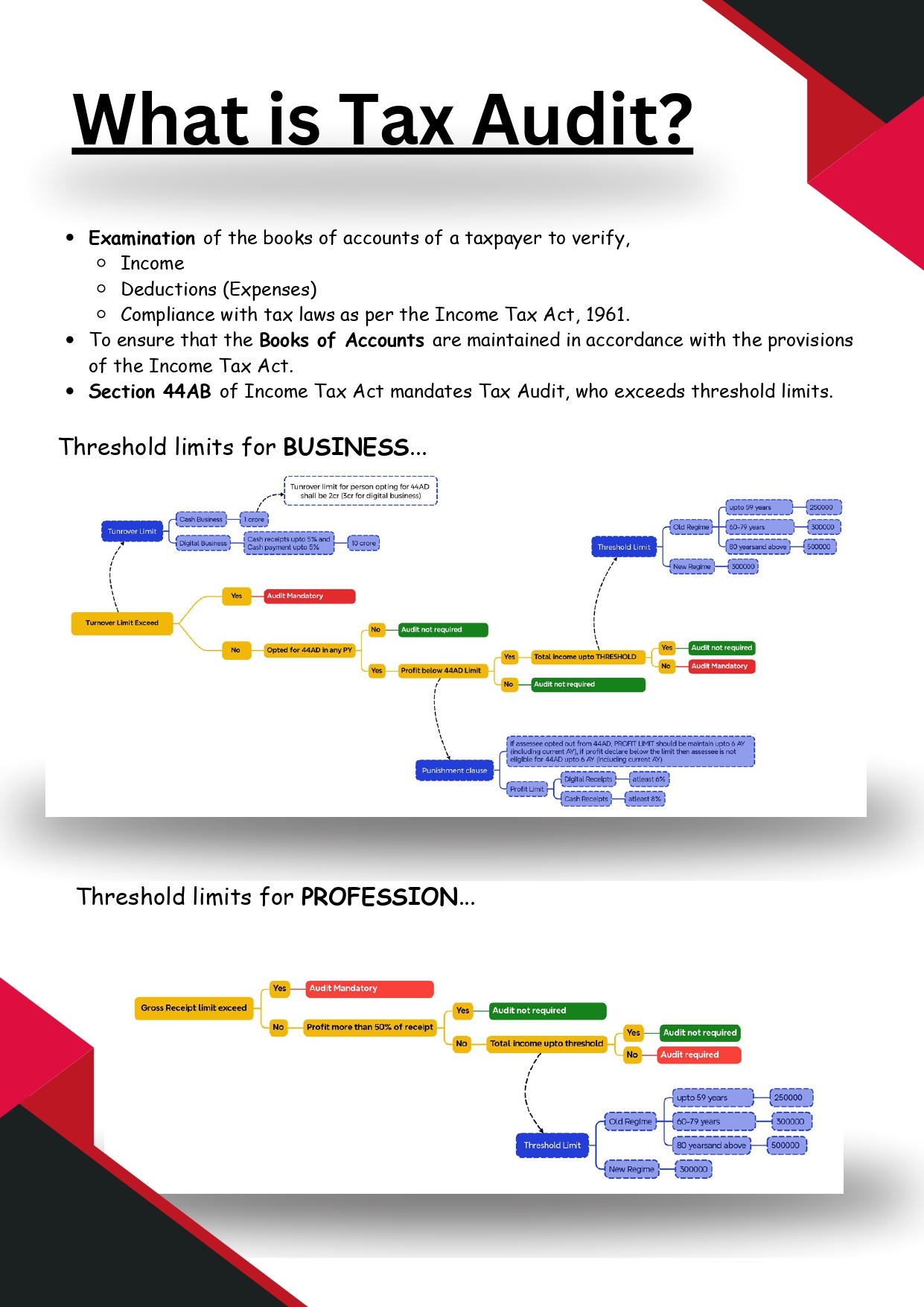

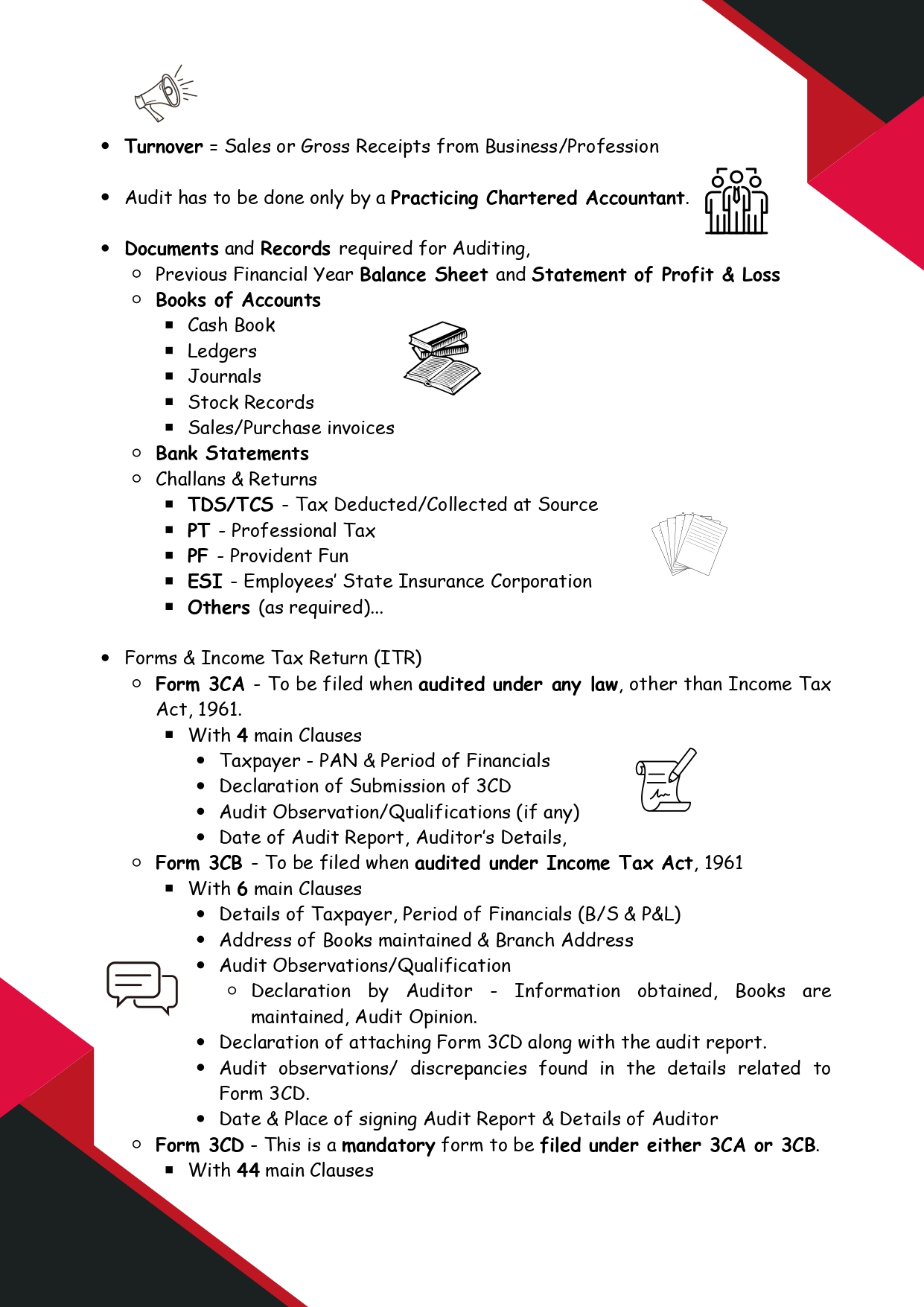

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Bhavya luthra

obsessed with why an... • 1y

Budget 2025 – A Win for the Middle Class, But What About Businesses? 🤔 Here's what caught my eye: ✅ More spending power for consumers – Zero tax up to ₹12 lakh means a cash boost for the middle class. Great for businesses targeting this segment! �

See MoreAccount Deleted

Hey I am on Medial • 7m

SaaS is the future — and AI makes it unstoppable. At Opslify, we help startups & enterprises build AI-driven SaaS platforms that revolutionize industries. ✅ Automate workflows ✅ Personalize user experiences ✅ Scale without limits 💼 Let’s turn your

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 12m

💡 Not Every Registered Pvt Ltd/LLP/Firm is a Startup! 🚀 Just because your business is registered as a Private Limited Company, LLP, or Partnership Firm doesn’t automatically make it a Startup. There’s a clear definition in the notification issued

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)