Back

Anonymous

Hey I am on Medial • 1y

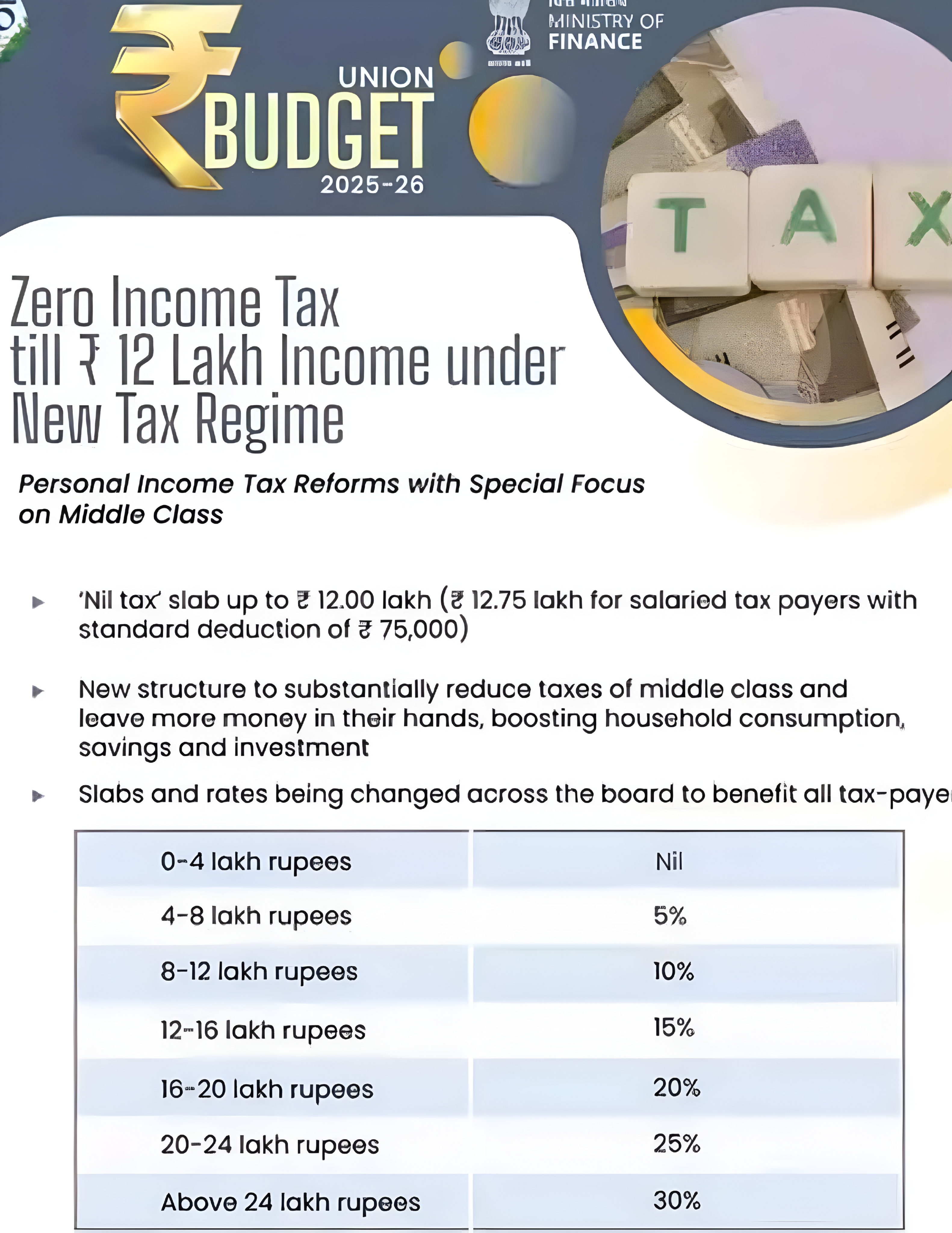

Are you happy with 12 Lakh No Income tax and 10K Crores funds for entrepreneurs by bjp government ?

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Adithya Pappala

Busy in creating typ... • 1y

All are murmuring about today's Nirmala Sitharaman India's Financial Budget Okay ~0 tax until 12 lakhs of Income ~4 lakh crores to repay ~48,000+ Crores for welfare schemes & etc ~Finally, The whole of India(144Cr+) People have to burn 55,00000+ C

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)