Back

Anonymous

Hey I am on Medial • 1y

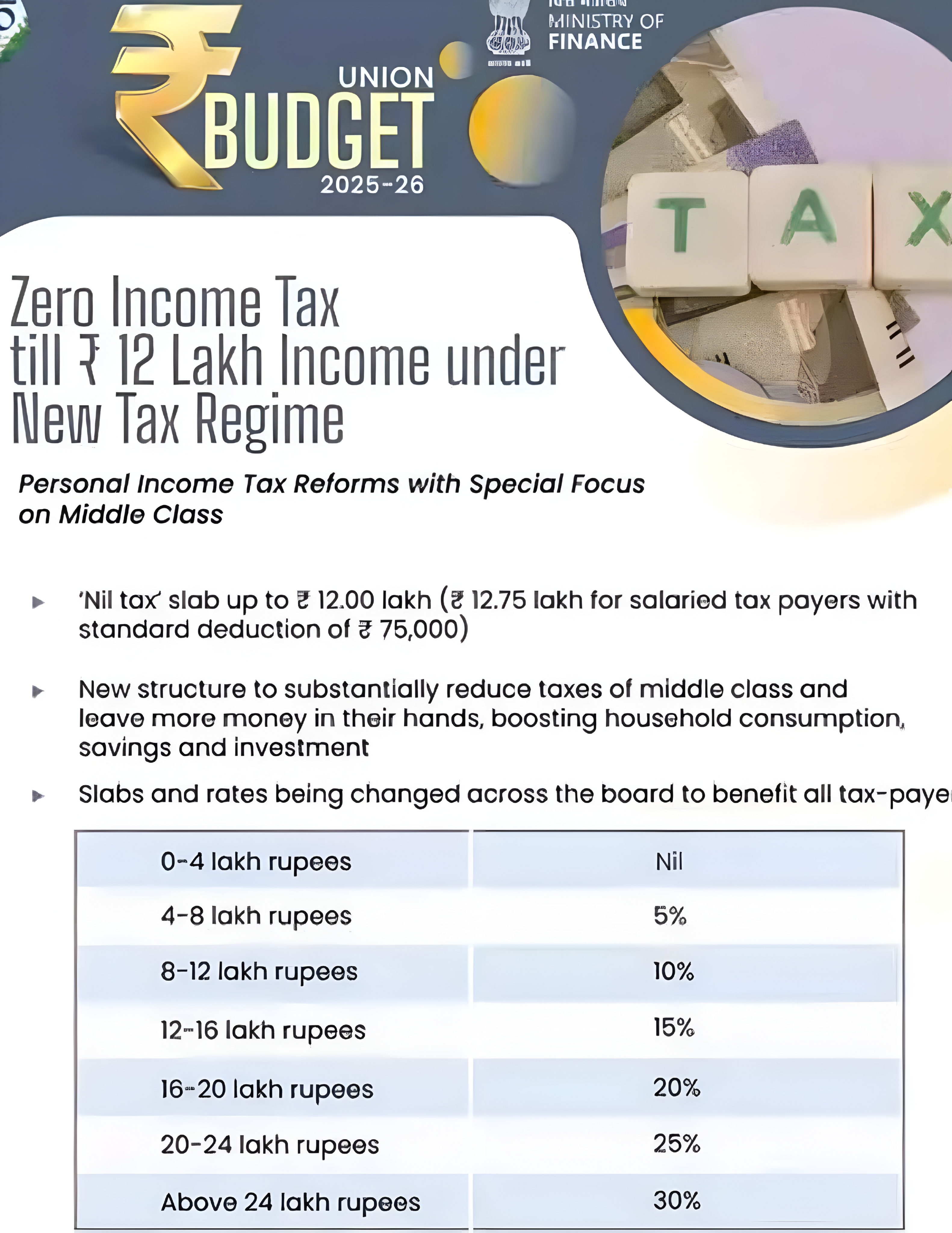

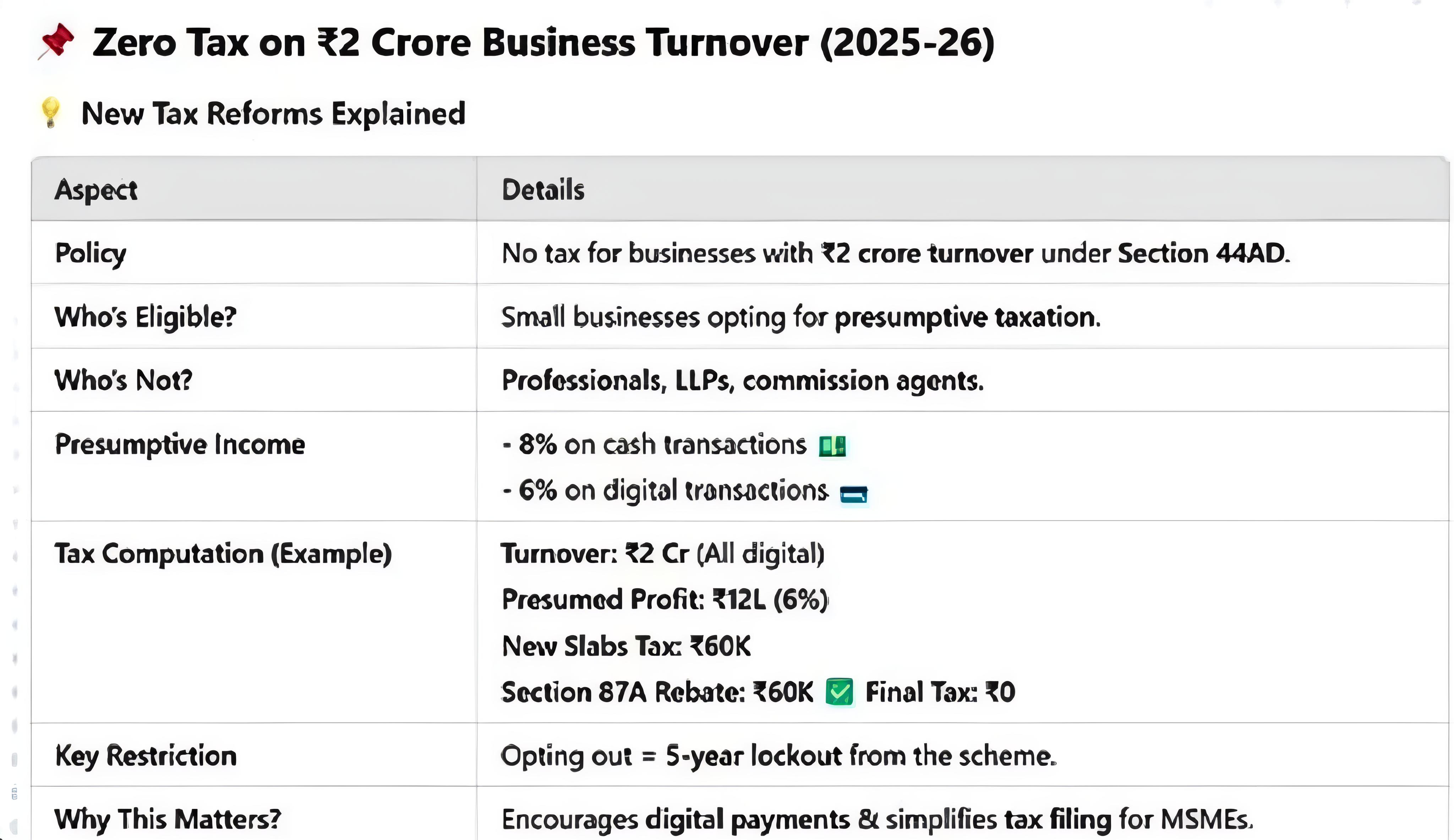

😅 Bjp government is on fire 🔥 • No income tax 💰 • Less toll tax 🚗 • Huge economic activities 🚀 • 10 Thousand crores for entrepreneurs 🧑🏫

Replies (9)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

All are murmuring about today's Nirmala Sitharaman India's Financial Budget Okay ~0 tax until 12 lakhs of Income ~4 lakh crores to repay ~48,000+ Crores for welfare schemes & etc ~Finally, The whole of India(144Cr+) People have to burn 55,00000+ C

See MoreSameer Patel

Work and keep learni... • 1y

PAN Card The PAN (Permanent Account Number) card is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It's crucial for various financial transactions such as opening a bank account, filing income tax returns, and buyin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)