Back

Naman Kapoor

🎒 • 1y

There is no income tax upto Rs. 12 lakhs of income. Great news. Now I just have to figure out how to earn an income of Rs. 12 Lakhs!

Replies (6)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

I won’t waste time on old tax regime for two reasons: -> 70%+ income taxpayers had already switched from it by the end of FY24 -> With what’s announced today, it’s anyway dead. One would have to be a fool to stick with it So, what about the News T

See More

financialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 8m

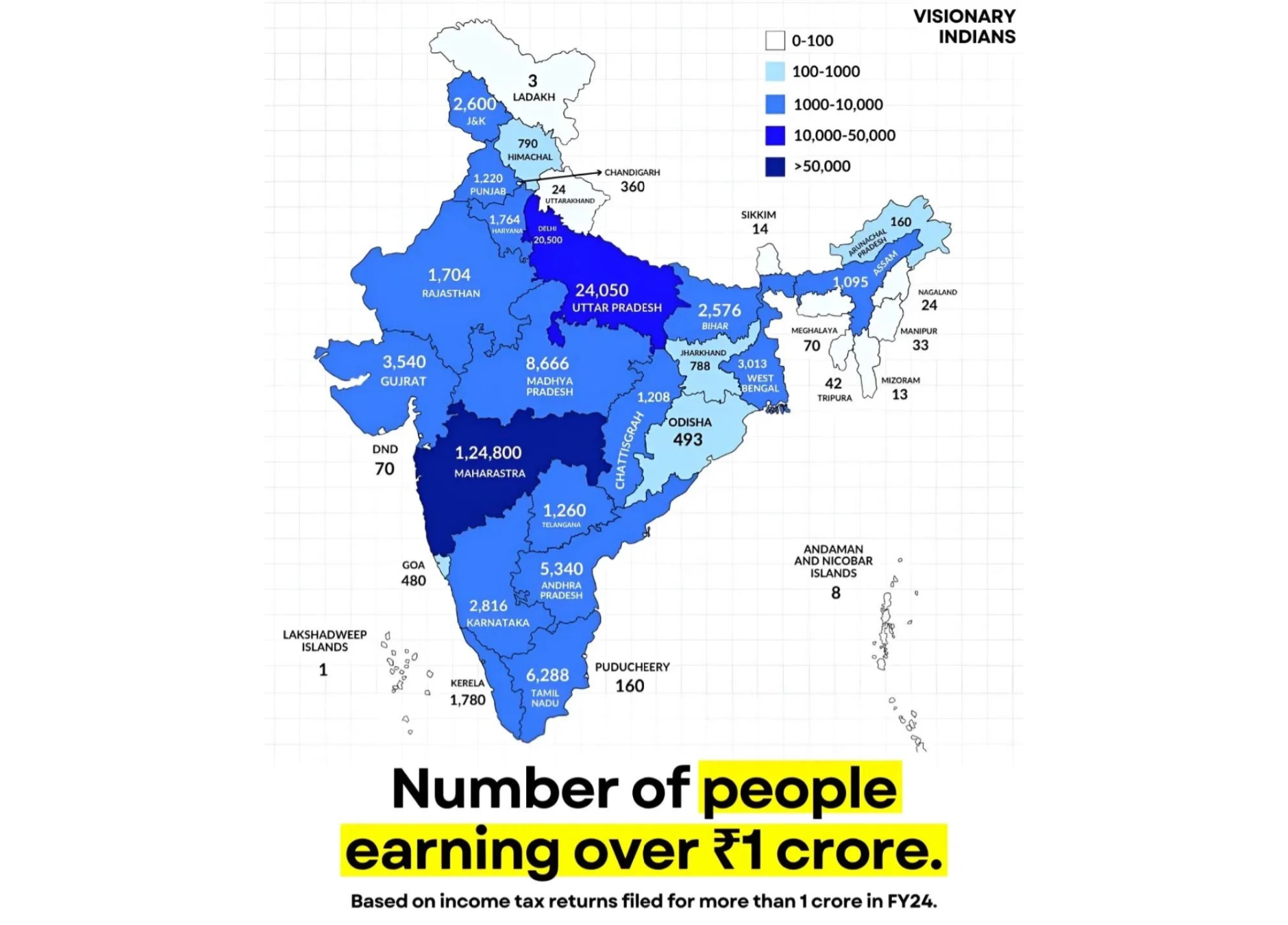

How Many Indians Actually Earn Over ₹1 Crore a Year? The Number Might Shock You. 💬 With a population of over 140 crore, you'd expect lakhs of crore plus earners in India. But the real number is surprisingly low. What does this say about income ineq

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)