Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

I won’t waste time on old tax regime for two reasons: -> 70%+ income taxpayers had already switched from it by the end of FY24 -> With what’s announced today, it’s anyway dead. One would have to be a fool to stick with it So, what about the News Tax regime that’s in force, and what has been proposed today? Say you earn Rs 15lacs a year. Here is how nos. differ. .. New Tax Regime (as per recent changes before the latest announcement): Rs 0 to 3L: 0% tax Rs 3 to 6L: 5% of 3L Rs 6 to 9L: 10% of 3L Rs 9 to 12L: 15% of 3L Rs 12 to 15L: 20% of 3L Total Tax: Rs 15k + 30k + 45k + 60k = Rs 1.5L And, up to Rs 7L there is no tax due to rebate. But here, income exceeds, so it is not applicable. .. Newly Announced Tax Regime: Rs 0 to 4L: 0% tax Rs 4 to 8L: 5% of 4L Rs 8 to 12L: 10% of 4L Rs 12 to 15L: 15% of 3L Total Tax: Rs 20k + 40k + 45k = Rs 1.05L And, up to to 12L there is a full rebate. But here, income exceeds, so it is not applicable. .. So, to be very clear, the income tax outgo drops by 30%! I know this will vary basis we consider the income to be Rs 12L, 15L or 35L, or so on. Nonetheless, the difference is a big one Thus, seems like the middle class collectively bashing the Govt on social media left, right and centre has played its role to get us some good deal. -> This is why it is so important to speak up and raise your voice against what you believe is wrong -> Had the middle class like us not gone rampant voicing our rage, this would’ve never happened. So, kudos and congrats to us all Let’s collectively keep raising our voices for a more equal India for income taxpayers, as farmers do for their interests; unions do for theirs; industrialists do for theirs. ..

Replies (9)

More like this

Recommendations from Medial

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

If your income is 12L, You pay 0 for the first 4L. From 4L - 8L i.e. next 4L, you pay 5% = 20,000. From 8L - 12 i.e. another 4L, you pay 10% = 40,000. Total Tax Payable= 60,000. Standard Deduction -75,000. So NO TAX FOR INCOME UP TO 12L. Get it?

theresa jeevan

Your Curly Haird mal... • 1y

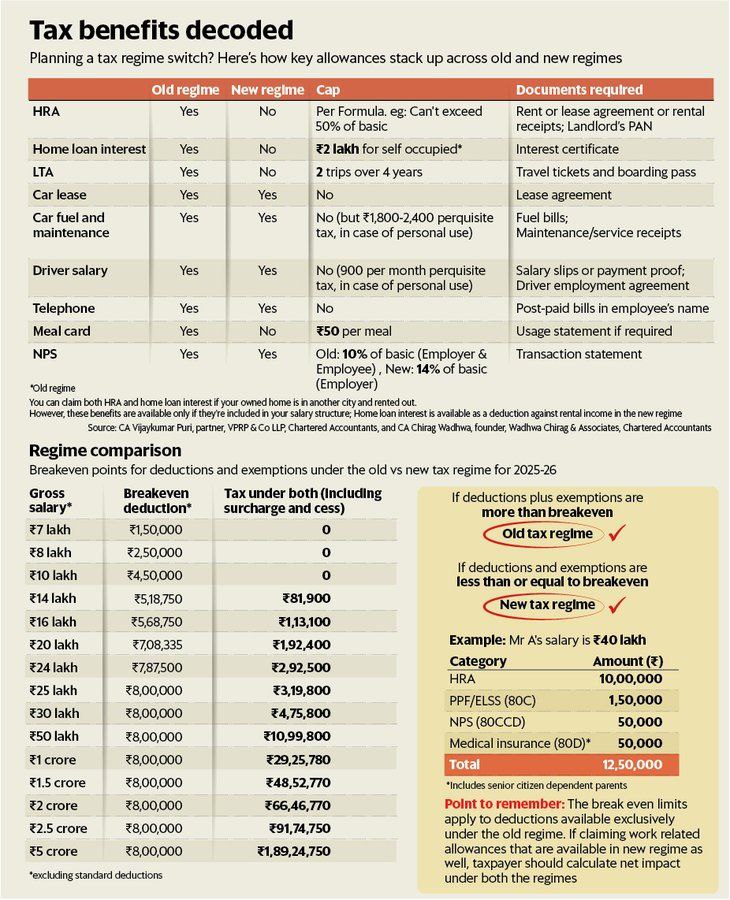

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

financialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)