Back

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

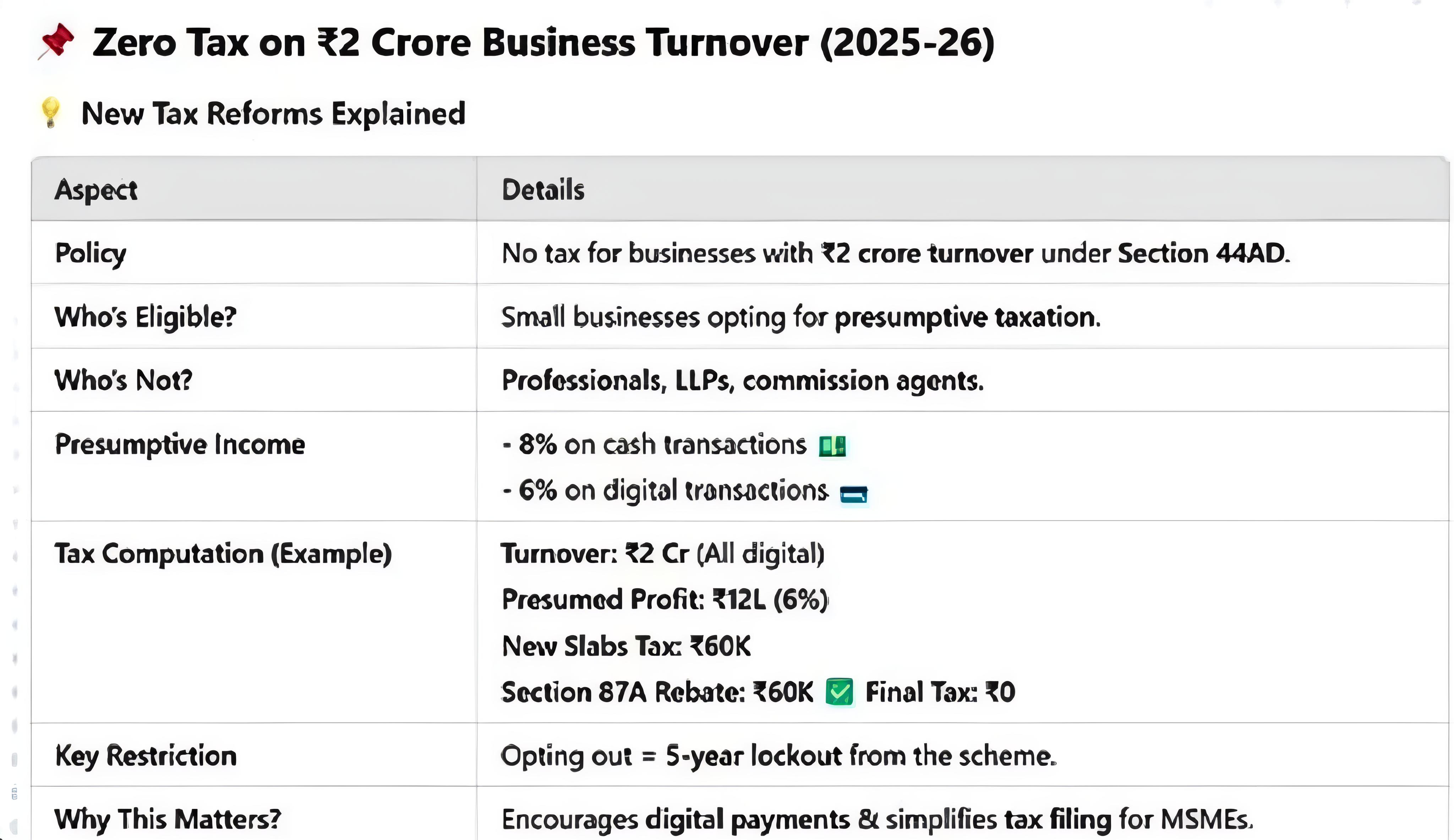

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See More1 Reply

1

9

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

4 Replies

5

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)