Back

Laxmesh Ankola

Kaizen • 1y

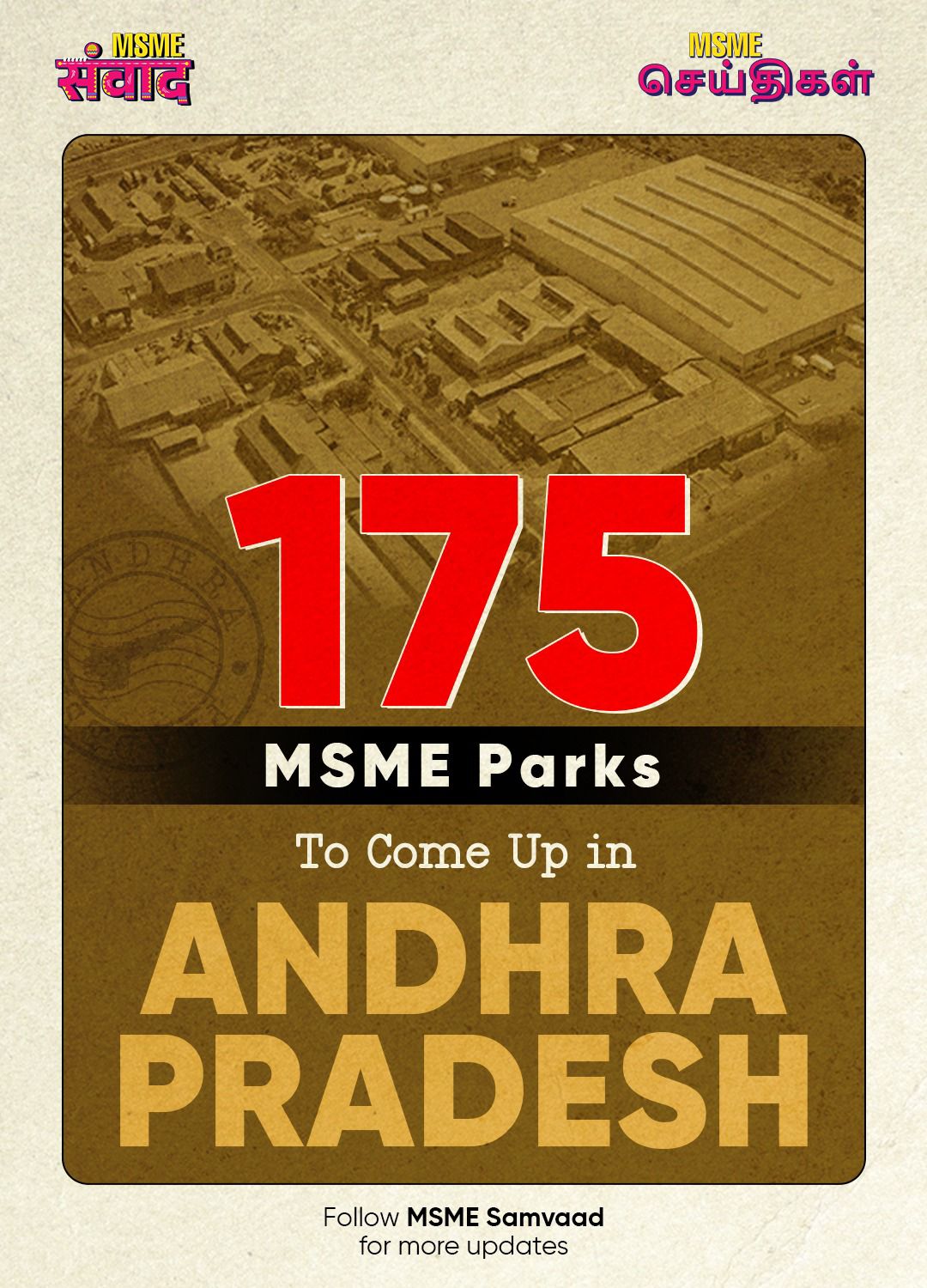

🚀 Join Us in Revolutionizing Tax Compliance for MSMEs! Tax filing and compliance are major pain points for small businesses, often leading to errors, penalties, and high CA fees. Apna CA is here to change that! With AI-powered automation, real-time compliance tracking, and tax-saving insights, we are building a game-changing solution for MSMEs. We are already in talks with investors who see the potential, but we’re looking for more visionary partners to help us scale. If you believe in the future of AI-driven tax solutions, now is the time to be part of something big! Let’s connect and build the future of MSME tax compliance together! 🚀📈

Replies (2)

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Jasmeet Singh

In God We Trust, The... • 10m

Tax season got you sweating? 😅 Here’s your survival kit: ✅ Organize receipts monthly (use apps like Expensify!). ✅ Track deductible expenses (yes, that home office counts!). ✅ Hire a CA who speaks ‘tax’ fluently—😎 DM me for a FREE tax checklist to

See More

calculus

Your Bottom Line Our... • 9m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)