Back

CA Jasmeet Singh

In God We Trust, The... • 11m

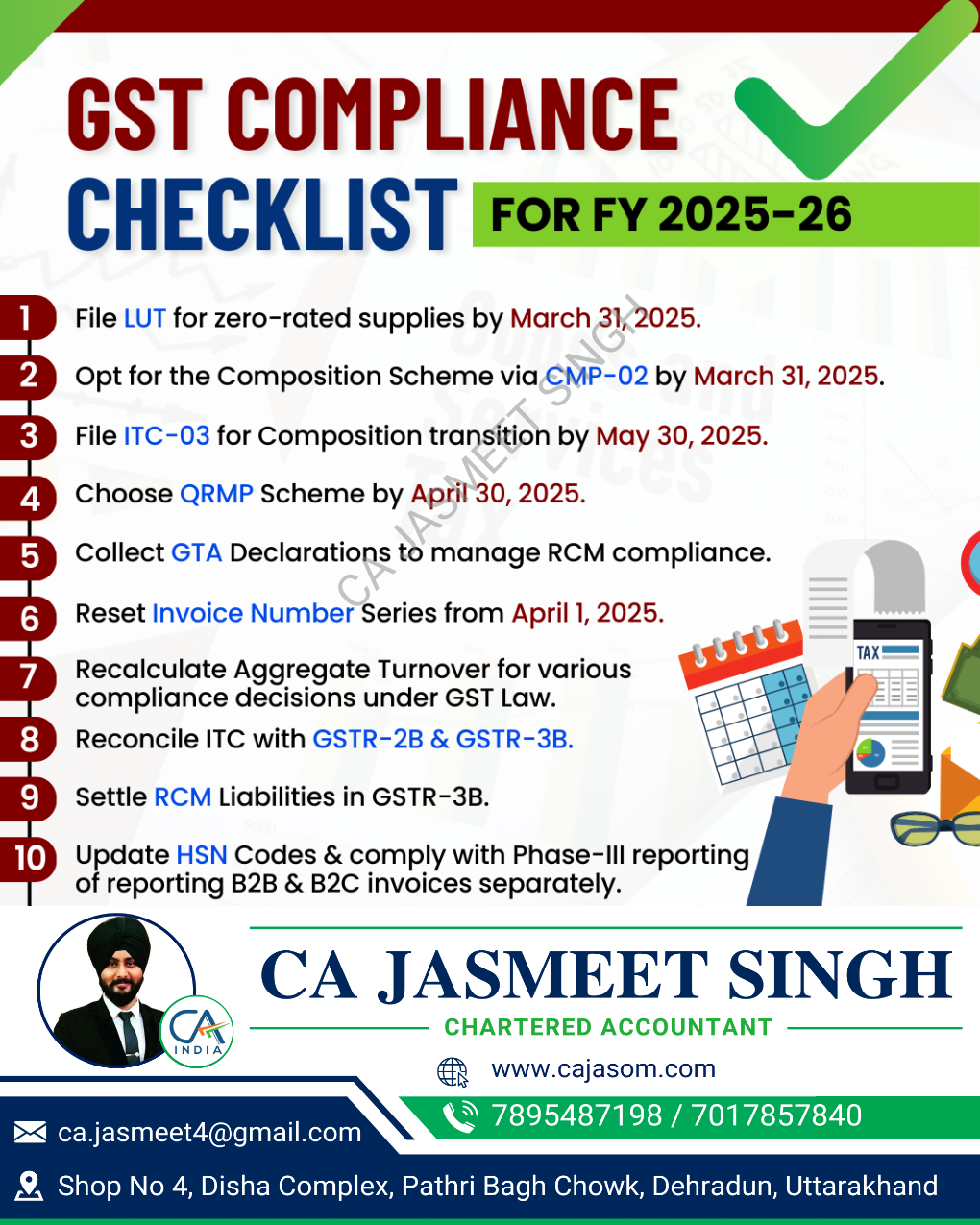

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST Registration – Update any changes in business details. 🔹 Reconcile Input Tax Credit (ITC) – Match invoices with GSTR-2B. 🔹 File Pending Returns – Clear any backlogs to avoid late fees. 🔹 Annual Turnover Check – Verify eligibility for different GST schemes. 🔹 E-Invoicing & E-Way Bill Compliance – Ensure adherence to latest rules. 🔹 GST Payment & Liability Review – Pay dues on time to avoid interest. 🔹 Maintain Proper Records – Keep invoices & documents for audits. Stay compliant & stress-free this financial year! 🚀💰 #GST #TaxCompliance #NewFinancialYear

More like this

Recommendations from Medial

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

Free Consultation From your CA Friend for your Startups. 🌸 Holi Special Offer from Your Trusted CA! 🌸 This Holi, let’s clear not just the colors but also your compliance worries! 🎨✨ I am offering a FREE Business Compliance Consultation until Su

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Sumit Chandwani

The New way of Compl... • 10m

🚀 The Role of Financial Strategy in Business Growth Managing a business involves countless decisions—budgeting, fundraising, compliance, and financial planning. One common challenge I’ve observed is that many startups and SMEs struggle with financi

See MoreCA Kakul Gupta

Chartered Accountant... • 1y

Breaking Chains, Building Clarity! 💡🏛️ Just write about the New Income Tax Bill 2025, and it feels like history in the making! 📖✨ Finance Minister Nirmala Sitharaman has introduced a bill that promises to simplify, modernize, and revolutionize In

See MoreCA Kakul Gupta

Chartered Accountant... • 11m

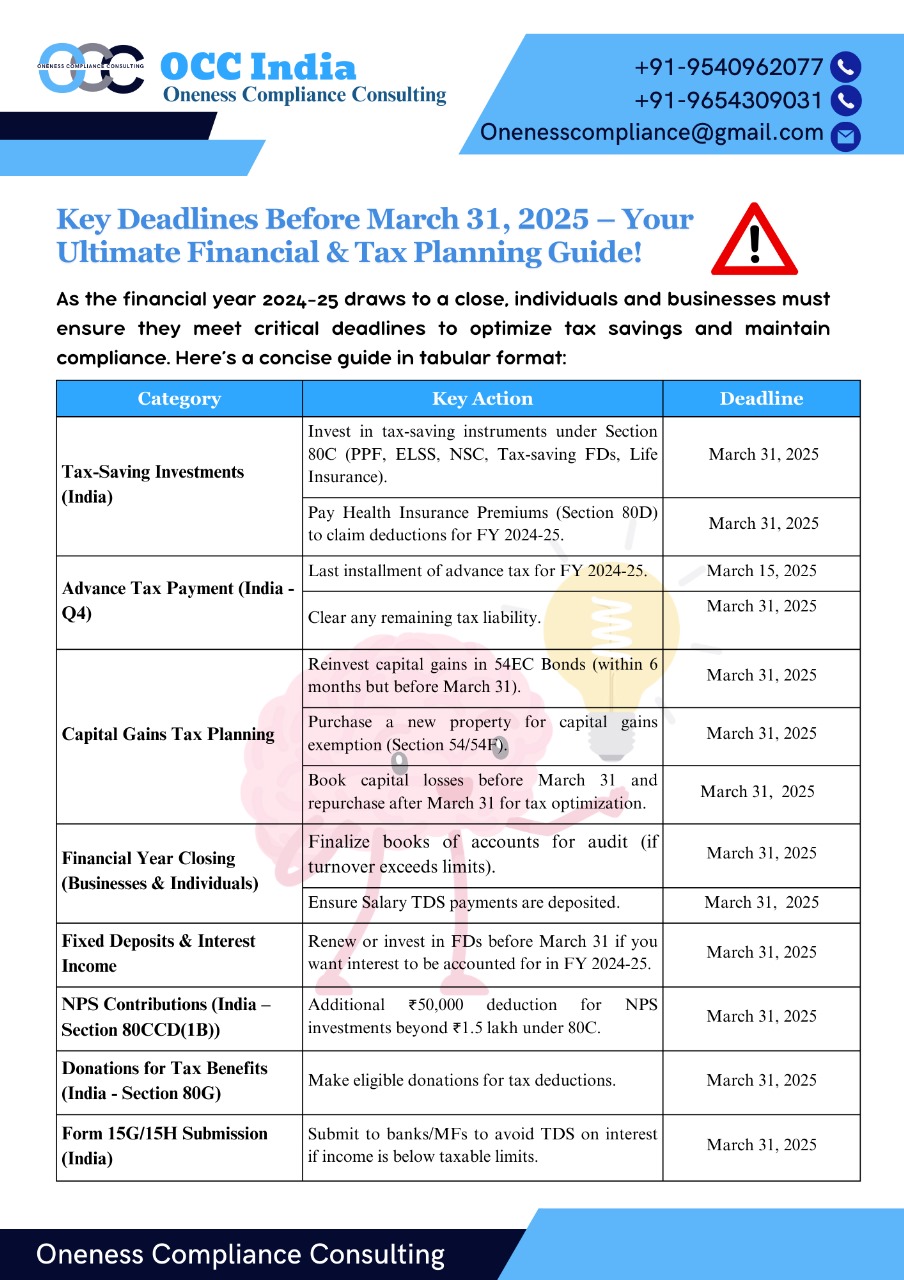

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)