Back

CA Kakul Gupta

Chartered Accountant... • 1y

Breaking Chains, Building Clarity! 💡🏛️ Just write about the New Income Tax Bill 2025, and it feels like history in the making! 📖✨ Finance Minister Nirmala Sitharaman has introduced a bill that promises to simplify, modernize, and revolutionize India’s tax system! 🇮🇳💼 🔹 823 pages cut down to 622—because less confusion means more compliance! 🔹 ‘Previous Year’ is out, ‘Tax Year’ is in—global best practices, finally! 🌍 🔹 Higher presumptive limits & pre-filled returns—a future where tax filing isn’t a nightmare! The bill is now in Parliament—will this be the tax transformation we’ve all been waiting for? 🤔🔥 🔗 Read the full breakdown here: sites.google.com/view/onenesscompliance/articles/new-income-tax-bill-2025-key-highlights-and-comparison-with-explanation

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 11m

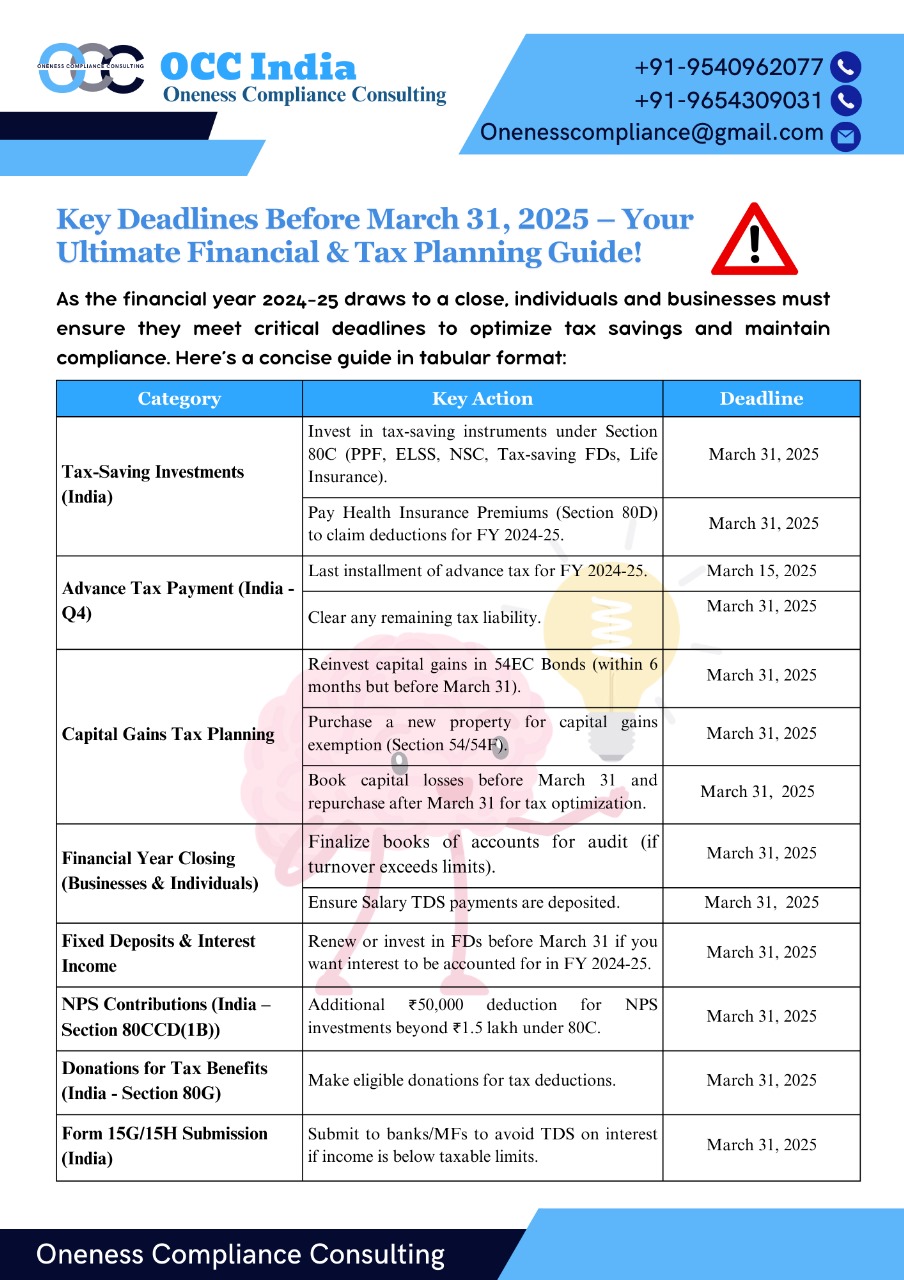

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

CA Chandan Shahi

Startups | Tax | Acc... • 12m

Finance Bill 2025: Crypto Assets Under Greater Scrutiny! 🚨 The Indian government is tightening regulations on crypto-assets with key amendments in the Finance Bill 2025: 🔹 Expanded Definition of Virtual Digital Assets (VDAs):The definition unde

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreSameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreB Yashwanth

Customer success ent... • 1y

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

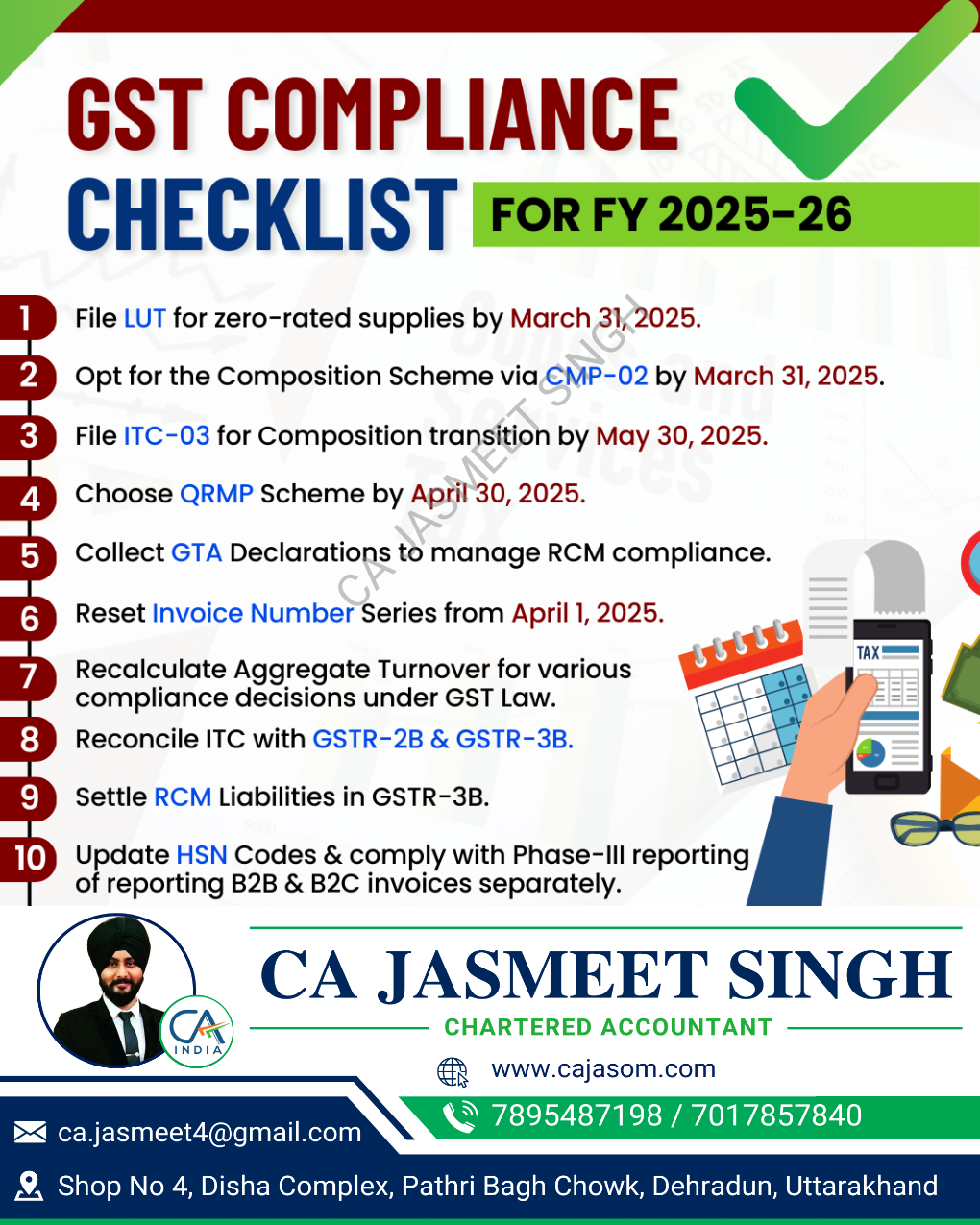

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)