Back

CA Chandan Shahi

Startups | Tax | Acc... • 12m

Finance Bill 2025: Crypto Assets Under Greater Scrutiny! 🚨 The Indian government is tightening regulations on crypto-assets with key amendments in the Finance Bill 2025: 🔹 Expanded Definition of Virtual Digital Assets (VDAs):The definition under Section 2(47A) now explicitly includes all crypto-assets, covering any digital representation of value secured by cryptographic technology or a distributed ledger. 🔹 New Reporting Obligations (Section 285BAA):Banks and financial institutions must report crypto transactions to tax authorities, improving transparency and compliance. 🔹 Alignment with Global Standards India is moving towards the **Crypto-Asset Reporting Framework (CARF), ensuring international tax cooperation for digital assets. 🔹 Effective from April 1, 2026: Crypto traders, investors, and businesses must prepare for these regulatory changes. This marks a significant step in India's evolving crypto regulations! What are your thoughts on these new measures?

More like this

Recommendations from Medial

Madhav Kartheek Bhumireddi

Hey I am on Medial • 1y

Next-Gen Crypto Bidding Platform Idea! Imagine an exclusive online bidding platform that operates only with cryptocurrency and is accessible to high-tier subscribers. 🔹 Crypto-Only Transactions – 100% decentralized, secure, and seamless payments.

See MoreUbed Khan

Turning bold ideas i... • 11m

Starting this journey on Medial to share insights, strategies, and experiences from my diverse career—trading, digital marketing, and business growth. 🔹 Built and managed Shopify stores for brands 🔹 Handled digital marketing for multiple businesse

See MoreKarthikeya Pasumarthi

Inspiring Entreprene... • 1y

🌟 GTC Gen-Z: The Future of Digital Assets! 🌟 Say hello to GTC (Gen-Z Crypto Technology)—a revolutionary platform designed to make your digital assets accessible anywhere you go. With state-of-the-art security and Gen-Z innovation, GTC is not just

See More

Harshajit Sarmah

Founder & Editor of ... • 1y

Crypto India Magazine is now the Official Media Partner of the European Blockchain Convention🤝 Be part of Europe's top Blockchain and Digital Assets event! 🎙️6,000 attendees and 300 speakers! 📅 Date: 25-26 September 2024 📍 City: Barcelona, Spai

See More

Ashish Tiwari

Try again, Fail agai... • 7m

🚀 My First Investment Pitch – This Saturday! Excited. Nervous. Hopeful. This weekend marks a huge milestone — I’ll be presenting my first-ever pitch for SM-Arth, a platform designed to revolutionize Futures & Options and Crypto trading in India thr

See More

Cryptoreach

Crypto News & Analys... • 5m

CryptoReach – The Best Crypto App for News, Prices & Market Analysis Stay ahead in the fast-moving world of digital assets with CryptoReach, the all-in-one free crypto app for iOS designed for investors, traders, and crypto-curious minds alike. Get

See More

Dr Bappa Dittya Saha

We're gonna extinct ... • 1y

So much noise about AI And what u missing is blockchain! How AI will be secured from manipulation? We don't trust private finance organisation. Because PSU banks doing so well. But we need a better currency! Rupees, dollars, Euro are relative asset

See MoreSinan ahmad

Building Stoxii | Fi... • 6m

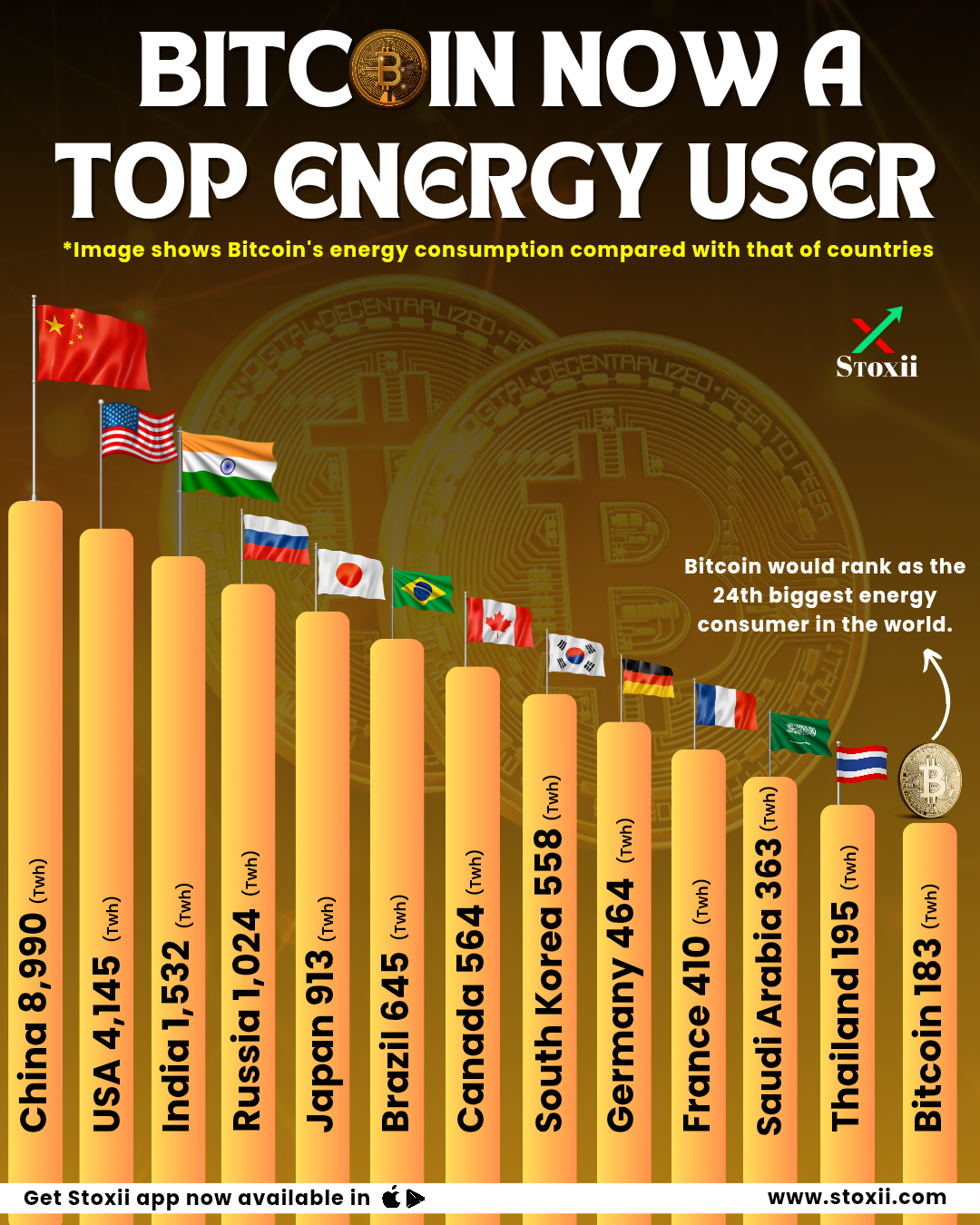

Bitcoin has officially entered the global energy charts. ⚡ With an estimated annual consumption of 183 TWh, Bitcoin now uses more energy than countries like Thailand (195 TWh) and Saudi Arabia (363 TWh). If treated as a country, Bitcoin would rank as

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)