Back

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies between bank balances and accounting records. ✅ 2. Review and Clear Outstanding Receivables and Payables Follow up on pending customer payments to reduce outstanding receivables. Ensure all vendor payments are accounted for and clear pending liabilities. ✅ 3. Verify and Adjust GST Filings Cross-check GST returns (GSTR-1, GSTR-3B, and GSTR-9). Ensure proper input tax credit (ITC) reconciliation and resolve mismatches. File any pending GST returns. ✅ 4. Review TDS and TCS Compliance Ensure all TDS/TCS deductions and deposits are correctly recorded. File pending TDS returns (24Q, 26Q) and generate Form 16 for employees. ✅ 5. Depreciation and Fixed Asset Register Update Update fixed asset register with new additions and disposals. Charge depreciation as per applicable rates and methods. ✅ 6. Finalize Provisions and Accruals Record all year-end provisions (e.g., salary, bonuses, audit fees). Ensure expense accruals are accurate and complete. ✅ 7. Stock Valuation and Physical Verification Conduct a physical stock count. Reconcile stock discrepancies and update the books accordingly. Value closing stock as per accounting standards. ✅ 8. Review and Record Adjustments for Prepaid and Outstanding Expenses Adjust prepaid expenses for the current financial year. Record any outstanding expenses to match with the actual period. ✅ 9. Prepare Financial Statements Draft the Profit & Loss Account, Balance Sheet, and Cash Flow Statement. Analyze variances and reconcile all major accounts. ✅ 10. Tax Planning and Filing Preparation Estimate taxable income and plan for tax-saving options (investments, deductions). Ensure compliance with advance tax payments and adjust any shortfall. #incometax #gst #compliance

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 11m

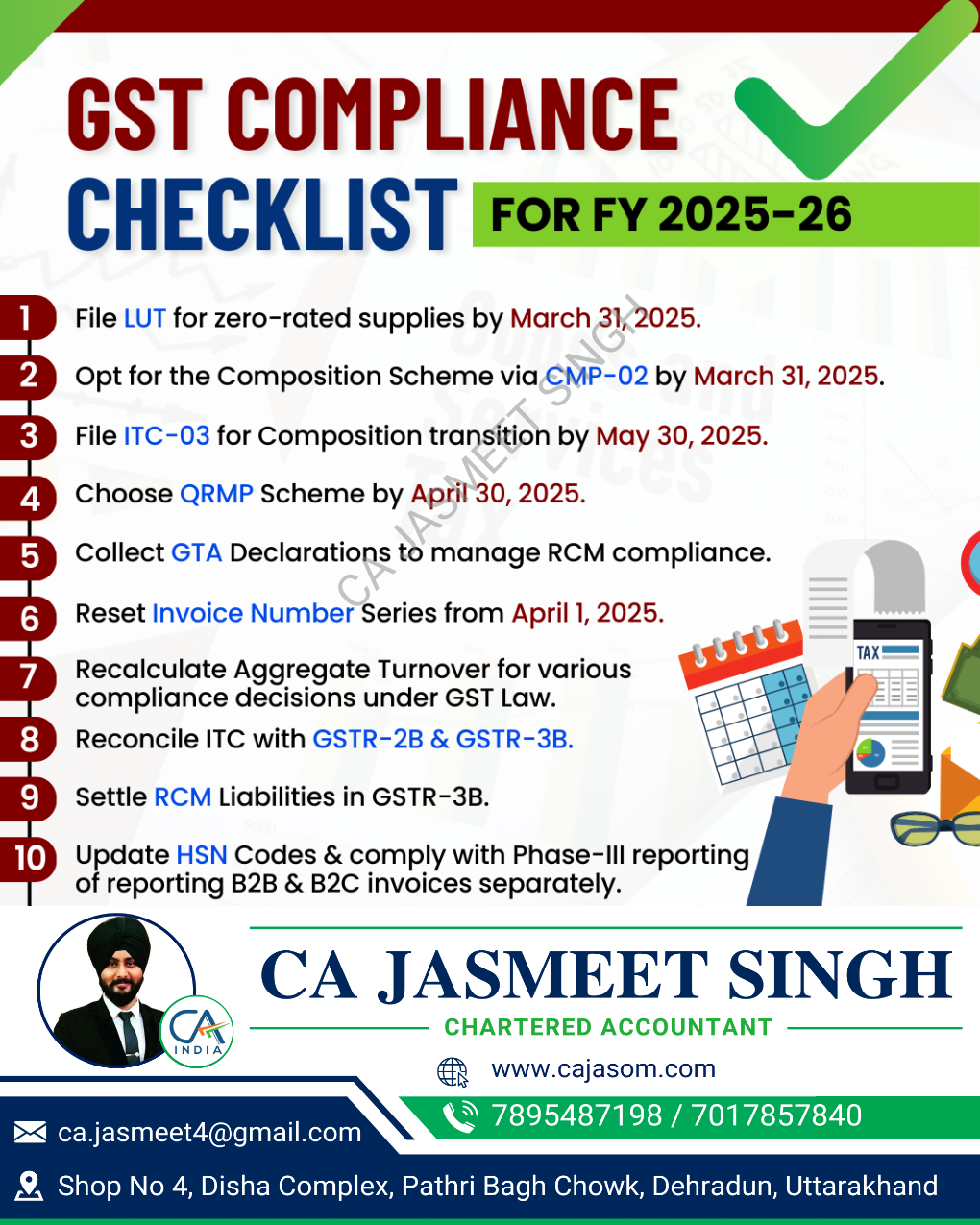

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Recouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MorePremsukh kumawat

Hey I am on Medial • 6m

Proudly sharing Bizrelievo's upcoming launch on July 27th! Your Partner for Seamless Business & Tax Compliance. What is Bizrelievo? It's your dedicated partner for comprehensive business incorporation, meticulous ongoing compliance, and expert in

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Dear Companies, This is a reminder that the due date for filing the Tax Deducted at Source (TDS) return for Quarter 4 (January to March) is 31st May 2024. Please ensure proper submission of your TDS return. Dear Individuals, Ensure that your TDS d

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)