Back

CA Dipika Pathak

Partner at D P S A &... • 1y

Dear Companies, This is a reminder that the due date for filing the Tax Deducted at Source (TDS) return for Quarter 4 (January to March) is 31st May 2024. Please ensure proper submission of your TDS return. Dear Individuals, Ensure that your TDS deposits are accurate and properly reported. Also, make sure to receive your Form 16 (Tds for salary income) and 16A (Tds for other than salary income) by 15th June 2024 #DPSA #FORM16 #FORM16A #TDSRETURN #CA #charteredaccountants #Accounting #finance

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

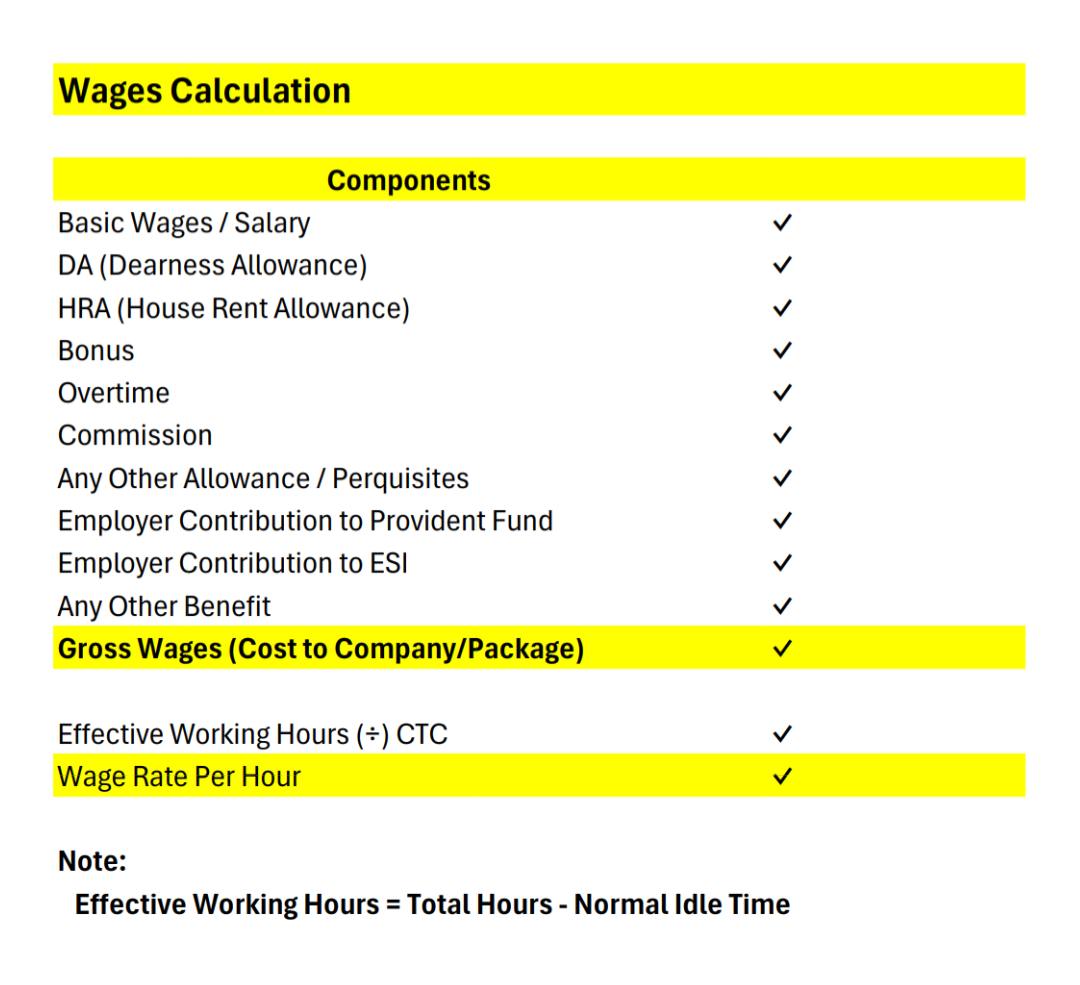

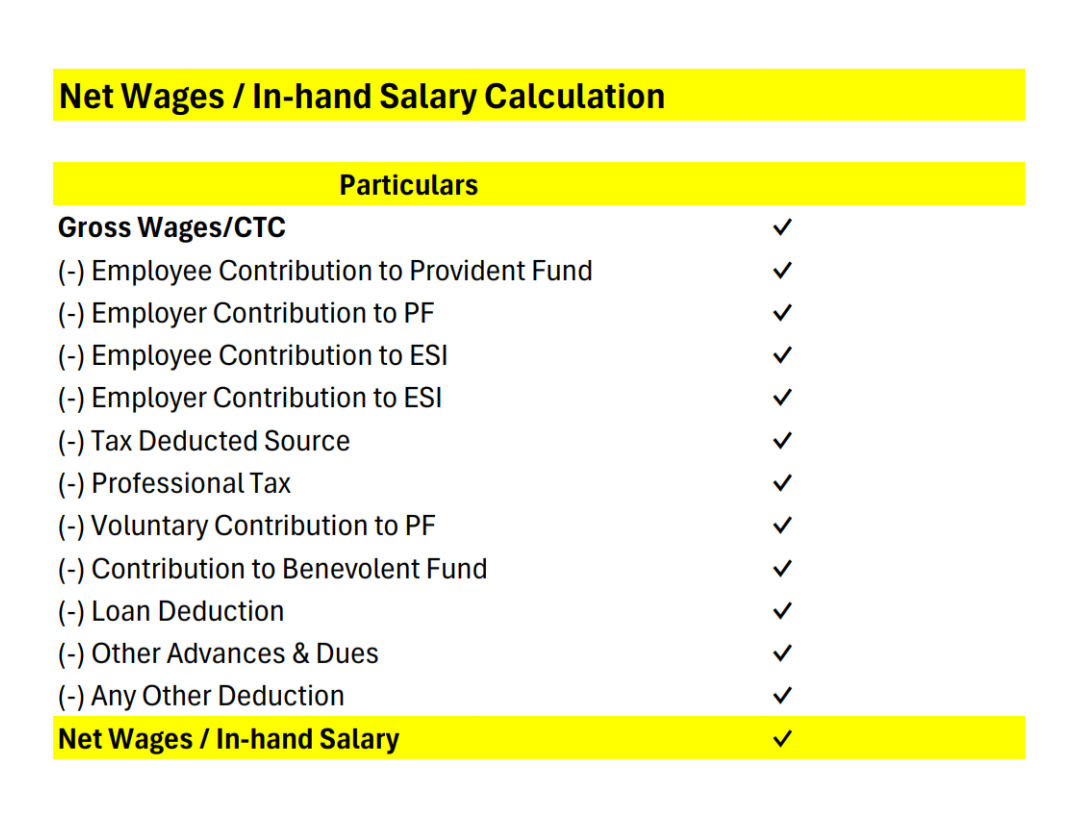

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

Free Consultation From your CA Friend for your Startups. 🌸 Holi Special Offer from Your Trusted CA! 🌸 This Holi, let’s clear not just the colors but also your compliance worries! 🎨✨ I am offering a FREE Business Compliance Consultation until Su

See MoreRushikesh Shinde

Hey I am on Medial • 7m

🧾 The Curious Case of Unused Billions in India In June 2024, SEBI ordered Jane Street to return ₹4,843 crore earned via alleged Nifty expiry manipulation. But even if recovered, the money won’t go to investors—it’ll sit in SEBI’s Investor Protection

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)