Back

CA Saloni Jaroli

Grow & Glow • 11m

Smart Tax Planning = More Savings & Zero Stress! Are you overpaying taxes or struggling with compliance? Many high-income individuals and large businesses miss out on legal tax-saving opportunities and end up paying more than necessary. At Saloni Jain & Associates, we specialize in Income Tax & GST return filing with a focus on: ✅ Maximizing tax efficiency – so you save more ✅ Complete & accurate documentation – reducing risks of notices ✅ Competitive pricing – premium service without the premium cost 💡 Why wait until the deadline? Stay compliant, save money, and avoid last-minute stress. 📩 DM us or comment "TAX" to know how we can help you optimize your tax filings today! #TaxPlanning #GST #IncomeTax #ComplianceMatters

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreSai Vishnu

Income Tax & GST Con... • 11m

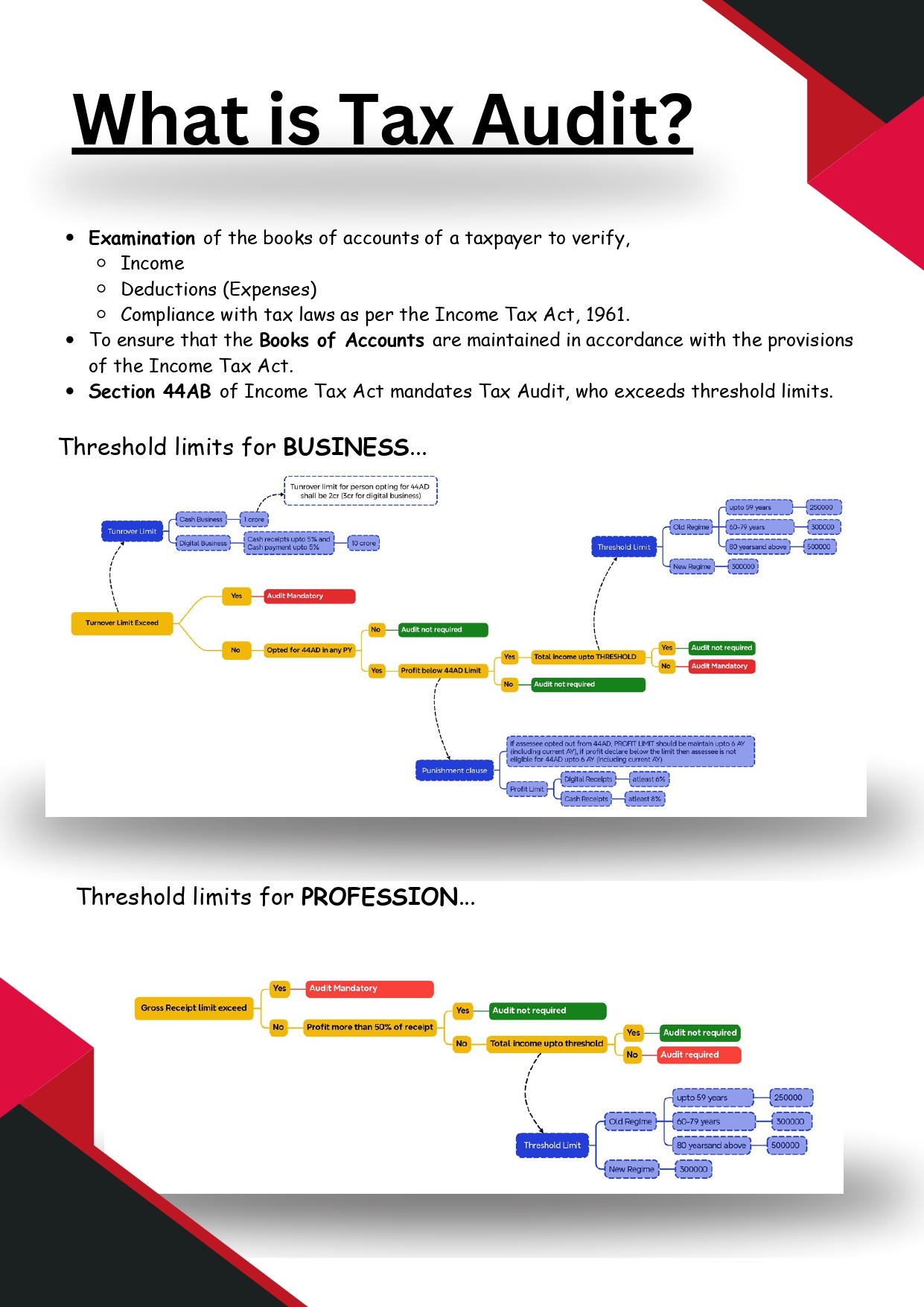

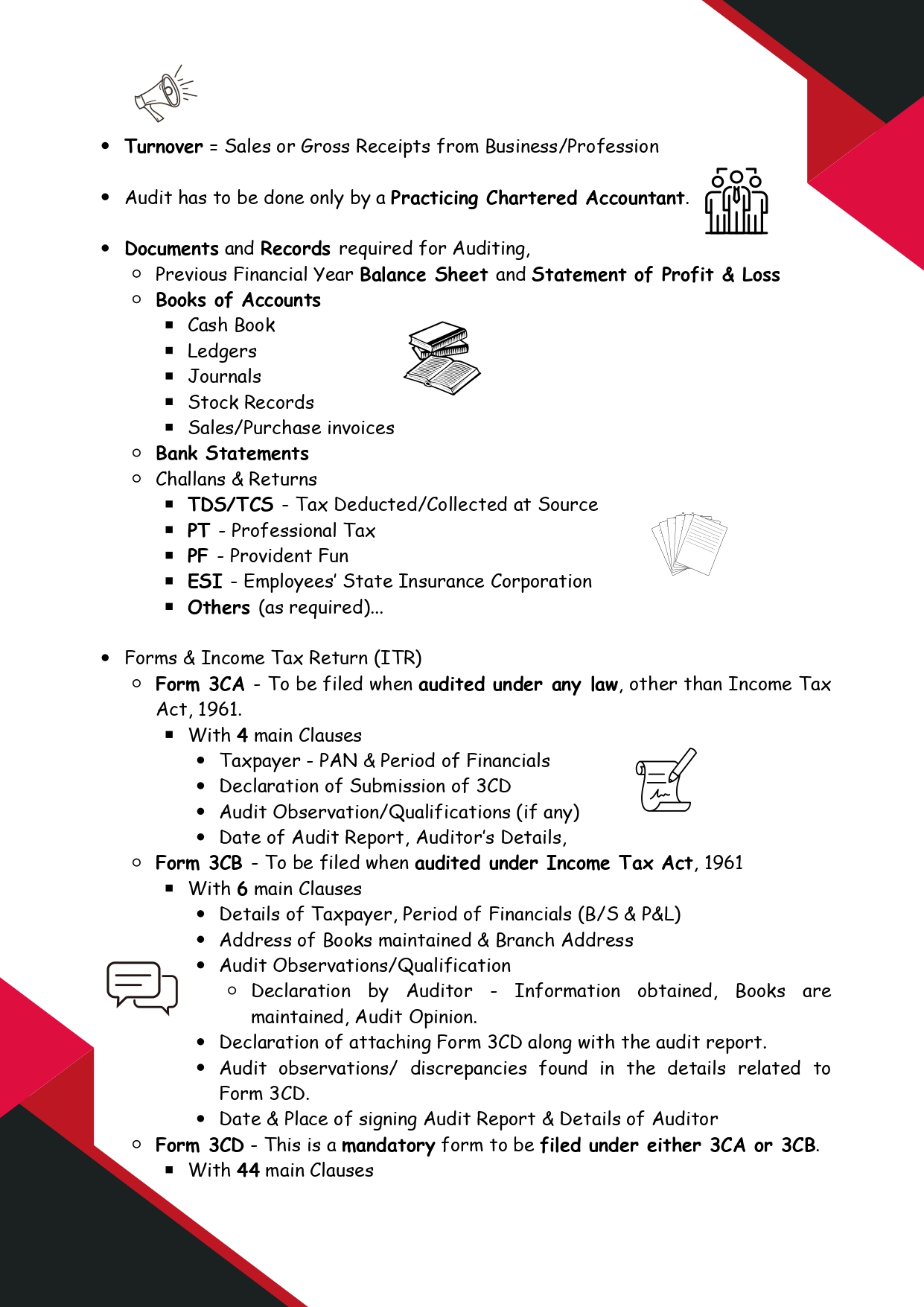

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)