Back

Aryan patil

•

Monkey Ads • 8m

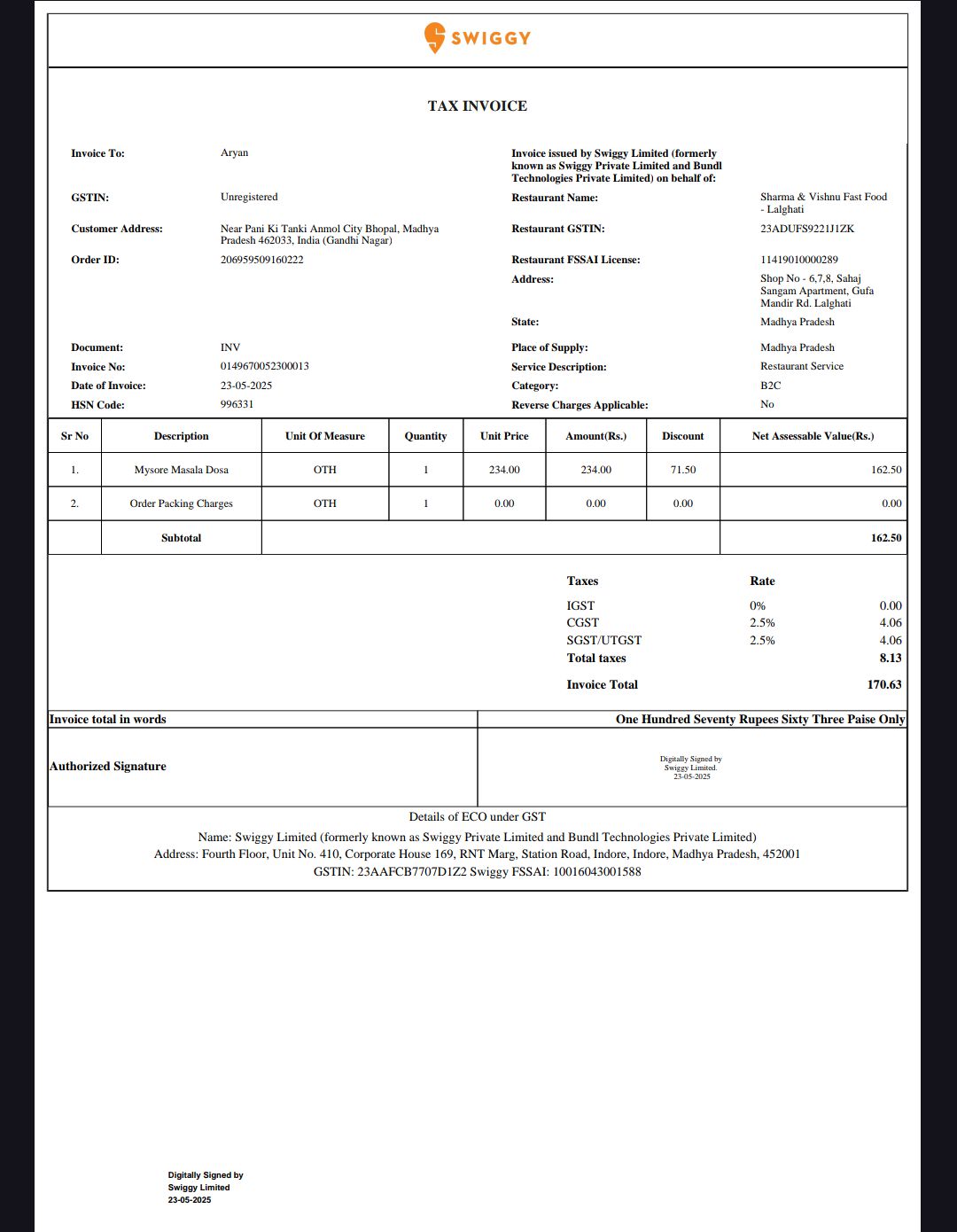

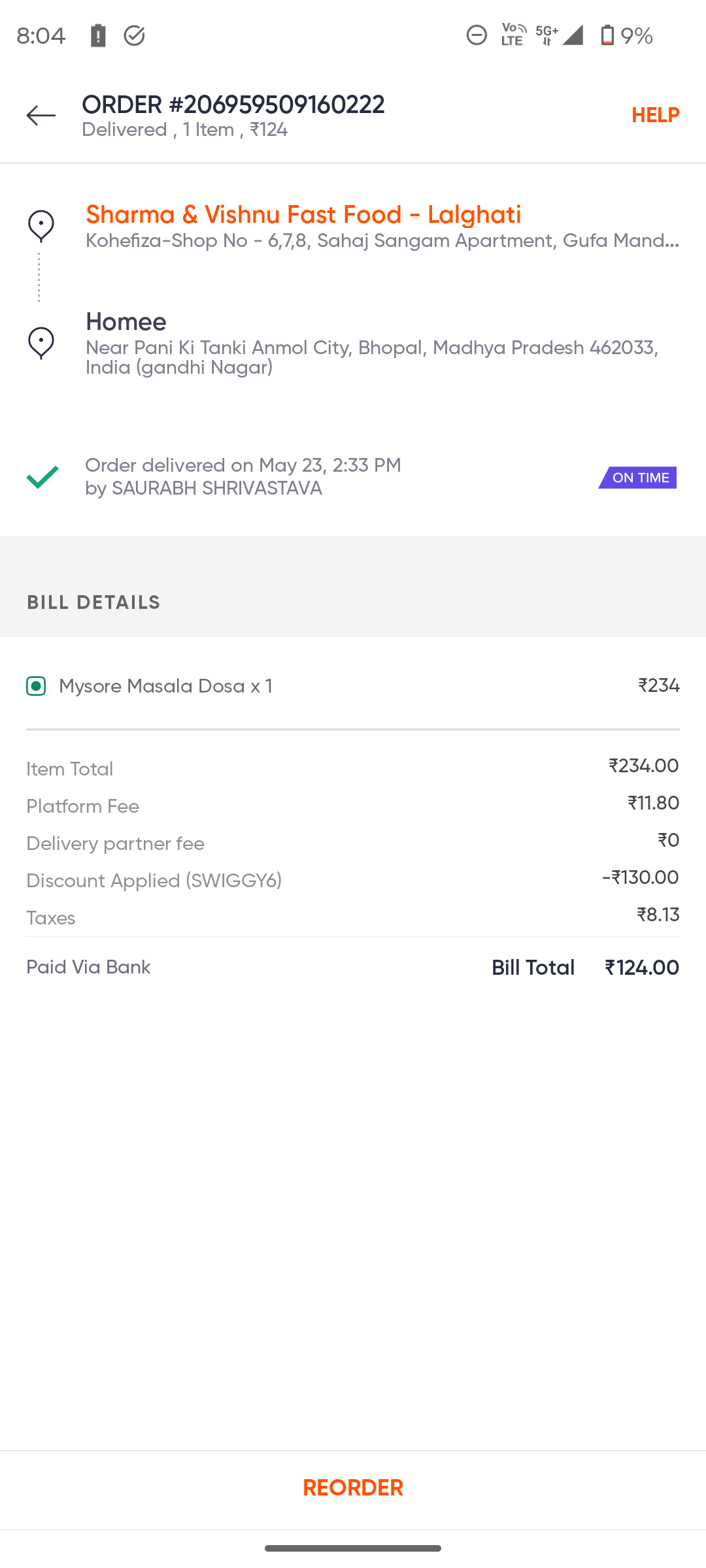

🚨 Is Swiggy Overcharging You on GST? Checked my order (ID: 206959509160222) and found troubling gaps: ✅ Paid: ₹124 ❌ Invoice: ₹170.63 ❌ Discount mismatch: ₹130 vs ₹71.50 ❌ GST overcharged: ₹8.13 instead of ₹5.79 Under Sec 15 of CGST Act, tax must be on actual paid, not inflated values. Swiggy's platform discounts seem excluded from invoice, pushing up taxable value. 🧾 Millions may be unknowingly overpaying tax. 📣 Tag @Swiggy & demand #TaxTransparency 🔁 Share to spread awareness.

Replies (19)

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 5m

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)