Back

Samanth Shetty

Be yourself • 8m

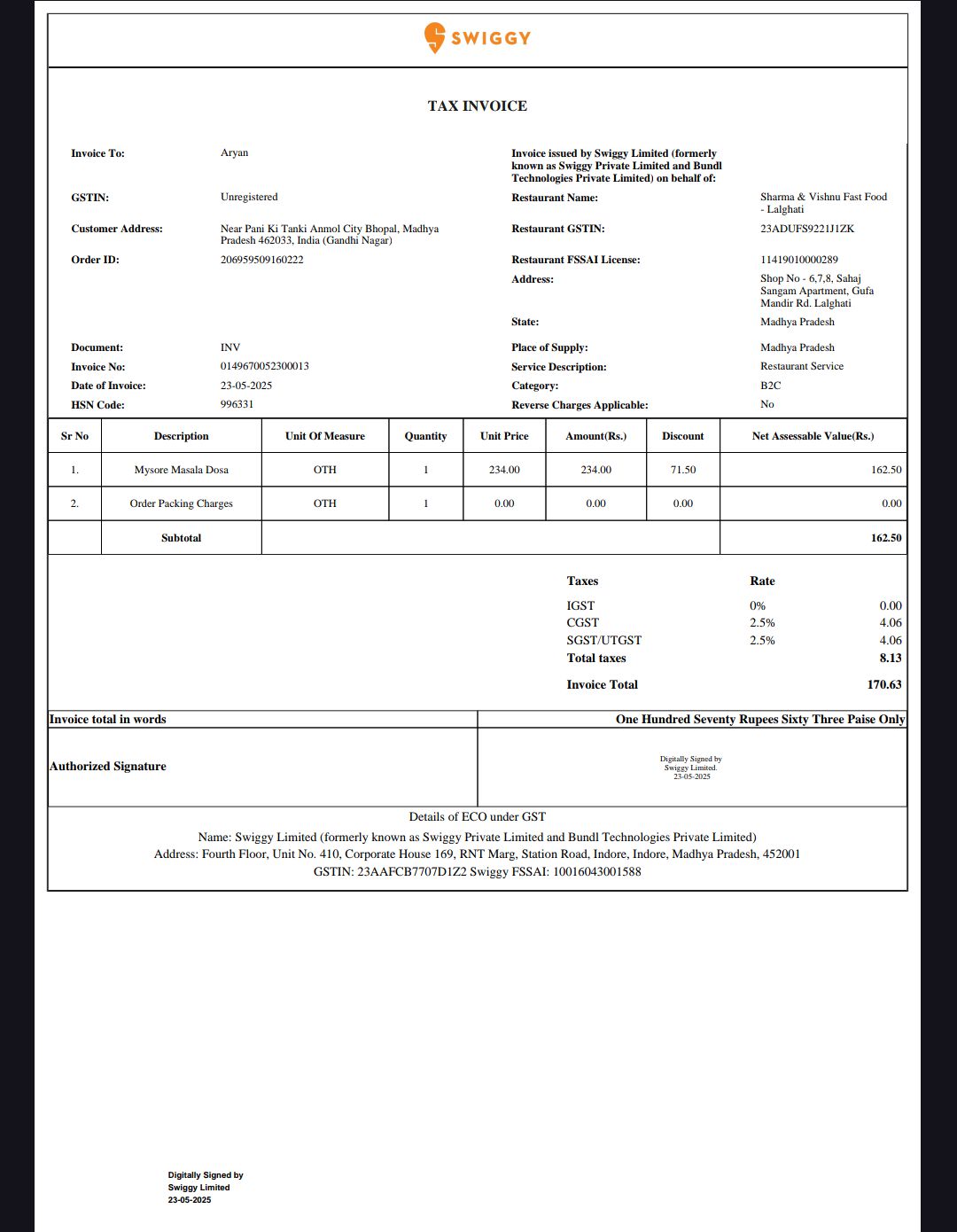

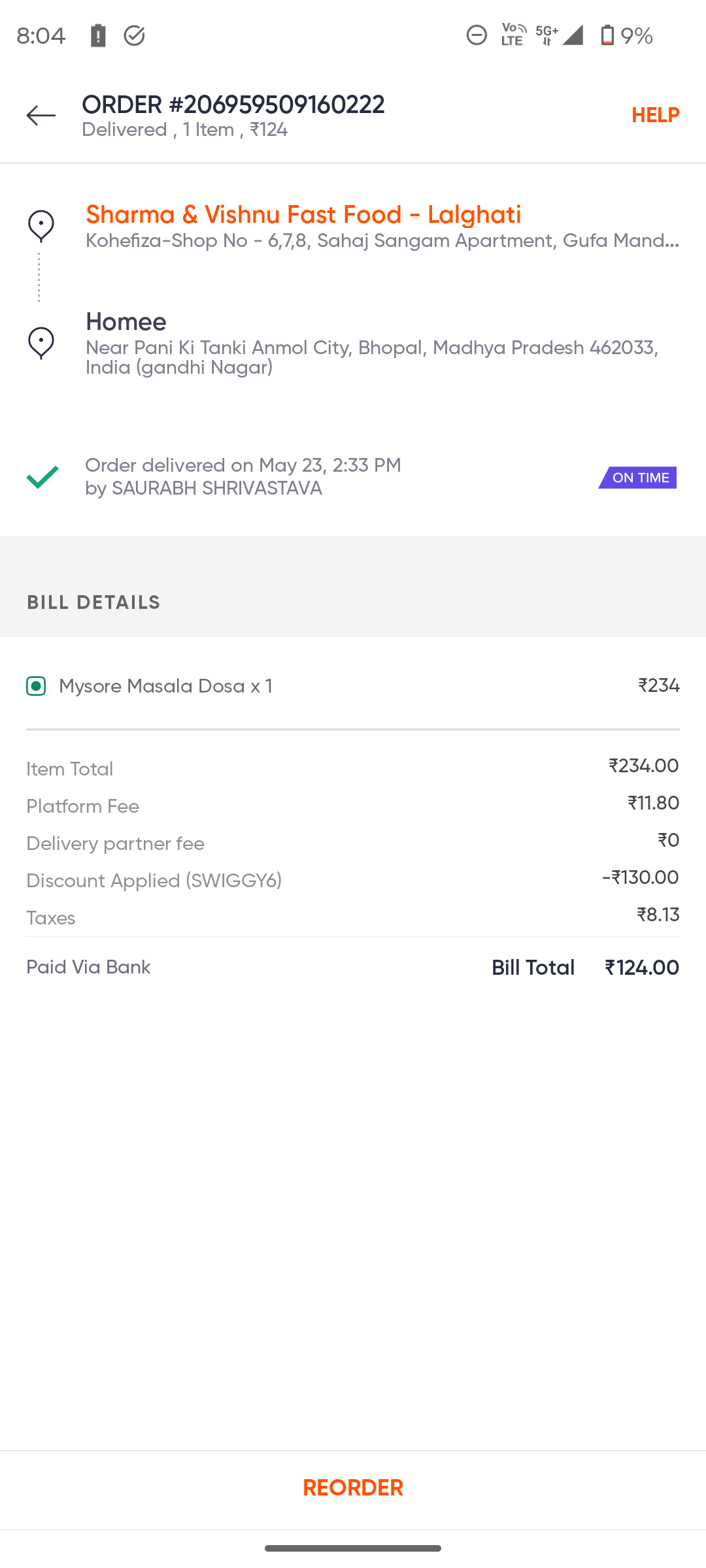

You paid 124. With a discount stated 130 but the Swiggy will even deduct the discount given by them before the deduction of commission that's the reason in invoice the discount is stated as 71.50₹. The invoice is clear and proper you can ask your CA or commerce friend if you have any doubt, the invoice is clear and the GST have been deducted in the correct way. And GST will be recieved by government so that can't be possibly tampered, even if they do that's no profit or loss for Swiggy the whole GST is collected by goverment it directly goes to goverment.

Replies (1)

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 5m

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreDinesh H

Mission to Quit 9 to... • 8m

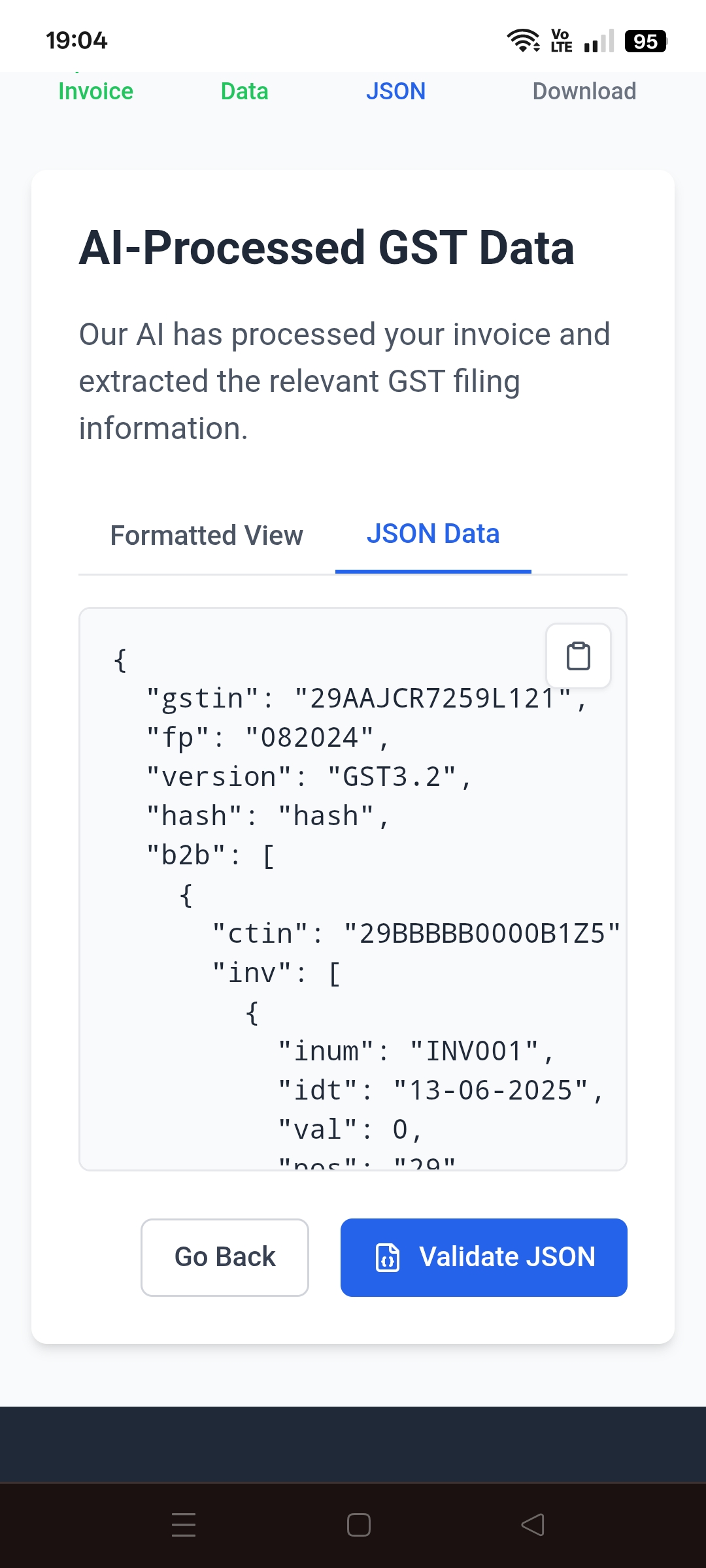

I am looking for some funding to my SaaS startups. so are there any hackathons or some competition to participate and get funds related to Fintech and Gst solution products ? my product is: AI GST Filling Automation helps the gst filling process si

See More

Mesride Tech

Software hamara, bus... • 1y

Must have softwares for startups : 1. CRM : Manage your relationship with customers 2. Accounting : have a check on in & out financials 3. Invoice : to make invoices fast 4. GST billing : to manage GST 5. HR Management: to manage your human resource

See MoreNawal

Entrepreneur | Build... • 1y

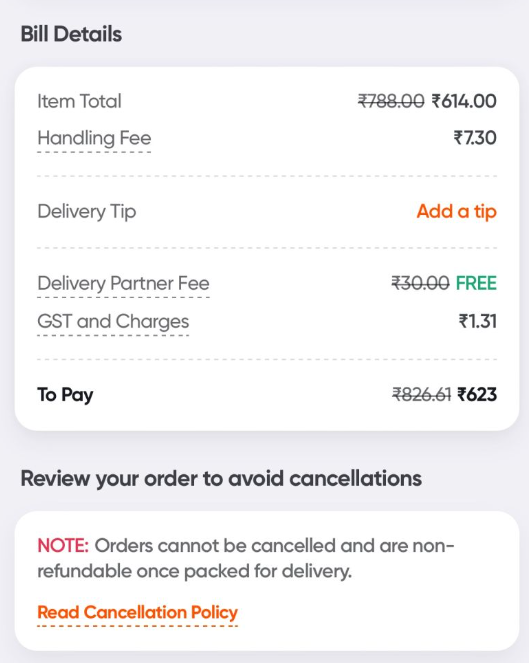

Swiggy makes over ₹40 crore 🔥 a year just through rounding off—something most users hardly notice. Have you ever observed that the handling fee on a Swiggy Instamart order is ₹7.30? While most platforms stick to whole numbers, this seemingly odd 30

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

🍽️ Why Did Swiggy Succeed While Others Failed? Swiggy transformed food delivery by solving key customer pain points: ❌ Old Model Issues – High delivery charges, slow service, lack of standardization and overpricing. ✅ Swiggy’s Solution – Built its

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)