Back

Shiva Prasad

•

Lognormal • 12m

Hi Guys, We are starting a new Internet Service Business. I want to know about the tax needs to be paid. Is Internet considered as product or service? Till how much returns, we can get GST relief and How much will be GST. If we register the business as Proprietorship firm, Do we really get Tax exception till 2 CR? I would like to have answers rather than likes.

Reply

3

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 5m

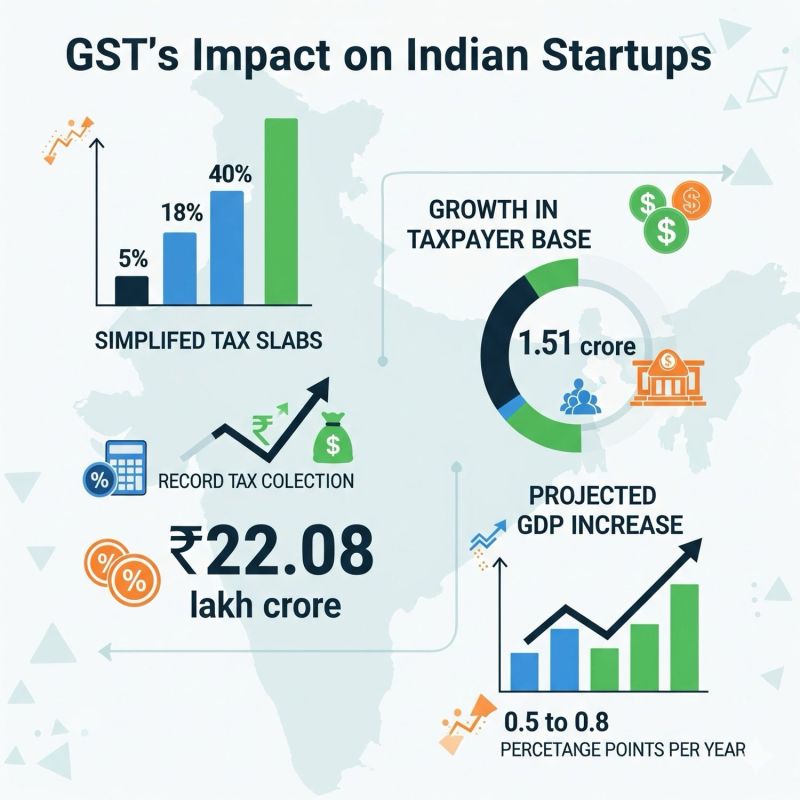

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

6 Replies

37

57

3

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)