Back

Amit Sharma

Lead Data Analyst @ ... • 6m

🚨 Breaking News: Major GST Overhaul Announced! 🚨 The GST Council just dropped a game-changer: a sharp two-tier tax structure replacing the old four slabs! 🔹 New slabs: 5% & 18% standard rates 🔹 Heavy sin goods now taxed at 40% This means simpler taxes, faster refunds, and smoother compliance—huge relief for businesses across India! What’s more: 🛒 Daily essentials like toothpaste and soaps now come under 18%, down from 28% 🚜 Agriculture inputs like fertilizers and tractors get a tax cut 🏥 Healthcare benefits with GST exemptions on insurance and affordable hospital stays 🎓 Education and skill programs become GST-free This is a landmark step toward an easier, more transparent tax system. The future of business just got brighter. #GST #GSTReform #TaxUpdate #BusinessNews #FinanceIndia #NextGenGST #EaseOfDoingBusiness #IndiaEconomy #Entrepreneurship #StartupIndia #MSME #ComplianceSimplified #PolicyUpdate #CXOperations #MakeInIndia #DigitalIndia

Replies (1)

More like this

Recommendations from Medial

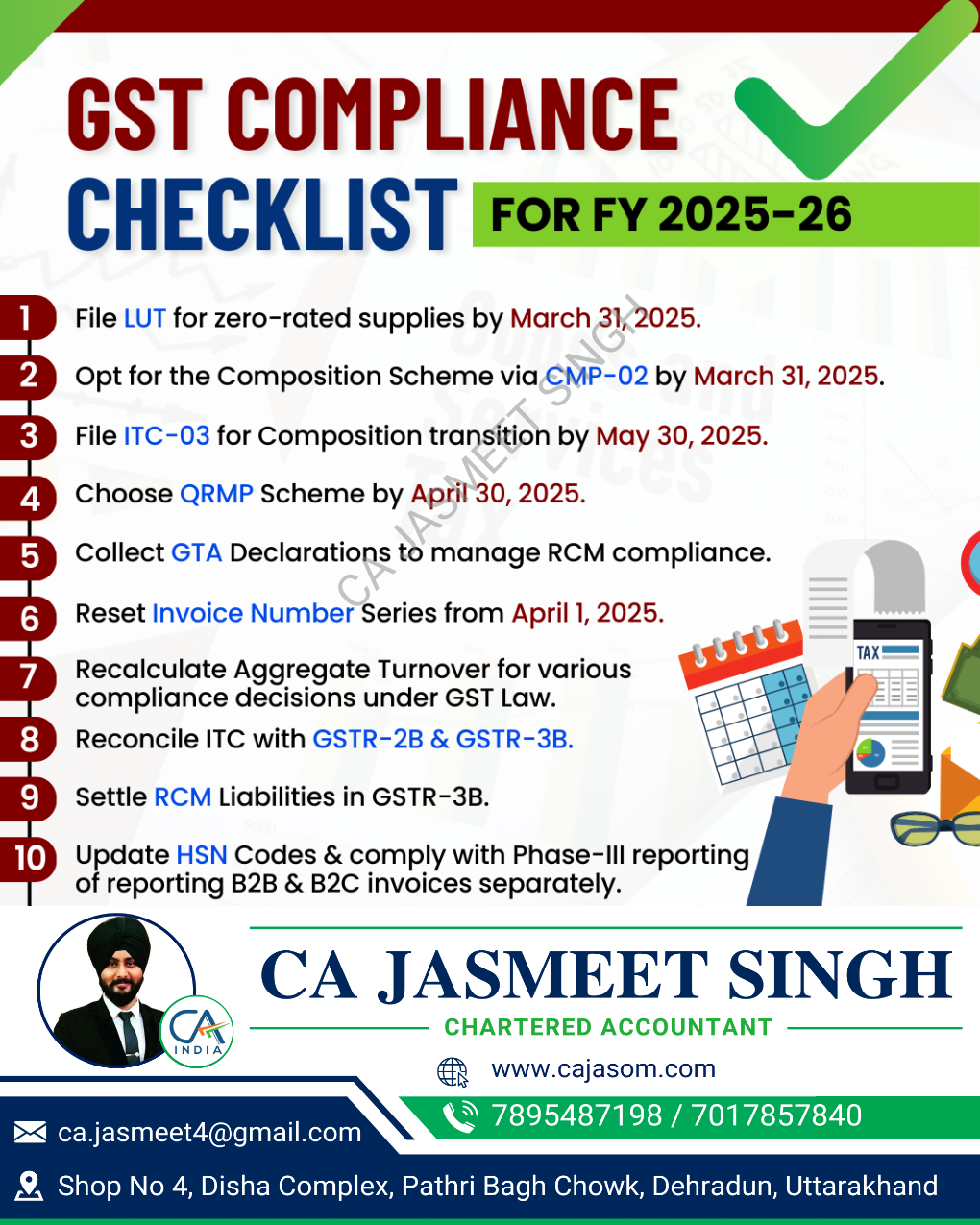

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

theresa jeevan

Your Curly Haird mal... • 1y

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

Aditya Arora

•

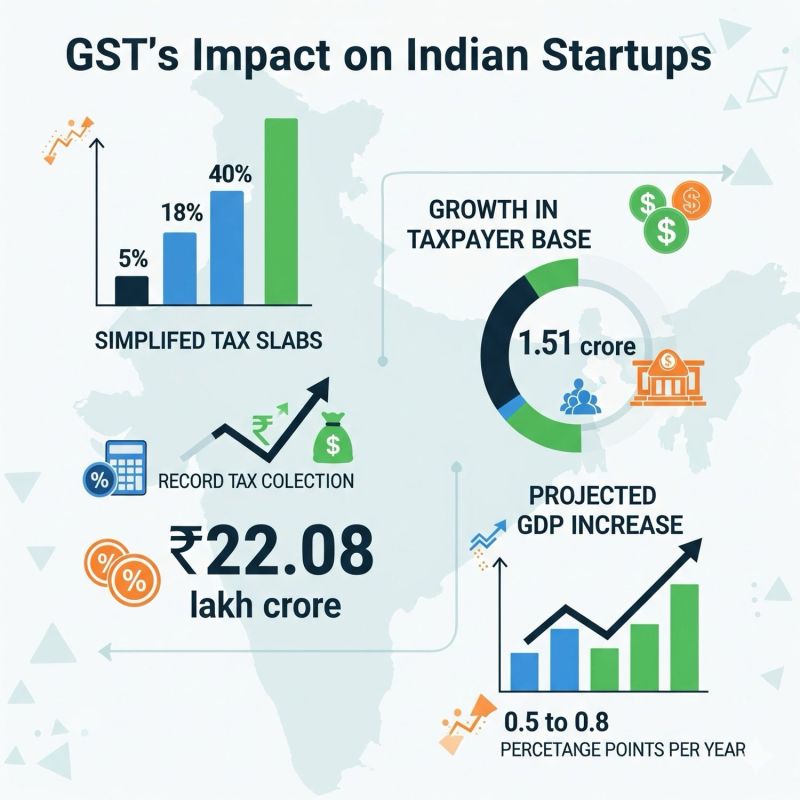

Faad Network • 5m

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 11m

How Parachute Outsmarted India’s Tax System & Saved Crores🤯🌝 Ever noticed that Parachute Coconut Oil never says "hair oil" on its bottle? Instead, it’s labeled as “100% Pure Edible Coconut Oil.” This isn’t just a branding choice—it’s a smart tax-s

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)