Back

Amit Sharma

Lead Data Analyst @ ... • 6m

🚨 Breaking News: Major GST Overhaul Announced! The GST Council just dropped a game-changer: a sharp two-tier tax structure replacing the old four slabs! 🔹 New slabs: 5% & 18% standard rates 🔹 Heavy sin goods now taxed at 40% This means simpler taxes, faster refunds, and smoother compliance—huge relief for businesses across India! What’s more: 🛒 Daily essentials like toothpaste and soaps now come under 18%, down from 28% 🚜 Agriculture inputs like fertilizers and tractors get a tax cut 🏥 Healthcare benefits with GST exemptions on insurance and affordable hospital stays 🎓 Education and skill programs become GST-free 🎟️ Cinema tickets under ₹100 drop to 12% GST This is a landmark step toward an easier, more transparent tax system. The future of business just got brighter. BreakingGST #GSTReform #TaxUpdate #BusinessNews #FinanceIndia #NextGenGST #EaseOfDoingBusiness #IndiaEconomy #Entrepreneurship #StartupIndia #MSME #MakeInIndia #DigitalIndia

Replies (3)

More like this

Recommendations from Medial

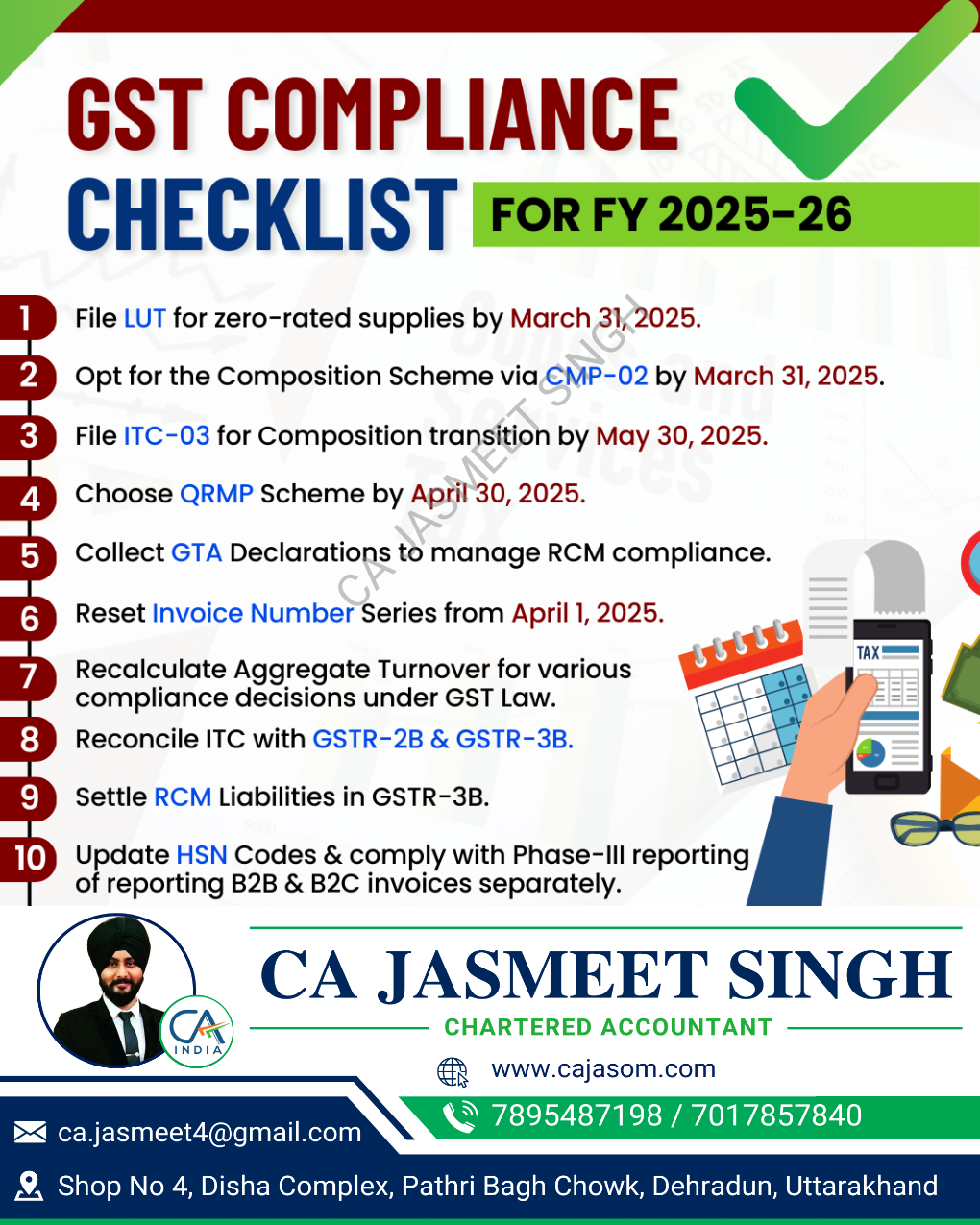

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

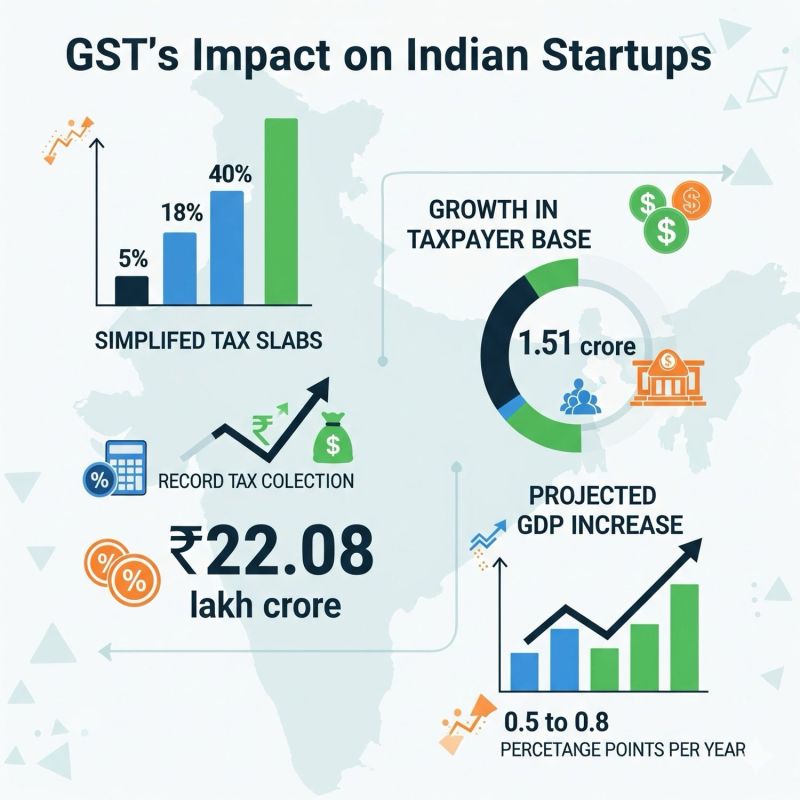

Aditya Arora

•

Faad Network • 5m

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 11m

How Parachute Outsmarted India’s Tax System & Saved Crores🤯🌝 Ever noticed that Parachute Coconut Oil never says "hair oil" on its bottle? Instead, it’s labeled as “100% Pure Edible Coconut Oil.” This isn’t just a branding choice—it’s a smart tax-s

See More

Rohan Saha

Founder - Burn Inves... • 6m

India’s GST Rate Cut - What It Means for You From this September 22 the government is making some big changes in GST instead of too many tax slabs now there will mostly be two rates 5%, 18% and for luxury stuff a new 40% rate for common people this

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)