Back

Rasal

Never Give Up • 5m

Current GST Policy in India (2025): A Comprehensive Overview India’s Goods and Services Tax (GST), introduced in July 2017, has undergone several reforms to simplify the indirect tax structure and create a unified national market. In September 2025 the GST Council announced a landmark reform rate rationalisation and procedural streamlining aimed at boosting consumption, easing compliance and addressing industry concerns. This article explores the current GST policy framework and its key implications. Rationalisation of Tax Slabs One of the most significant changes is the simplification of GST slabs. The earlier four-tier system (5%, 12%, 18%, 28%) has now been reduced to mainly two standard slabs: •5% – for essential goods and services. •18% – for standard goods and services. •40% (Special/Demerit rate) for luxury and sin goods such as tobacco, pan masala and certain sugary drinks

More like this

Recommendations from Medial

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Shubham Patel

•

E-Cell, IIT Bombay • 1y

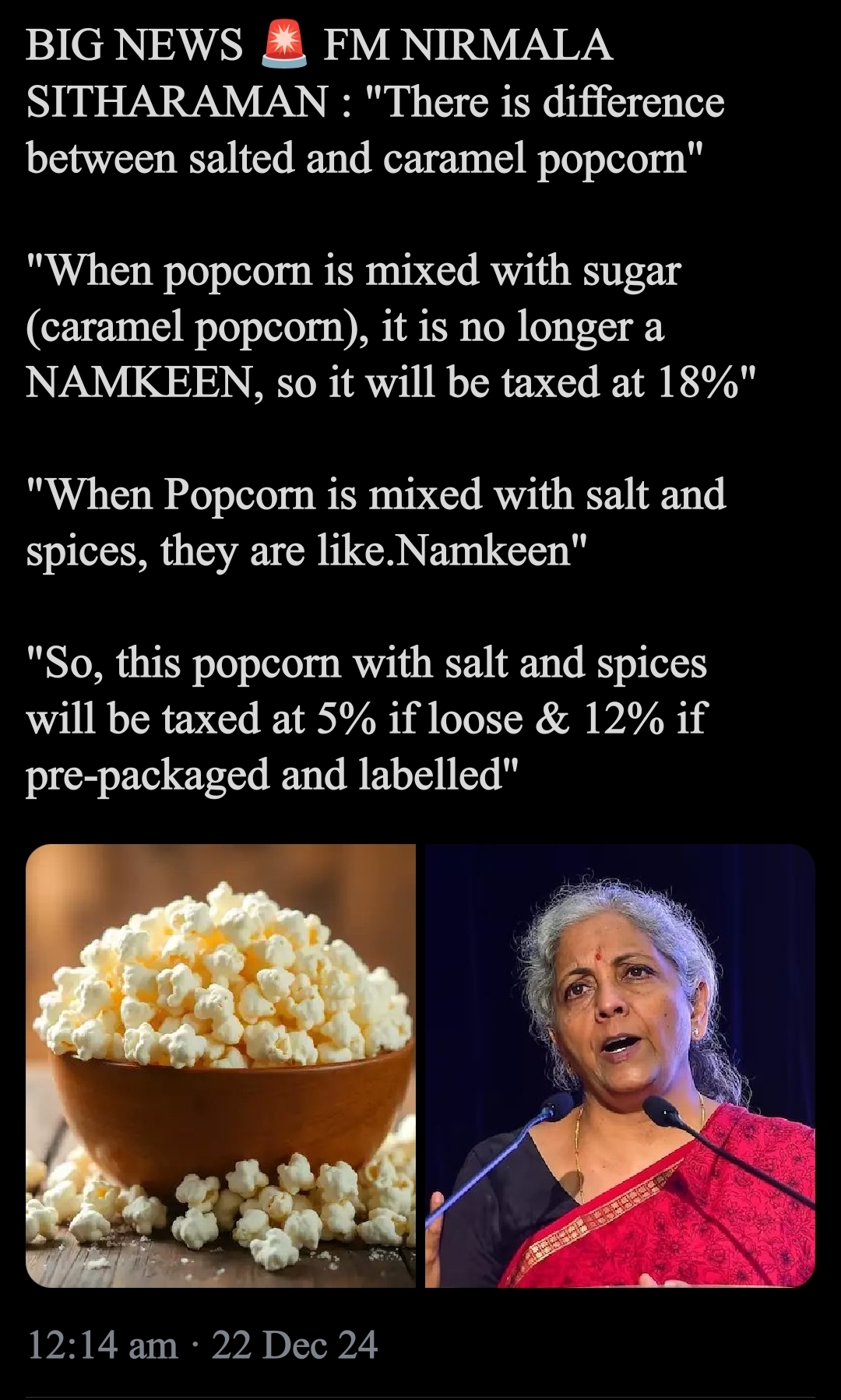

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representative

See More

gray man

I'm just a normal gu... • 10m

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)