Back

Shubham Patel

•

E-Cell, IIT Bombay • 1y

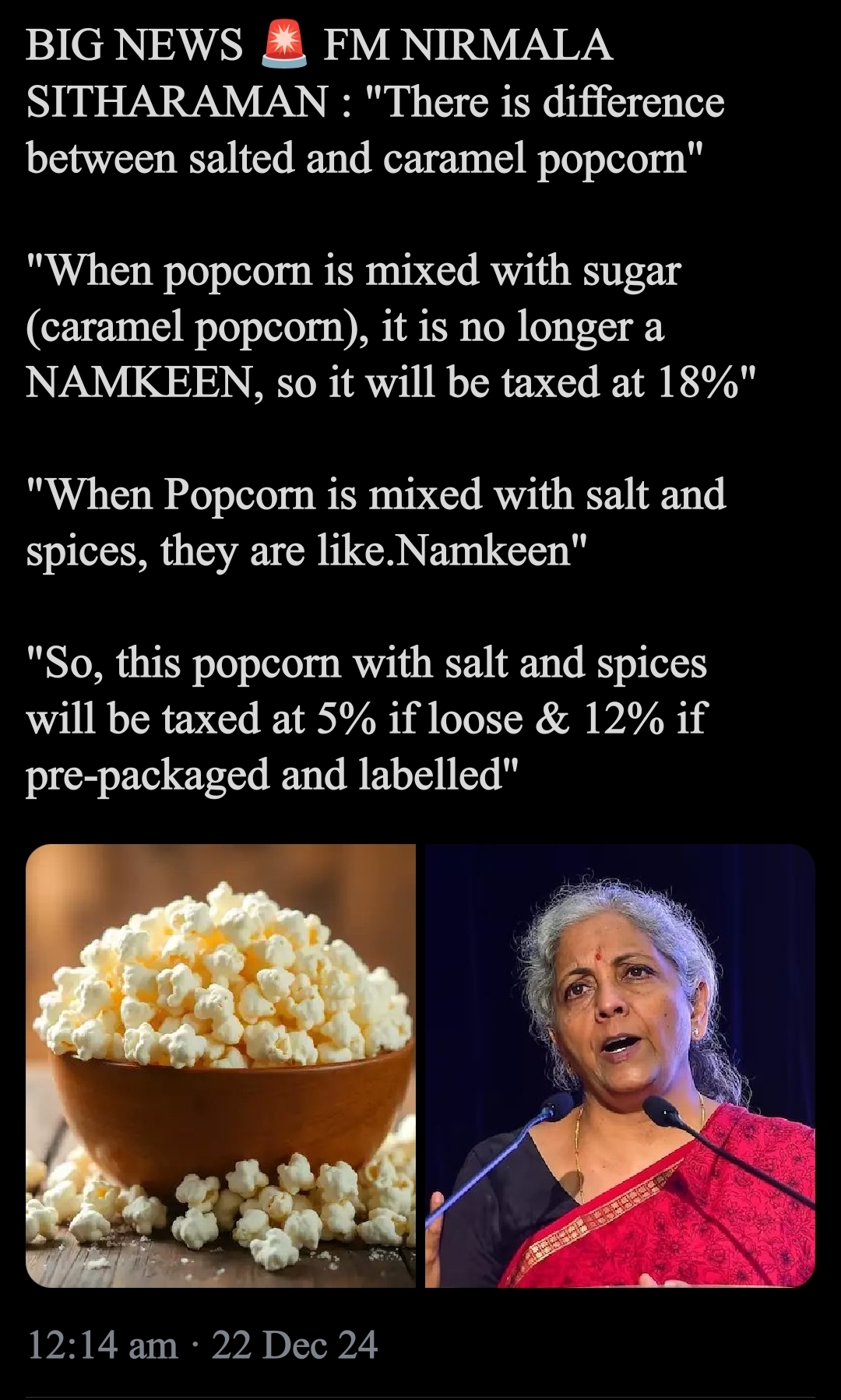

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representatives, announced on Saturday that non- branded popcorn mixed with salt and spices would attract a 5% GST, pre- packaged and branded popcorn 12%, and caramel popcorn, categorised as sugar confectionery, 18% #financeminister #Gst #tds #surcharges #cess #incometax #nirmalasitaraman #budget #indiantaxes Sign up today and take the first step towards your entrepreneurial dream! 👉 Click Here to Register! https://linktr.ee/tech.indro

Replies (7)

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Vamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

TREND talks

History always repea... • 1y

😠 Leave India, where they even tax your popcorn – statement from a startup founder has sparked a lot of aggressive discussions 💬 🚀 The founder, who returned to India after studying at top institutes in the U.S., set up a business employing 30 pe

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)