Back

Vamshi krishna Nayini

Hey I am on Medial • 1y

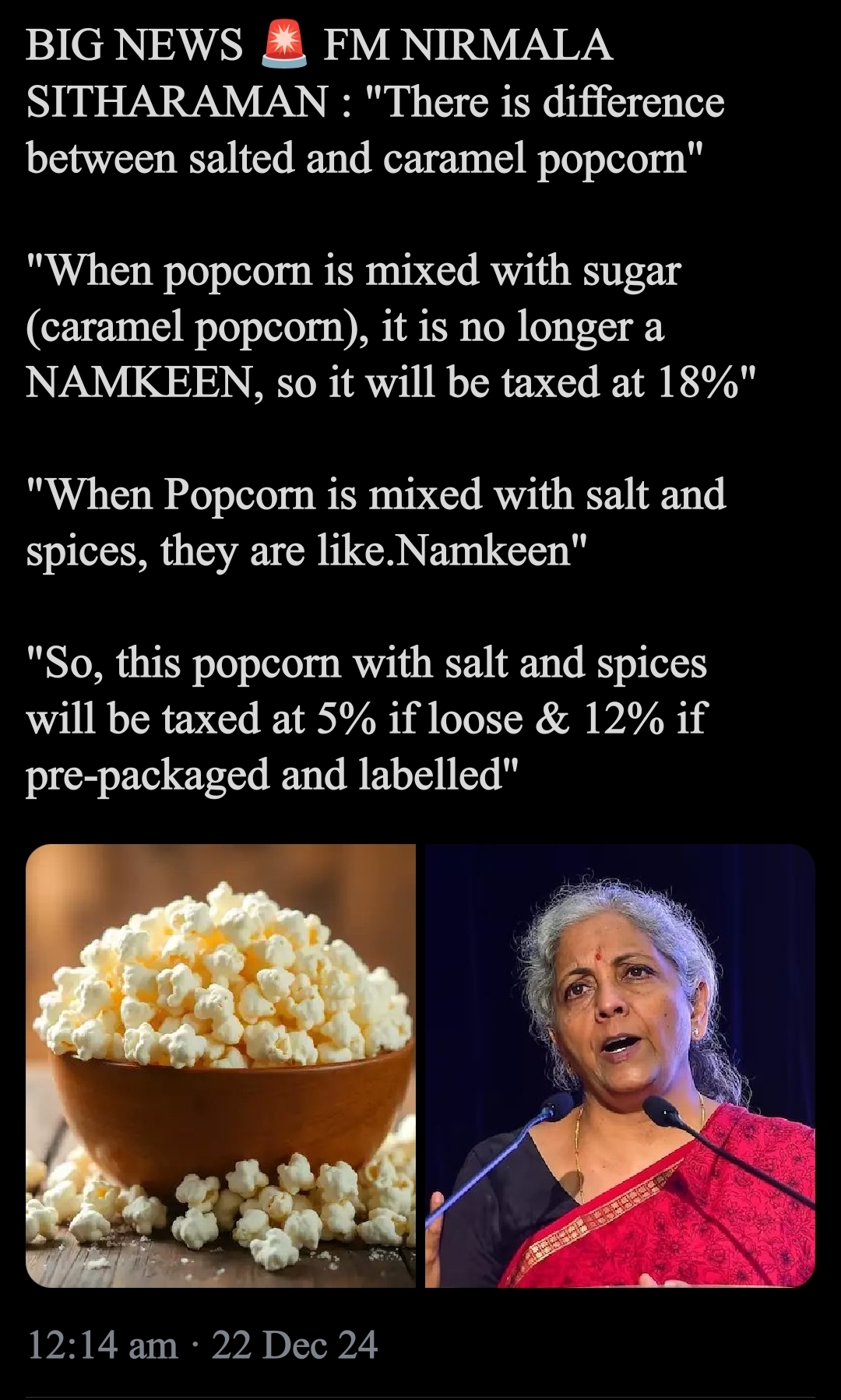

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwide for collecting exorbitant taxes. No wonder leaders like Ambani are opening offices in Singapore to escape this burden. For a middle-class individual, it’s even worse: - Pay income tax (ITR) on your salary. - Use the remaining income to buy goods/services and pay GST. - Tax on education, healthcare, insurance—almost everything! How is this sustainable? Taxation should be reasonable and fair, not an endless cycle of burden. Think, Bharat. Think, India. Let’s push for policies that empower us to grow. 💡🇮🇳 #ReduceGST #FairTaxation #EconomicReforms #Modi #NirmalaSitharaman #Entrepreneurship #MiddleClassIndia @narendramodi @nsitharamanoffc @startupindia @dippgoi @mygovindia @FinMinIndia @RBI @NITIAayog

Replies (4)

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Shubham Patel

•

E-Cell, IIT Bombay • 1y

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representative

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreAditya Arora

•

Faad Network • 5m

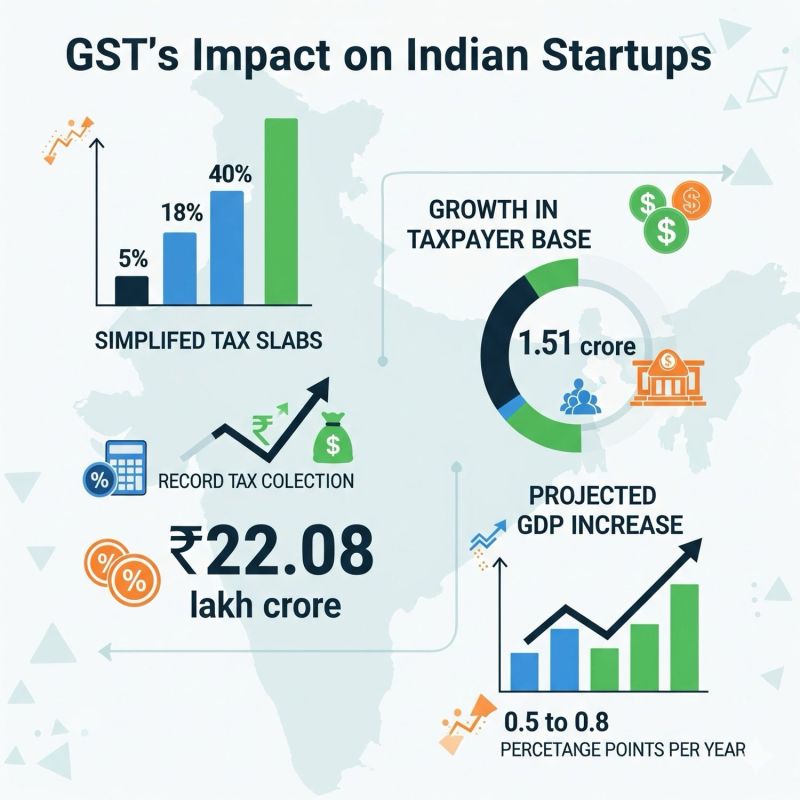

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Account Deleted

Hey I am on Medial • 1y

Hello Everyone, What do you think, India will be the next destination for startups because government is coming with some great policies for startups , let's take example of GIFT city where startups have 0% GST and first 10 years no tax for Startups.

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreTREND talks

History always repea... • 1y

😠 Leave India, where they even tax your popcorn – statement from a startup founder has sparked a lot of aggressive discussions 💬 🚀 The founder, who returned to India after studying at top institutes in the U.S., set up a business employing 30 pe

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)