Back

Arcane

Hey, I'm on Medial • 1y

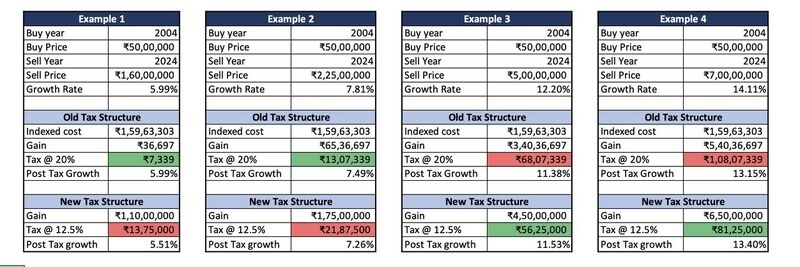

New Property Taxation Scenarios: 1) Modest Gains, High Burden 2004 Buy Price: ₹50 lakh 2024 Sell Price: ₹1.6 crore Old Taxation: ₹7,339 New Taxation: ₹13.75 lakh Your tax liability jumps from ₹7,339 to ₹13.75 lakh!!! 2) Moderate Gains, Heavier Load 2004 Buy Price: ₹50 lakh 2024 Sell Price: ₹2.25 crore Old Taxation: ₹13 lakh New Taxation: ₹21.8 lakh A rise from ₹13 lakh to ₹21.8 lakh in taxes is just unfair 3) High Gains, Slight Relief 2004 Buy Price: ₹50 lakh 2024 Sell Price: ₹5 crore Old Taxation: ₹68 lakh New Taxation: ₹56 lakh Tax reduces from ₹68 lakh to ₹56 lakh, but such high returns are rare. 4) Exceptional Gains, Significant Relief 2004 Buy Price: ₹50 lakh 2024 Sell Price: ₹7 crore Old Taxation: ₹1.08 crore New Taxation: ₹81 lakh There's relief for high returns, but you have to be lucky for exceptional returns The new system burdens modest investors with higher taxes(who make up the majority) & favors those with significant gains.Need a more balanced approach.

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreNeelakanth Chavan

Analytics and Data s... • 1y

What are the taxation rules in india on investments in stocks. As per my knowledge, gains on stocks more than 1 lakh are taxed at 10% for long term gains(>1year) & 15% for short term gains(<1year). How can someone escape from this. One method that

See MorePrem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)