Back

Neelakanth Chavan

Analytics and Data s... • 1y

What are the taxation rules in india on investments in stocks. As per my knowledge, gains on stocks more than 1 lakh are taxed at 10% for long term gains(>1year) & 15% for short term gains(<1year). How can someone escape from this. One method that I know but not sure is selling stocks before it hits 1lakh and again buying them back. Won't this be taxed?

Replies (1)

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

VIJAY PANJWANI

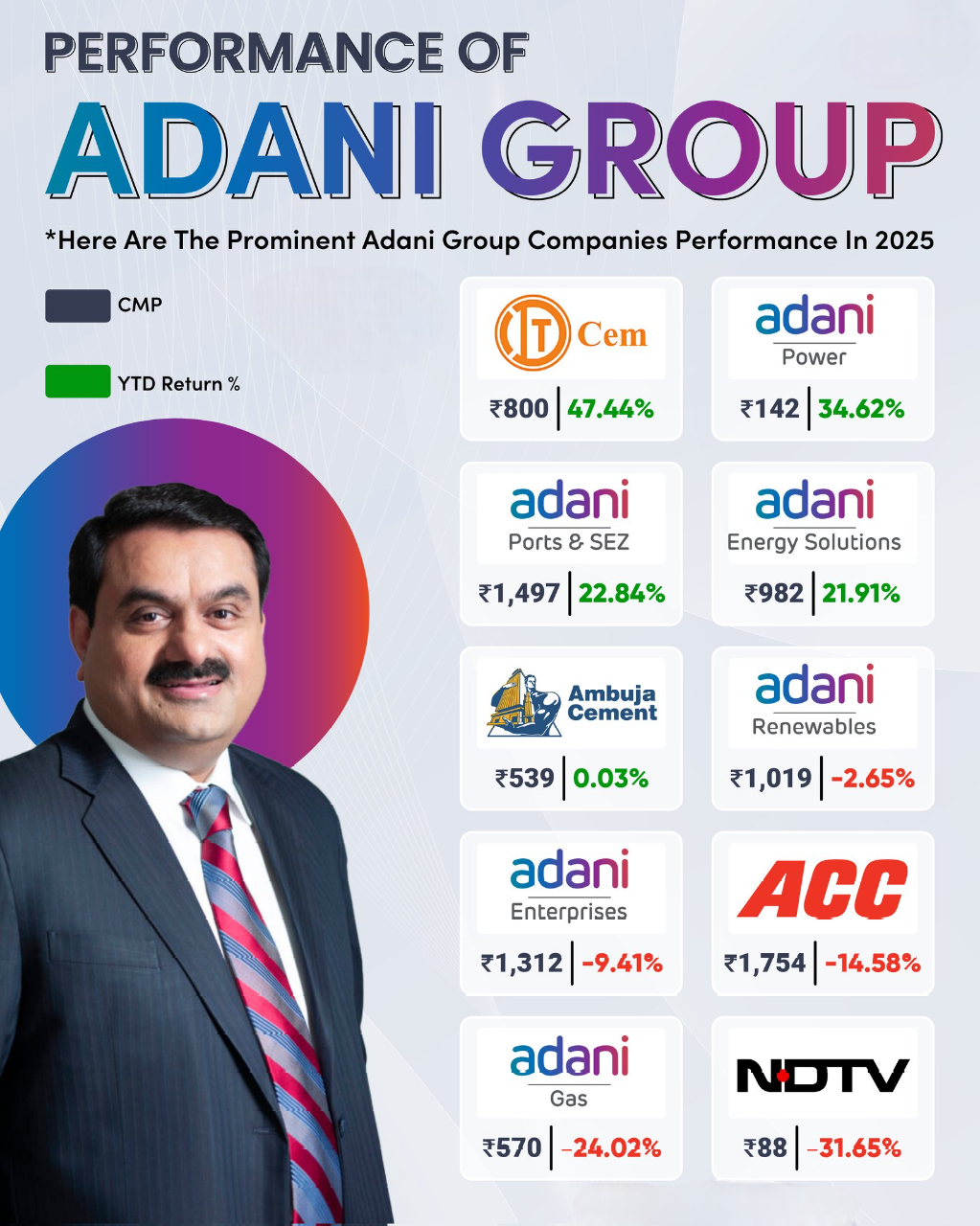

Learning is a key to... • 2m

Performance of Adani Group – 2025 Snapshot From power & ports to cement and renewables, the Adani Group shows a mixed but insightful performance this year. Some stocks delivered strong YTD gains 📈 while others faced pressure 📉 reminding us why d

See More

Tushar Aher Patil

Trying to do better • 1y

Day2 About Basic Finance Concepts Here's Some New Concepts 2. Corporate Finance Capital Budgeting: Deciding on long-term investments like new projects or equipment to enhance business profitability. Capital Structure: Determining the best mix of d

See More

Poosarla Sai Karthik

Tech guy with a busi... • 10m

It’s always not easy to mislead the public market compared to the private one, simply because public markets are more accessible and heavily scrutinized. Public companies have to follow strict reporting rules, making it harder to hide or manipulate i

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Taxation: Salary vs. Income Hey there! Let’s talk about something essential in finance—taxation—and the difference between salary and income. First off, your salary is the fixed amount you earn from your employer, usually detailed in

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)