Back

Poosarla Sai Karthik

Tech guy with a busi... • 10m

It’s always not easy to mislead the public market compared to the private one, simply because public markets are more accessible and heavily scrutinized. Public companies have to follow strict reporting rules, making it harder to hide or manipulate information. On the other hand, private investments come with less stringent disclosure obligations. Investors often deal with complex filings like Schedule K-1 forms and can’t expect to redeem their investments when or how they want - liquidity is limited. In public markets, volatility is a given. Share prices move based on sentiment, news, and external shocks. Plus, public companies face constant short-term pressure to perform well every quarter, sometimes at the cost of long-term strategy. #PublicMarkets #PrivateMarkets #VentureCapital #IPO #FinancialLiteracy

More like this

Recommendations from Medial

Rahul Jindal

ENTERPRENEURSHIP • 10m

I have a Idea. App is Based on Messaging First Social Media app. Opening Page is Chats Section Which is at the Middle of the Bottom Bar. Bottom Bar Consist of 5 Tabs. (1-Home, 2-Contacts, 3-Chats, 4-Private Feed, 5-Menu) Home Tab Consist Public Feed

See MoreVivek Joshi

Director & CEO @ Exc... • 6m

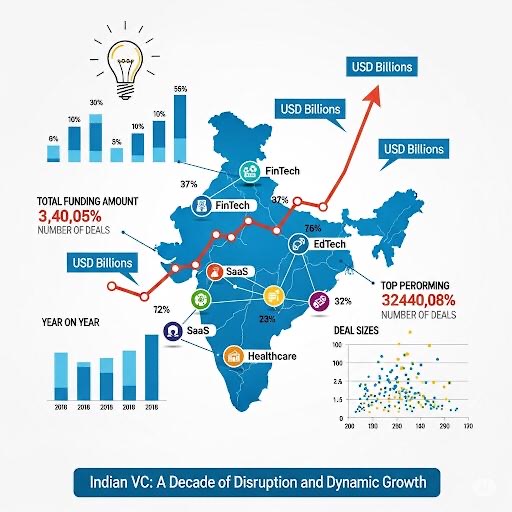

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Arcane

Hey, I'm on Medial • 1y

According to Zoho Founder Mr. Sridhar Vembu, 'Leading a public company is far more challenging than a private one.' I have a question for you - If your startup thrives, would you go public for growth and capital, or remain private for autonomy and f

See More

Tushar Aher Patil

Trying to do better • 1y

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investme

See More

Akash Sharma

Money follows you wh... • 1y

I have been trying to find good place to explore Finance and test my skills but found nothing. Also I got lot of fake people that tried to mislead giving spoofy investment schemes and lot of filthy stuff. So to resolve this problem for geeky people o

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)