Back

Tushar Aher Patil

Trying to do better • 1y

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investments. Examples of Non-Current Liabilities: Long-Term Loans: Bonds Payable: Deferred Tax Liabilities: Lease Obligations: Pension Liabilities: Importance of Non-Current Liabilities: These liabilities allow businesses and individuals to make substantial investments without needing immediate cash but require careful planning to manage long-term financial health.

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 8 About Basic Finance and Accounting Concepts Here's Some New Concepts In finance, Liabilities represent obligations or debts that an individual or organization owes to others. They indicate an outflow of resources, either cash or services, that

See More

Tushar Aher Patil

Trying to do better • 1y

Day 10 About Basic Finance and Accounting Concepts Here's Some New Concepts 3. Contingent Liabilities Contingent liabilities are potential obligations that may arise depending on the outcome of a future event. These liabilities are not always guar

See More

Tushar Aher Patil

Trying to do better • 1y

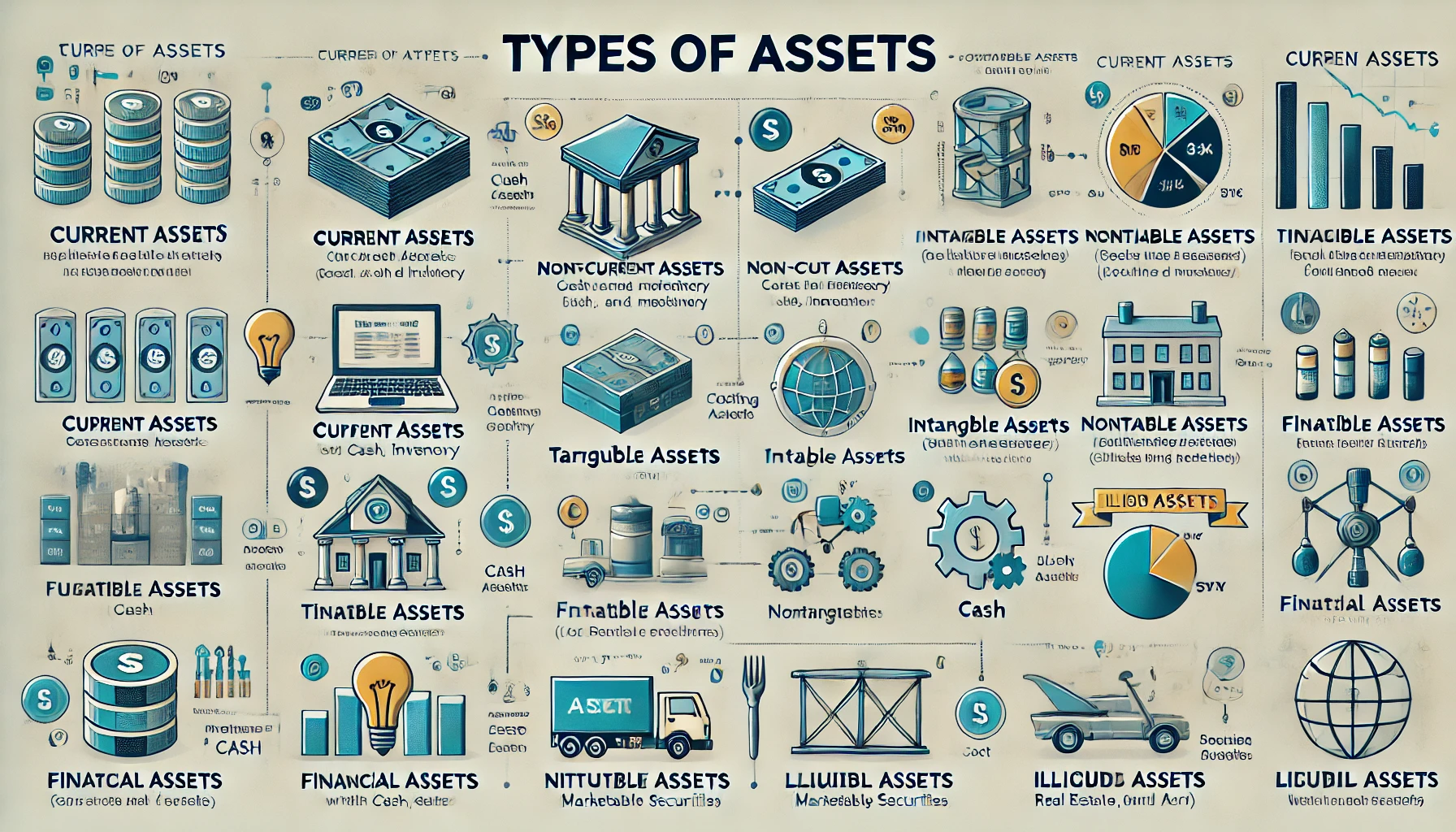

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Current ratio: =Current assets/current liabilities Purpose: -To evaluate the company's short-term financial health and liquidity. -This ratio tells us whether the company can meet its short term ob

See MoreTushar Aher Patil

Trying to do better • 1y

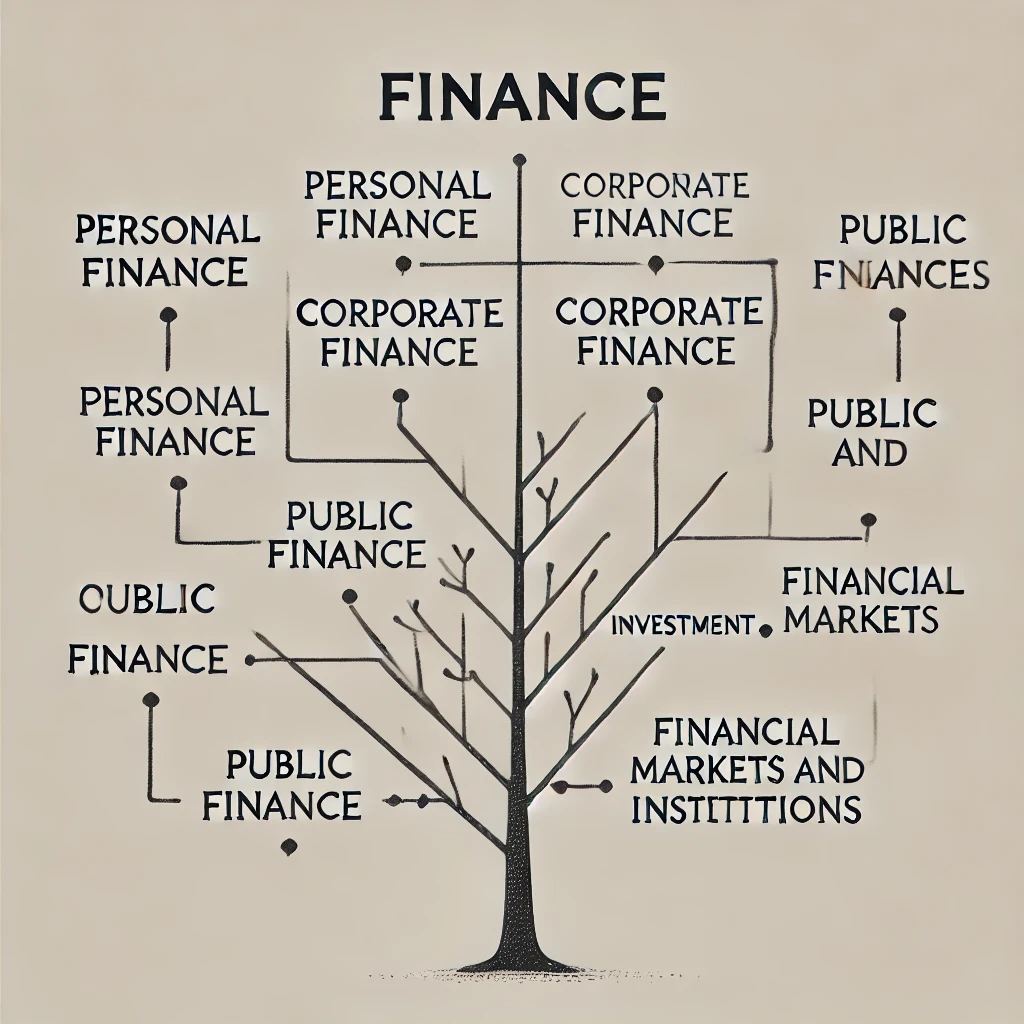

Day2 About Basic Finance Concepts Here's Some New Concepts 2. Corporate Finance Capital Budgeting: Deciding on long-term investments like new projects or equipment to enhance business profitability. Capital Structure: Determining the best mix of d

See More

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreDr Saurav singh

Doctor by profession... • 1y

Do you believe in god? Religion? I believe in importance of these concepts to keep humans civil. Humans are more long term than animals due to influence of such concepts. Every religion at its core makes human less animal like with hope and fear of

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)