Back

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Current ratio: =Current assets/current liabilities Purpose: -To evaluate the company's short-term financial health and liquidity. -This ratio tells us whether the company can meet its short term obligations with its short-term assets like cash, receivables, and inventory. What’s short term? -Typically, short term refers to a period of 12 months. -However, if the company’s operating cycle exceeds 12 months, then the duration of the operating cycle is considered instead. So,its never strictly 12 months, it depends upon each case. Ideal Ratio: >2, -Indicates that surplus assets are not being effectively used to generate enough cash. (Company ban gayi laad saab,sab kuch hain lekin kaam nahi kar raha hein) 1.5-2, -Capable of meeting its short term obligations. (Company mera baap jaisa hai , na udhaar ka bojh, na paise ki barbaadi. Har rupiya kaam mein lagta hai!) <1, -Fails to meet its short term obligations,company at risk (ab company banega aur ek nirav modi ,aur ek vijay mallya) On a final note, “Stop scrolling that creates nuisance, learn finance to give your life a new sense.” Follow for more.

Replies (2)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreTushar Aher Patil

Trying to do better • 1y

Day 8 About Basic Finance and Accounting Concepts Here's Some New Concepts In finance, Liabilities represent obligations or debts that an individual or organization owes to others. They indicate an outflow of resources, either cash or services, that

See More

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTushar Aher Patil

Trying to do better • 1y

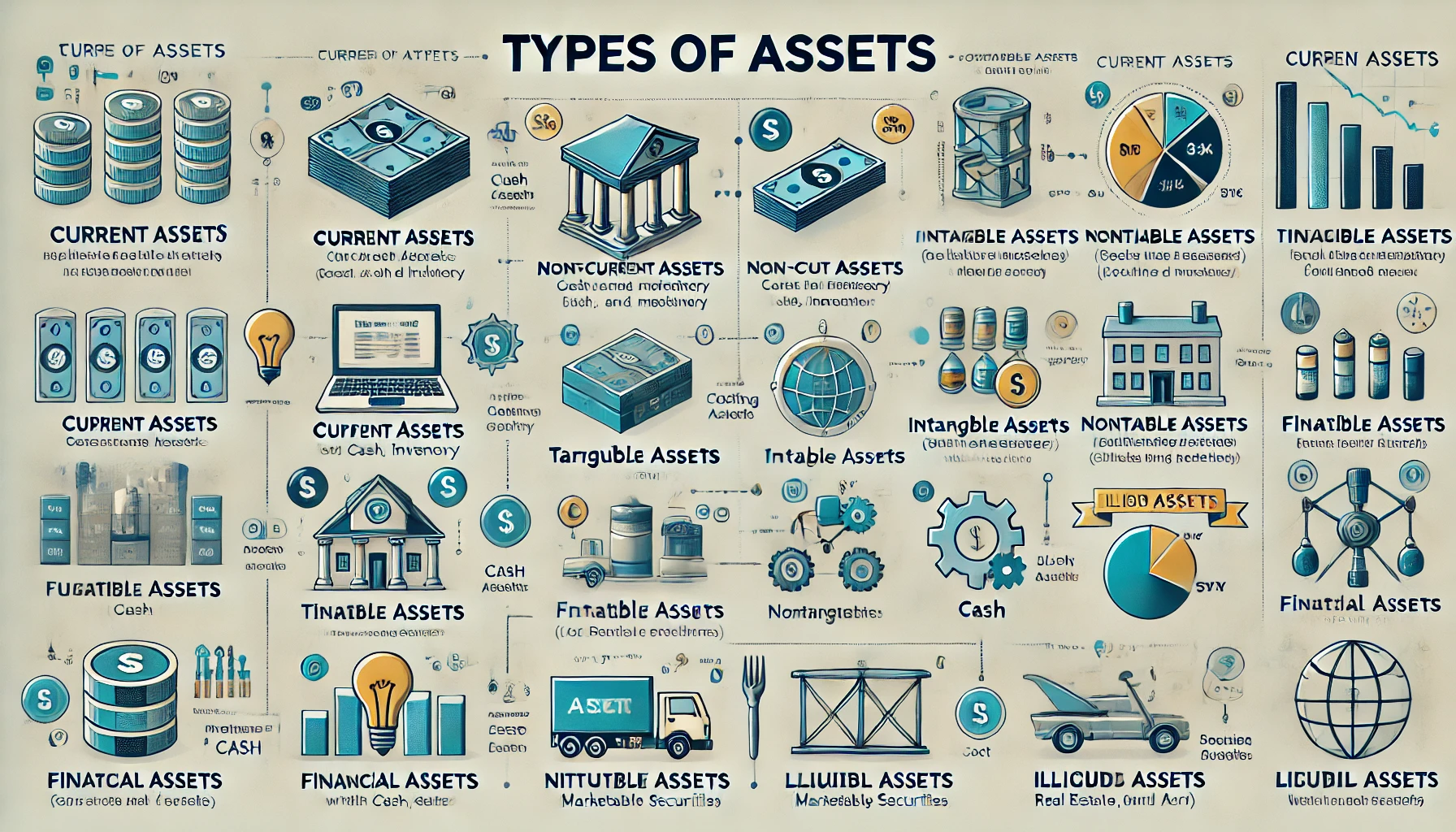

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Tushar Aher Patil

Trying to do better • 1y

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investme

See More

gray man

I'm just a normal gu... • 10m

E-commerce giant Flipkart is shifting its holding company from Singapore to India, a big step ahead of its planned IPO in the next 12–15 months. The Walmart-backed company, currently valued at $36 billion, has already secured internal approvals for

See More

Gangesh Rameshkumar

Figure it out • 8m

Fellas, I'm doing a self-post challenge where I'm going to explain a business term briefly every day Today's term: Assets Assets are resources that are owned by a company that provide economic value and future benefits such as generating income, im

See MoreGangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Equity Equity, in simple terms, is the money that is returned to all the shareholders of a company, if all the company's assets are liquidated and liablities are paid off. It is also a measure of the financial health of a c

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)