Back

Anirudh Gupta

CA Aspirant|Content ... • 7m

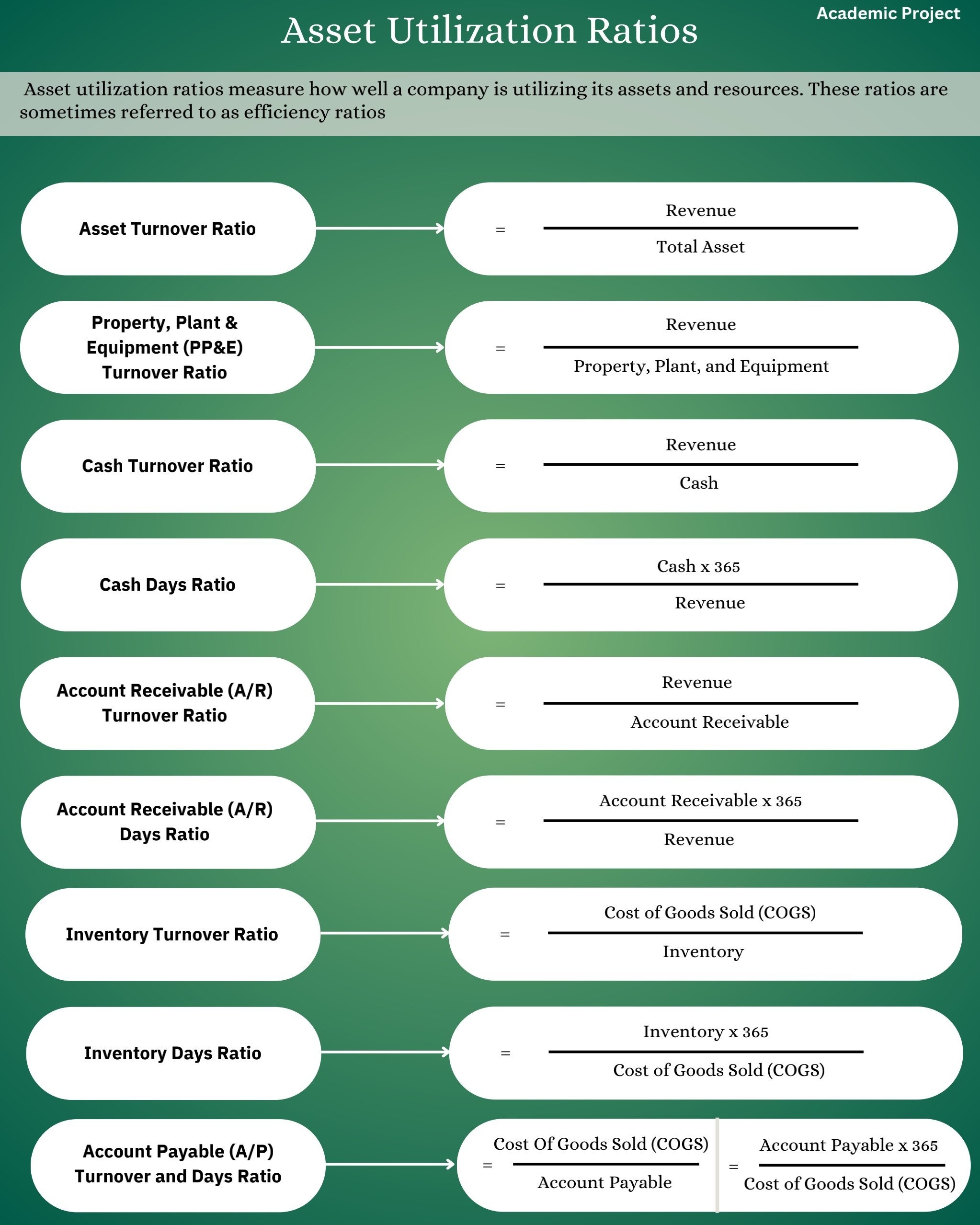

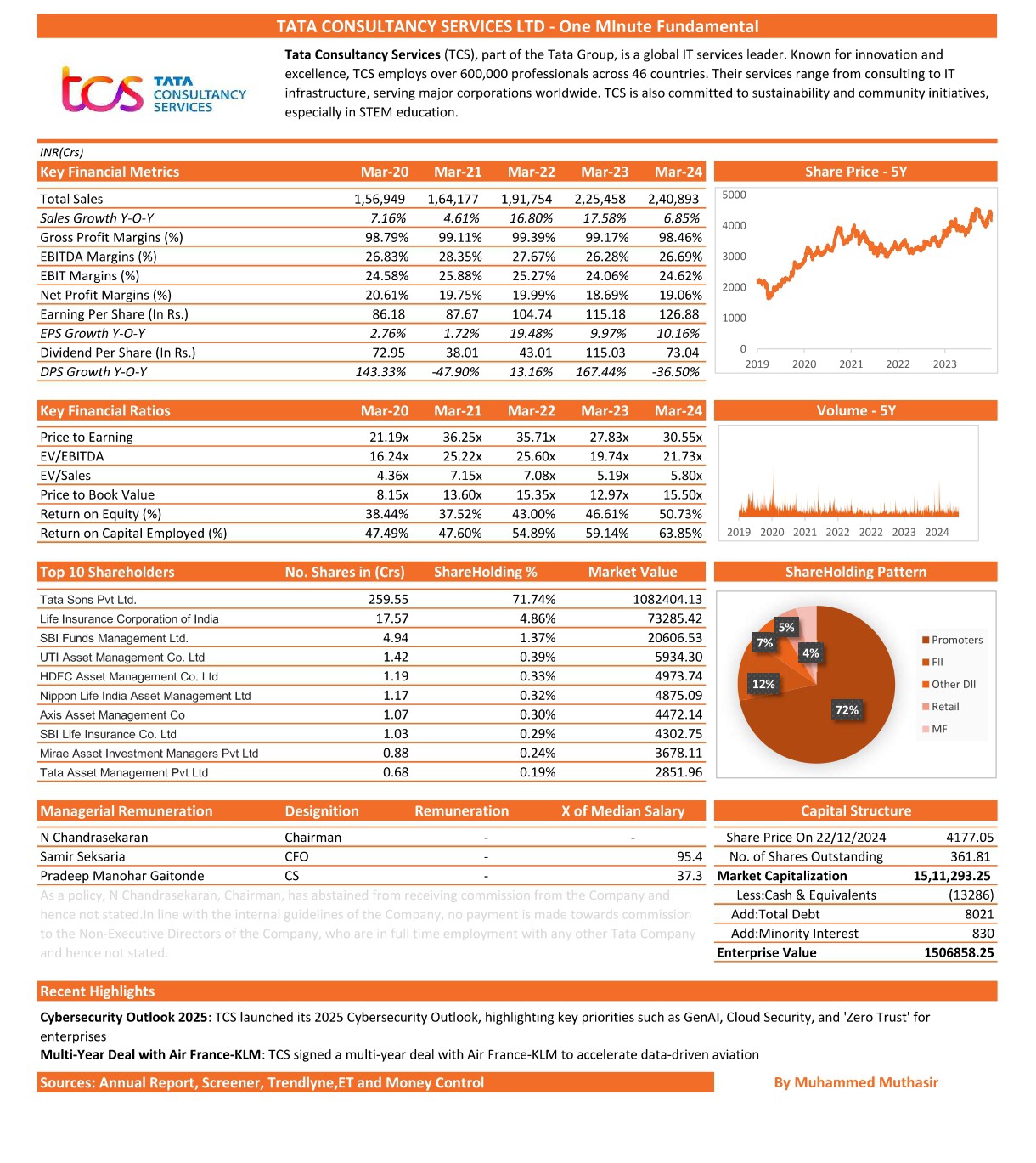

Daily(irregular 😅) dose of financial ratios by Anirudh Gupta Lets learn these two ratios 1.Capital turnover ratio: =Sales or Cost of goods sold/Capital employed Capital employed=Shareholders funds+ Non-current liabilities Purpose: -To understand, how many rupees of revenue are generated for every ₹1 of capital invested in the business? -Tests the company usage of assets to generate sales. 2. Ebit margin =Ebit or operating profit /sales Purpose: -It measures the profit a company earns from its operations, before deducting interest and taxes, for every rupee of sales generated. -To judge the company’s performance. These two ratios combined will result in a new ratio ,which we will discuss in the next post. It's actually a dead easy guess.Find it out! Stay tuned. Will come up with more posts which are not just limited to financial ratios.

Replies (2)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

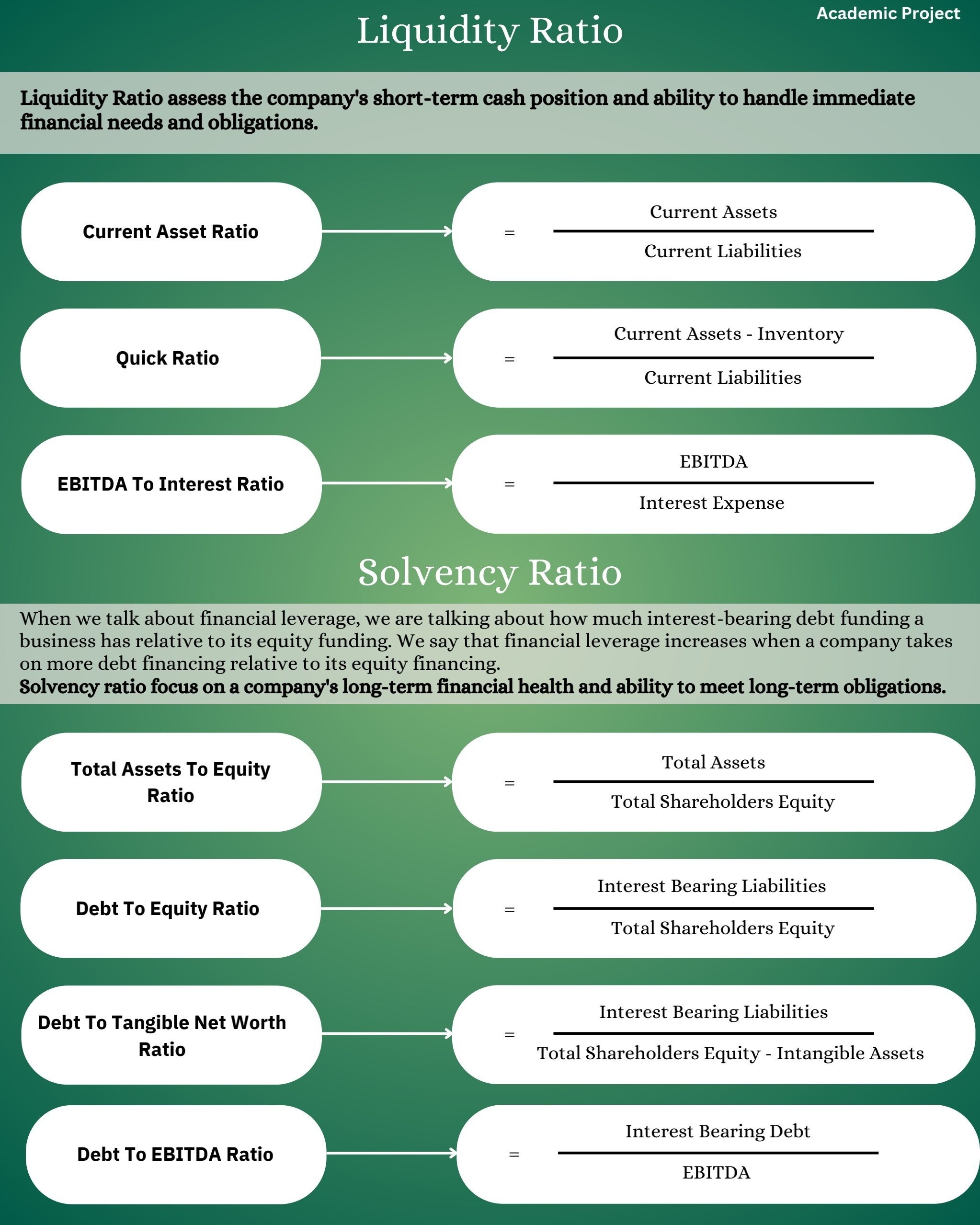

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)