Back

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we discussed about debt equity ratio which explains the capital structure of a company and, how it helps creditors in assessing the firm’s ability to settle its liabilities. -However,the debt-equity ratio overlooks cash flow, making it unclear whether a company can truly meet its debt obligations. Hence this ratio comes into the picture. Purpose: -Helps understand its creditors and investors about the company’s “cash flow” ability to repay its debt obligations thus increasing confidence. Ideal ratio: DSCR > 1, -Safe😌 -The company earns enough to cover its debt repayments satisfying the creditors. DSCR < 1, -Risky😰 -income is not enough to meet debt obligations On a final note, "Why do you need astrology,when you can learn finance-o-logy" Follow for more.

Replies (4)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Current ratio: =Current assets/current liabilities Purpose: -To evaluate the company's short-term financial health and liquidity. -This ratio tells us whether the company can meet its short term ob

See MoreShubham Khandelwal

Software Engineer • 1y

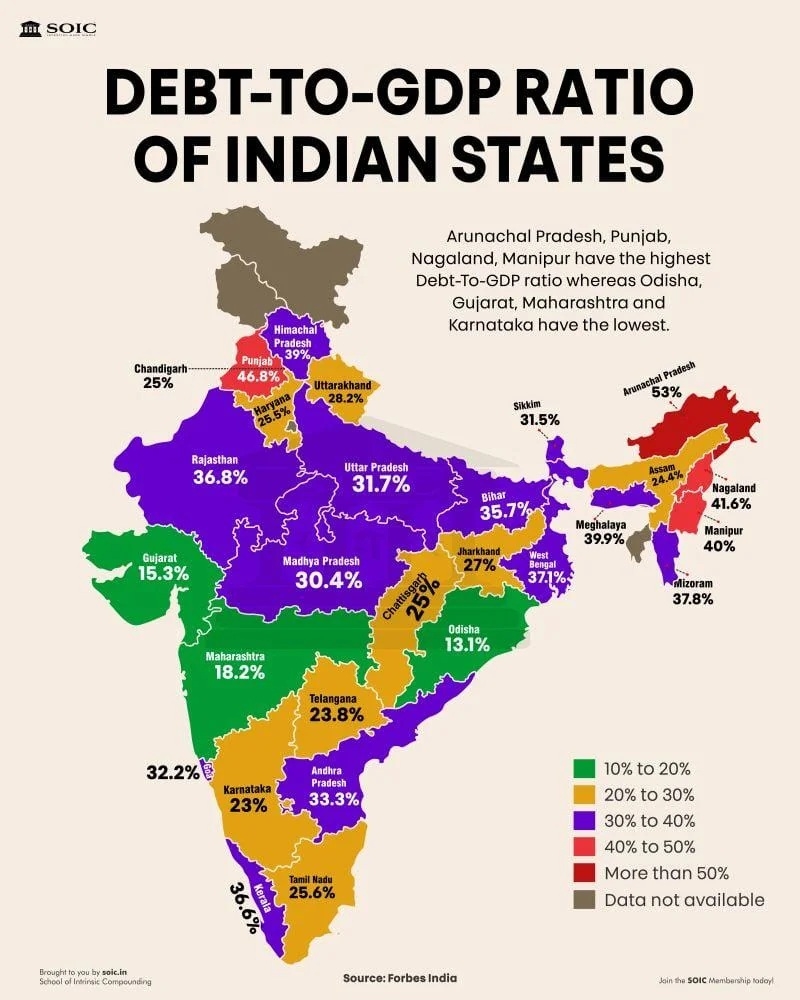

Debt to GDP Ratio of Indian States. Arunachal Pradesh, Punjab, Nagaland, Manipur have the Debt to GDP Ratio whereas Odisha, Gujarat, Maharashtra and Karnataka have the lowest Debt to GDP Ratio. Freebies in Poll Promises by Political Parties is the

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreVansh Khandelwal

Full Stack Web Devel... • 7m

In the blog titled "Bankruptcy: Understanding the Approaches," I explore essential strategies for businesses facing bankruptcy. The three primary approaches discussed are debt restructuring, deferment of payments, and emergency relief operations. D

See MoreAnonymous

Hey I am on Medial • 1y

Only two things sustain a stock price 1. Future Earnings/Cash flow Power(going concern): This tells a company's ability to generate sustainable profits or free cash flow. Whether you're analysing a high-growth tech company or a high dividend-paying

See MoreOmkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreVIJAY PANJWANI

Learning is a key to... • 5m

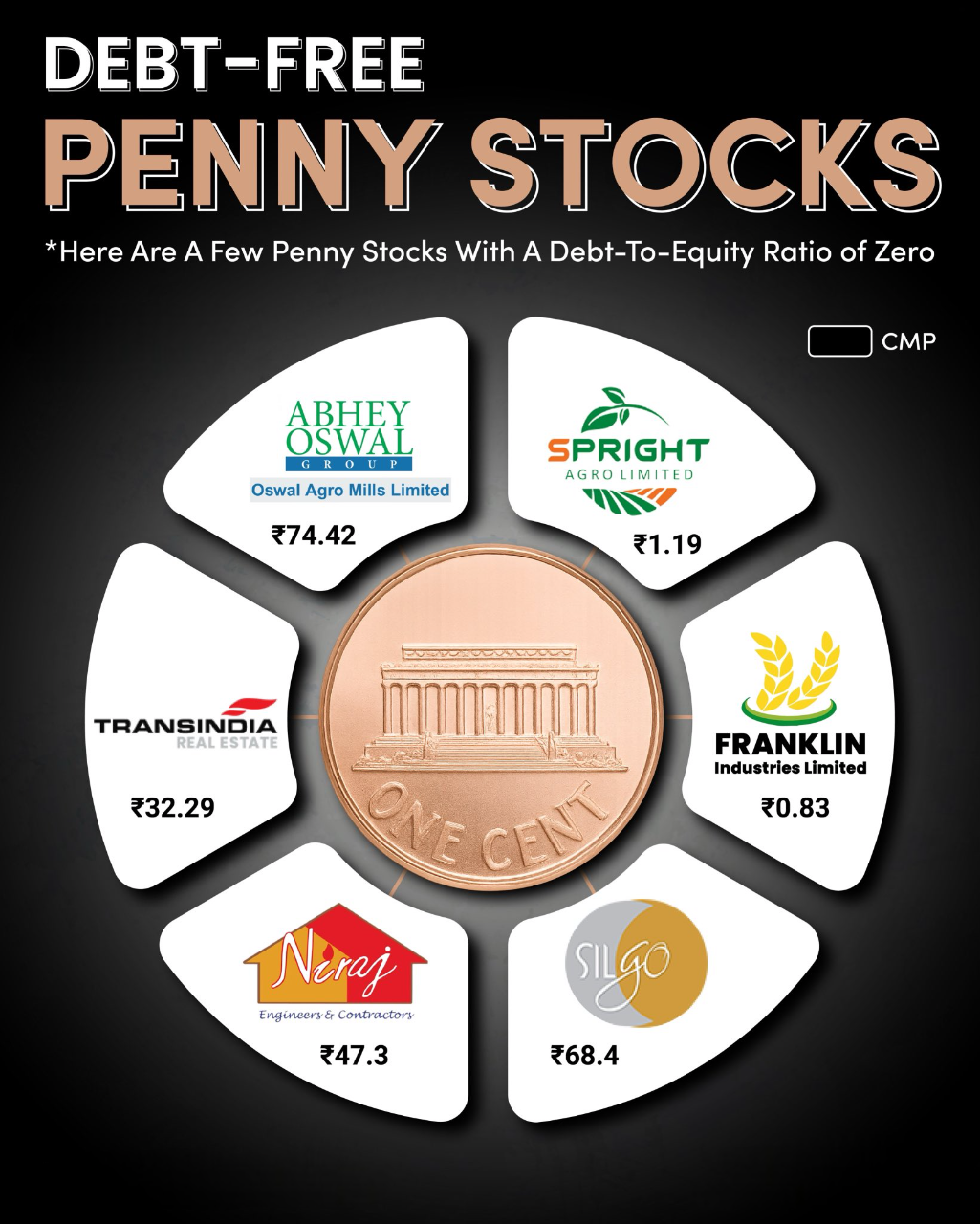

Debt-Free Penny Stocks to Watch in 2025 When it comes to penny stocks, financial health matters the most. One strong indicator is the Debt-to-Equity Ratio – and a zero debt ratio signals a company with no debt burden. Here are a few debt-free penn

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)