Back

Anonymous

Hey I am on Medial • 1y

Only two things sustain a stock price 1. Future Earnings/Cash flow Power(going concern): This tells a company's ability to generate sustainable profits or free cash flow. Whether you're analysing a high-growth tech company or a high dividend-paying industrial giant, the potential for future earnings and cash flow dictates stock's trajectory. 2. Residual asset value (If the business ceases operations) If a company were to shut down tomorrow, what tangible value could be extracted from its assets after liabilities? This provides a safety net for the investor. First point determines how high a stock can go. Second point puts a floor to the stock price. Price also is effected by things like: a. Market sentiments b. Macroeconomic factors c. Compititive positioning d. Management quality e. Liquidity and demand But, all these will eventually have to lead to future earnings potential and/or residual asset value for the price to sustain.

Replies (4)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 1m

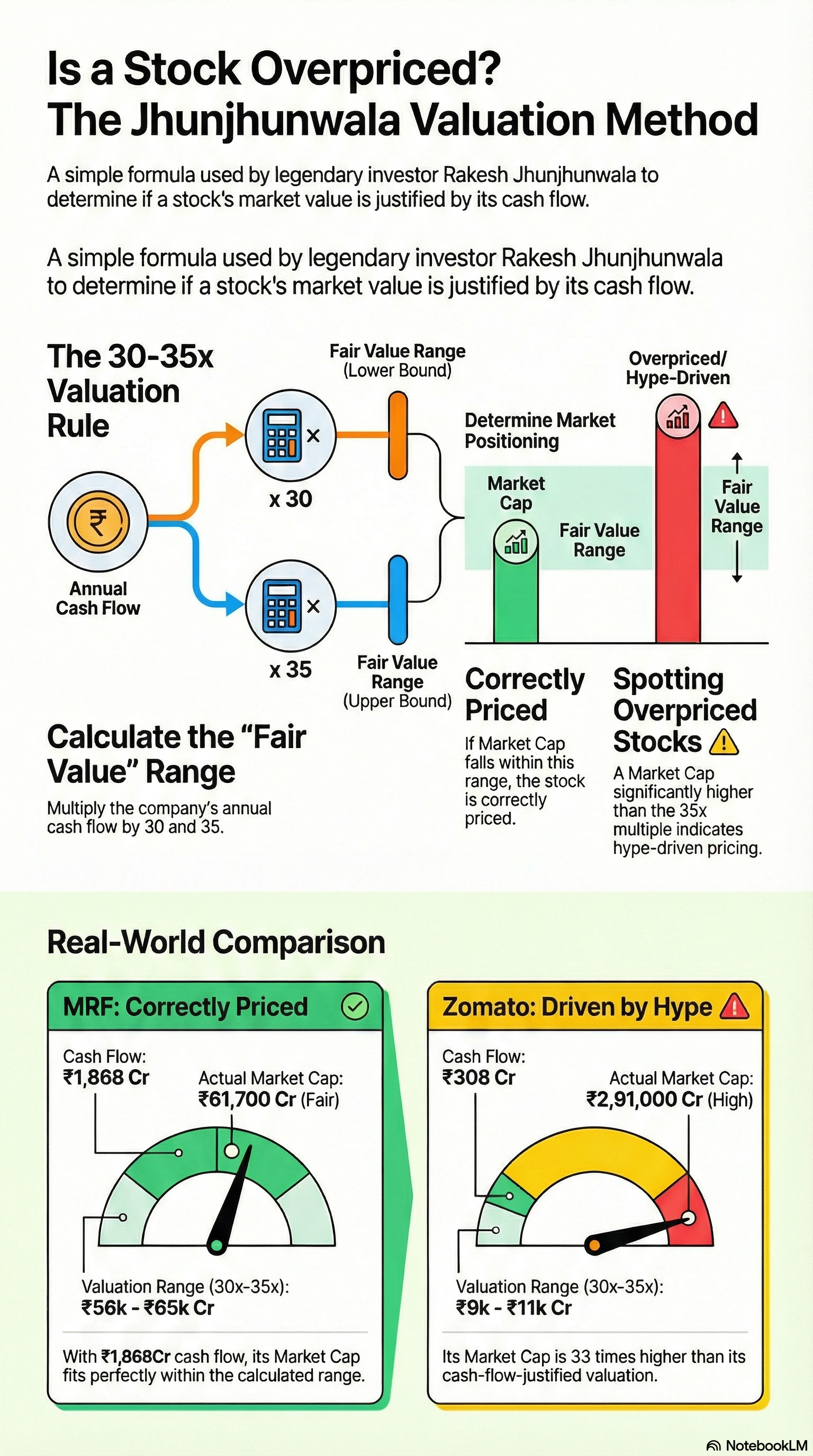

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Atharva Deshmukh

Daily Learnings... • 1y

Commonly used Jargons 1)Bull Market:-If you expect the stock prices to go up,you are bullish on the stock price. 2)Bear Market:-If you expect the stock prices to go down,you are bearish on the stock price. 3)Trend:-The term ‘trend’ usually refers

See MoreKarnivesh

Simplifying finance.... • 2m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreTushar Aher Patil

Trying to do better • 10m

Exploring Share Buybacks: What are they and why do companies do them? A share buyback (also known as a share repurchase) is when a company buys back its own outstanding stock shares from the open market. This action reduces the total number of share

See More

Vansh Khandelwal

Full Stack Web Devel... • 4m

Tapzo, once an ambitious all-in-one app, failed from frequent pivots that eroded trust and an unclear value proposition; persistent negative cash flow and inability to raise follow-on funding; neglect of customer feedback and prioritizing fame over u

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)