Back

Inactive

AprameyaAI • 1y

Top Investment Frameworks 1. QGLP (Quality, Growth, Longevity at a reasonable Price) 2. Cash Flow Based Framework 3. Value vs Growth Investing 4. Active vs Passive Investing 5. Profit Framework 6. Congruence Framework 7. Porter's Five Forces

More like this

Recommendations from Medial

Atharva Deshmukh

Daily Learnings... • 1y

Porter's Five Forces Analysis Porter's five forces framework is a method of analyzing the competitive environment of a business. The five forces are: 1] Competition: Intensity of rivalry among existing competitors, influencing pricing, profitabil

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

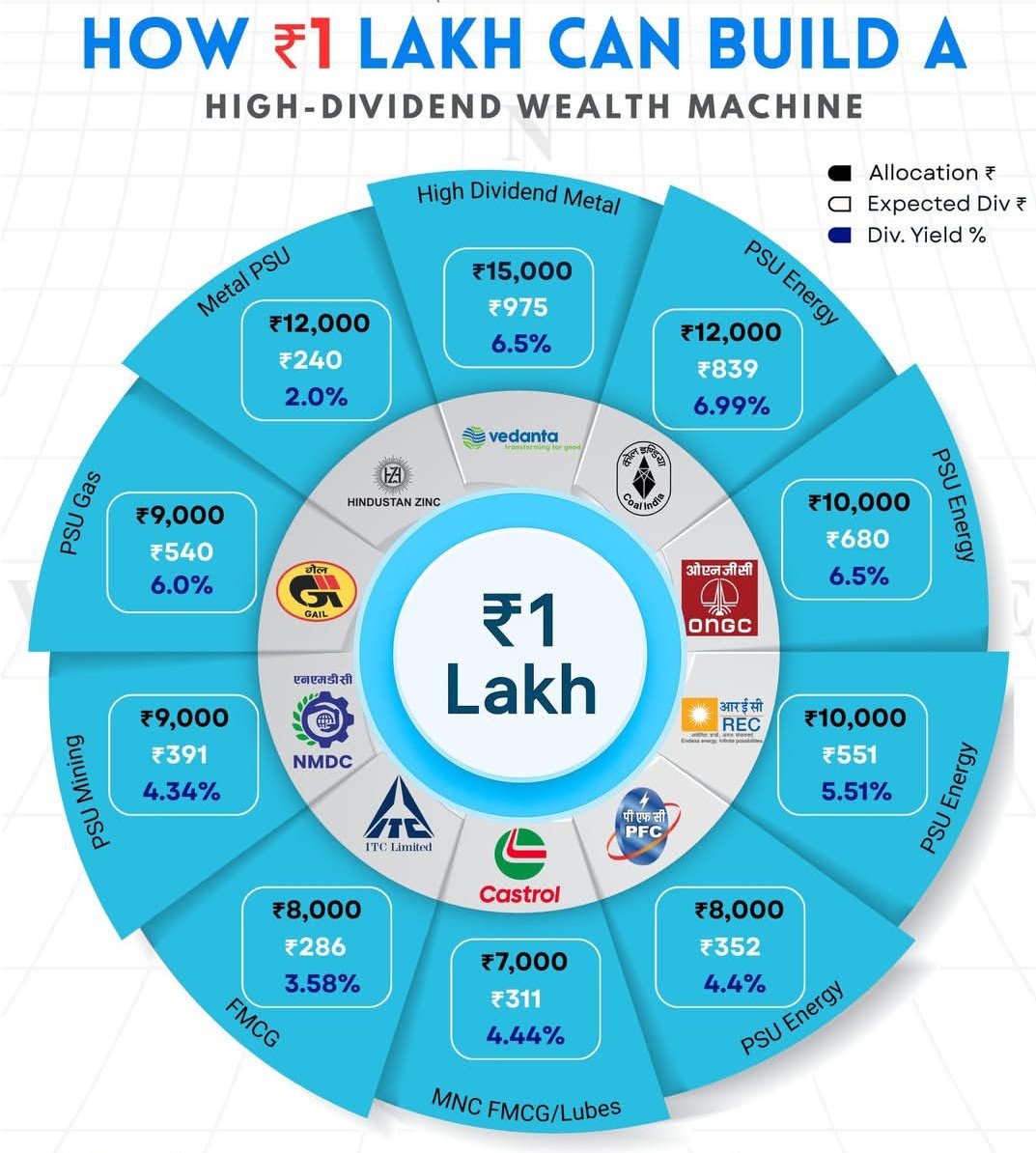

💰 ₹1 Lakh → High-Dividend Wealth Machine! So many people think you need crores to earn passive income… ❌ Not true. 📊 With smart allocation in high-dividend stocks, even ₹1 Lakh can start generating regular cash flow. ⚙️ This portfolio focuses on

See More

VIJAY PANJWANI

Learning is a key to... • 1m

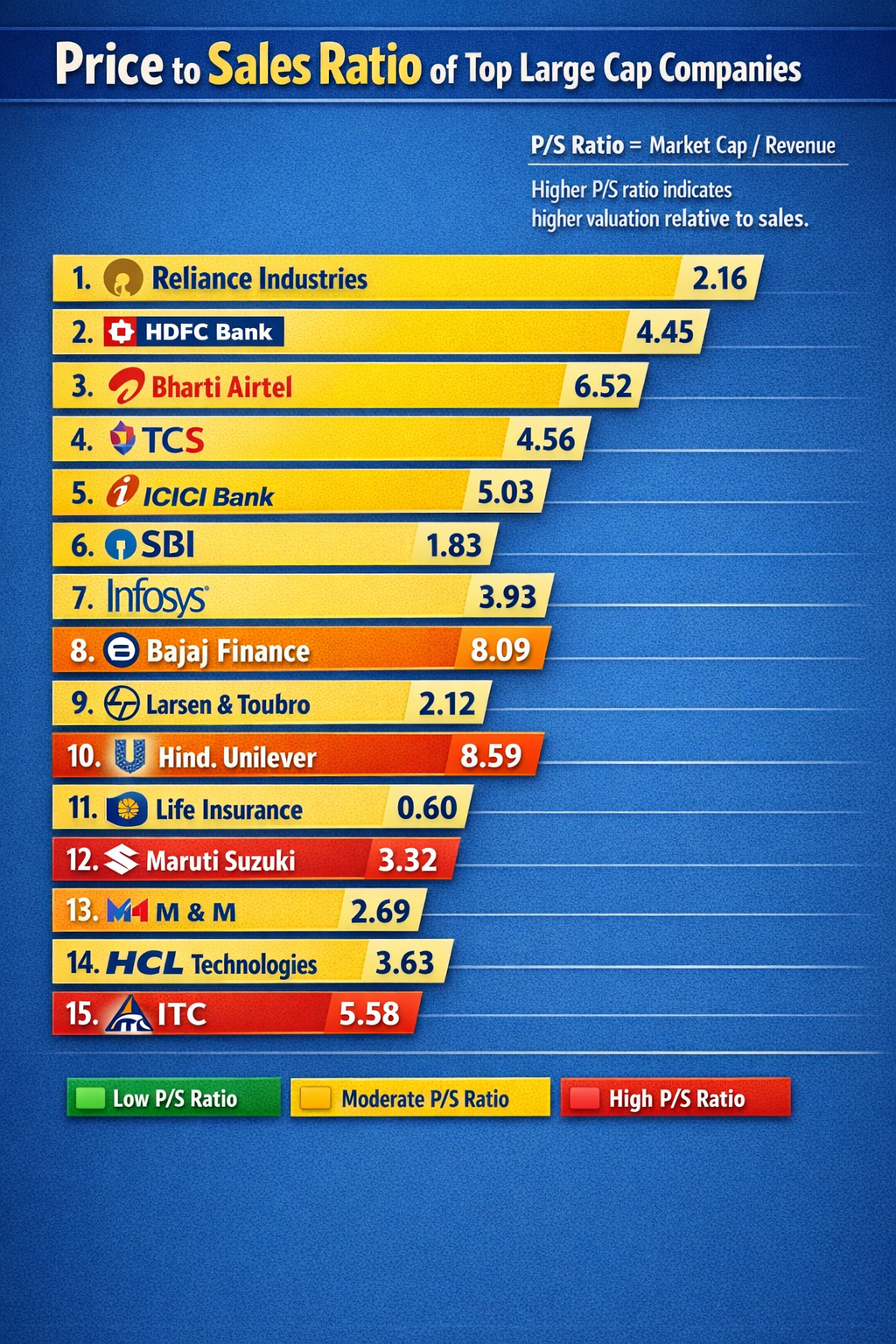

Price to Sales (P/S) Ratio of India’s Top Large-Cap Stocks 🇮🇳 Ever wondered which big companies are cheap vs expensive relative to their sales? That’s where P/S Ratio helps 👇 🔹 Low P/S → Potentially undervalued 🟡 Moderate P/S → Fairly valued �

See More

VIJAY PANJWANI

Learning is a key to... • 4m

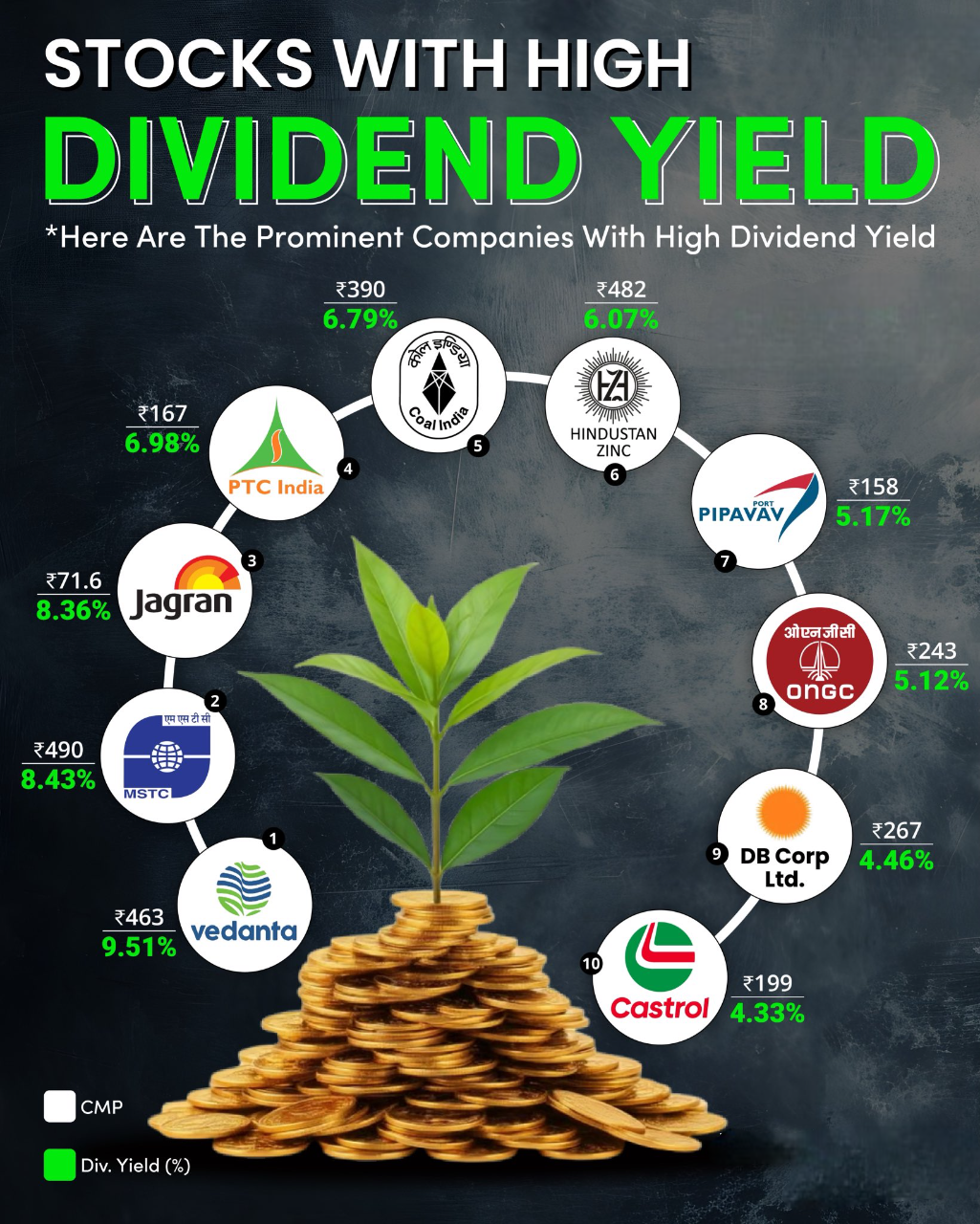

Top 10 Dividend Paying Stocks in India! Want to earn steady passive income while investing? These stocks are giving high dividend yields in 2025 📊 Top Picks: 1️⃣ Vedanta – 9.51% 2️⃣ MSTC – 8.43% 3️⃣ Jagran – 8.36% 4️⃣ PTC India – 6.98% 5️⃣ Coal

See More

Rishabh Jain

Start loving figures... • 11m

Is This the Right Way to Analyze Stocks? A colleague recently pointed out that a structured approach is key when investing, and skipping steps can lead to costly mistakes. They follow a Top-Down Analysis Framework, which breaks down like this: 🔹 M

See MoreVivek Joshi

Director & CEO @ Exc... • 4m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)