Back

Rishabh Jain

Start loving figures... • 12m

Is This the Right Way to Analyze Stocks? A colleague recently pointed out that a structured approach is key when investing, and skipping steps can lead to costly mistakes. They follow a Top-Down Analysis Framework, which breaks down like this: 🔹 Macro Overview – What’s shaping the market? ✅ Global trends 🌍 ✅ Key economic indicators 📊 🔹 Sector Analysis – Where is the money flowing? ✅ Major players & industry trends 💼 ✅ Risks & regulations ⚖️ ✅ Historical performance 🔄 🔹 Company Evaluation – Which stocks truly stand out? ✅ Revenue & management insights 🏦 ✅ Shareholding patterns & profit margins 📑 ✅ financial ratios 🏰 🔹 Buying a Stock – When & at what price? ✅ Risk vs. reward ⚖️ ✅ Earnings reports & volatility 📉 ✅ Timing & technical analysis 🕰️ It got me thinking how many of us actually follow a structured process like this before investing? Or do most just jump straight to picking stocks? Would love to hear your thoughts. How do you approach investing?

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 3m

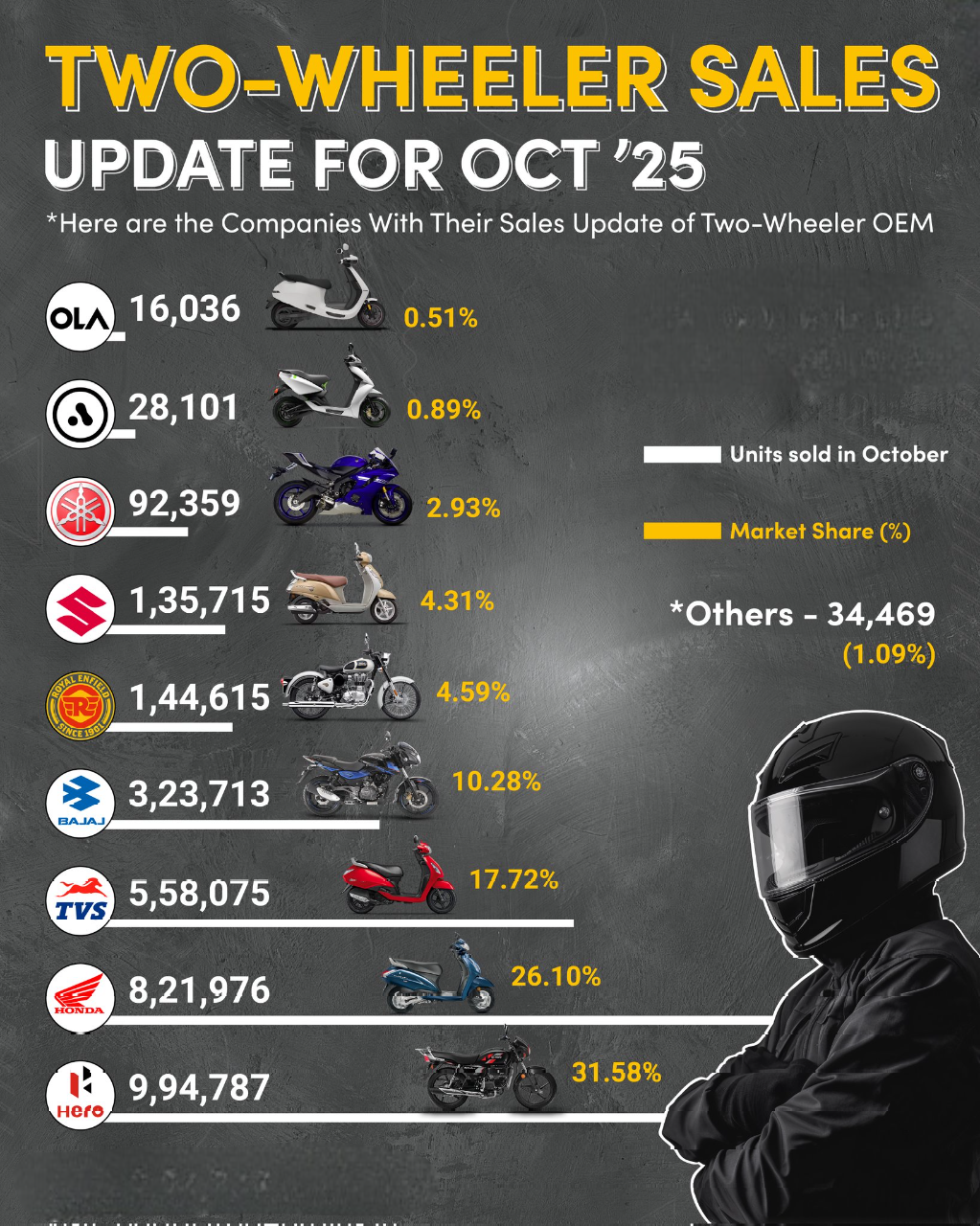

Two-Wheeler Sales Report – October 2025 For investors & market traders, this data isn’t just about bikes — it’s about momentum and market direction. 🔍 Use this report to: ✅ Identify strong-performing auto stocks 📈 ✅ Track demand trends across 2W

See More

Nandishwar

Founder @StudyFlames... • 1y

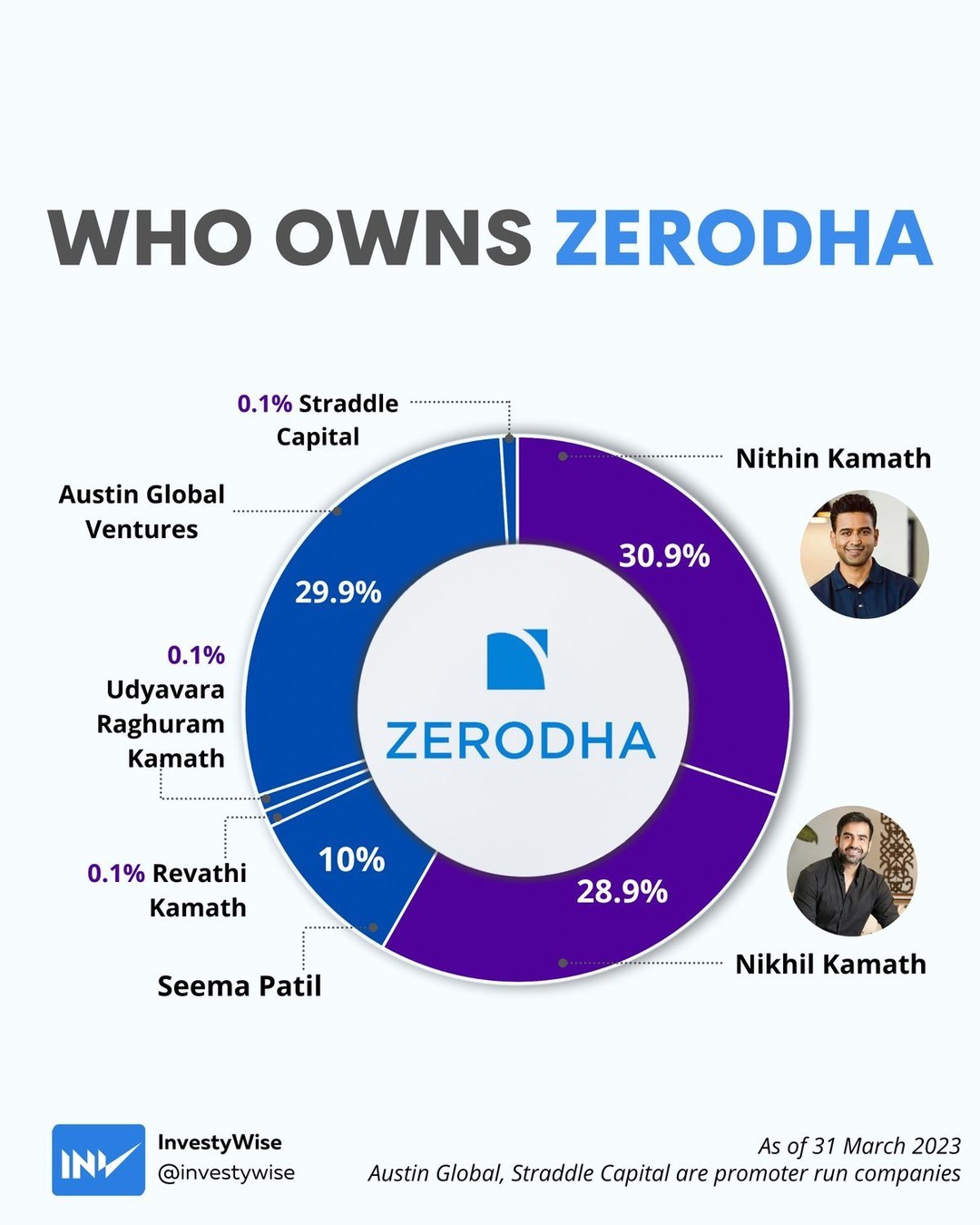

🚀 Who Really Owns Zerodha? The Inside Story! 📊 Zerodha, India's biggest stock brokerage, is 100% owned by its founders & close associates. No VC money, no outside investors—just pure bootstrapped success! 💪 Here's the breakdown of ownership: 🔹

See More

thecurious marketer

Hey I am on Medial • 12m

We’re Hiring: Social Media Manager & Strategist (Full-Time, Remote) Are you someone who: ✨ Is fueled by curiosity and loves asking “What if?” ✨ Has a knack for both strategy and execution—you can dream big and deliver. ✨ Knows how to grow brands in

See MoreCHINMAYEE SAMAL

Digital Marketing St... • 3m

🎯 Master the Steps of Digital Marketing! 🚀 From research to results — every step counts! ✅ Market Research ✅ Competitive Analysis ✅ Identify Target Audiences ✅ Set Goals & Objectives ✅ Define Strategies ✅ Evaluate & Improve Build your digital s

See More

VIJAY PANJWANI

Learning is a key to... • 2m

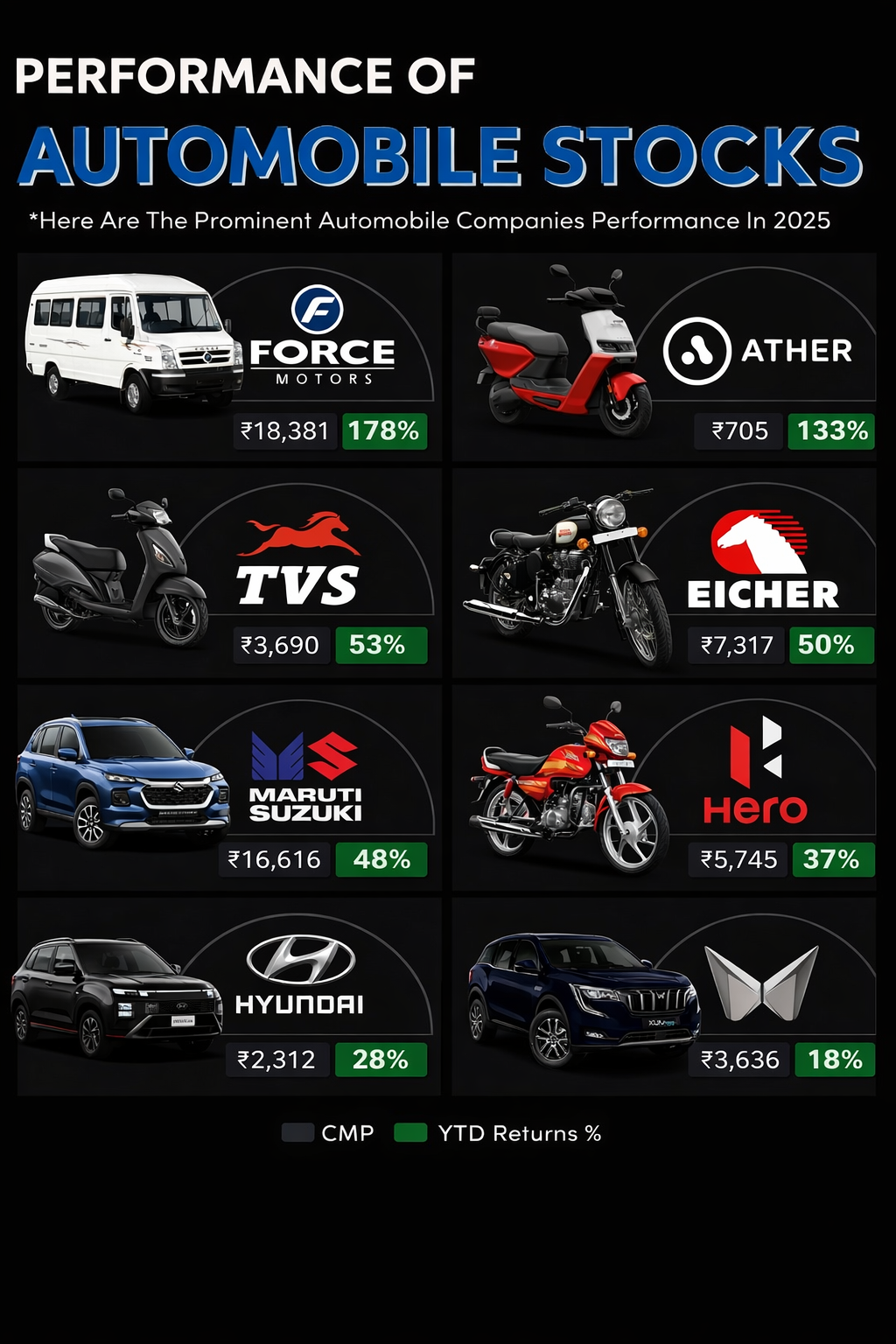

Automobile Stocks Performance in 2025! From Force Motors to Ather Energy, the automobile sector has delivered impressive returns this year 🔥 ✅ Top YTD Performers: 🚐 Force Motors – 178% 🛵 Ather Energy – 133% 🏍 TVS Motor – 53% 🏍 Eicher Motors –

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)