Back

Pulakit Bararia

Founder Snippetz Lab... • 1y

So how do you calculate your company’s valuation? Here’s the simplest way to think about it: 1. Forecast Future Earnings: Start with what your business makes now and apply a growth rate. Example: Year 1: $100K → Year 2: $120K → Year 3: $144K. 2. Adjust for Time (Discounting): Money now is worth more than money later. Use a discount rate (e.g., 10%) to calculate what those future earnings are worth today. 3. Add Long-Term Value (Terminal Value): Estimate how much your business will be worth after 3–5 years. Example: Coffee shop: Discounted future profits = $330K. Terminal value = $500K. Total Valuation = $330K + $500K = $830K. Simple: future cash + long-term or you can go like this 1. Find a Key Metric: Use your company’s profit, revenue, or EBITDA (earnings before interest, taxes, etc.). Example: Your profit is $100K. 2. Apply an Industry Multiple: Look at what similar companies are selling for (e.g., 5x profit). Example: $100K × 5 = $500K valuation.

Replies (7)

More like this

Recommendations from Medial

Pulakit Bararia

Founder Snippetz Lab... • 1y

I recently posted how do you calculate violation, many people were saying most startup doesn't earn profit , so there are two more ways you can go about Revenue Multiples Method 1. Focus on Revenue: Use your company’s current or projected revenue

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 10m

Ever wondered what your business is really worth? 🤔 Many business owners grapple with this question, unsure if valuation hinges on the balance sheet or profit, or even how to value a company with no sales or profit. ❓️What Company Valuation Is (an

See More

Mahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 why ₹1 today is more valuable than ₹1 tomorrow? Let me break down the concept of Present Value (PV)—it’s simpler than you think! It’s the value of future money today, adjusted for risk and opportunity cost using a "discount rate." It

See MoreRohan Saha

Founder - Burn Inves... • 7m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

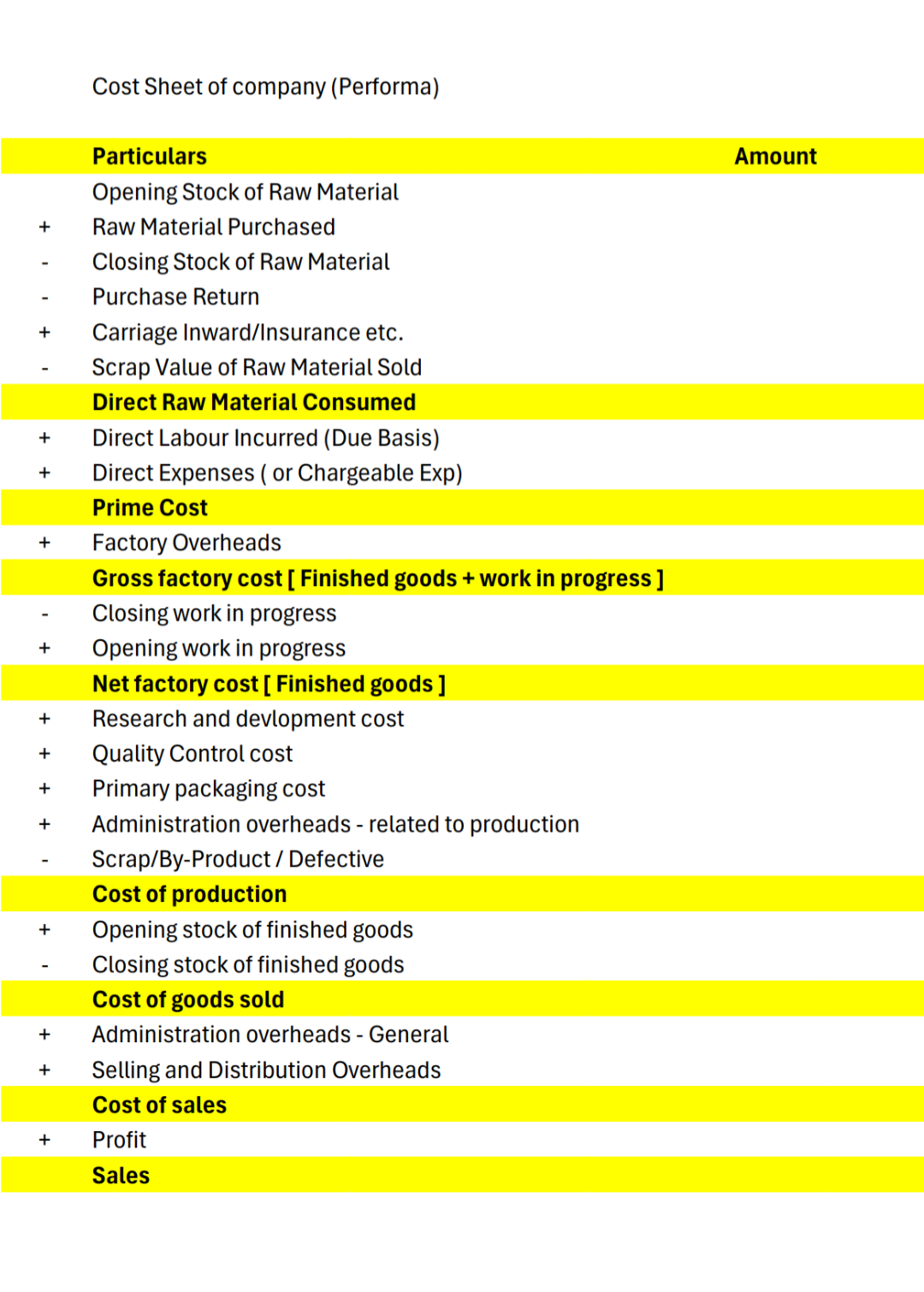

How to Calculate Product Cost, Set Profit & Selling Price - Using a Cost Sheet 🤔 Ever wondered how businesses actually price their products? It all starts with one simple but powerful tool: the Cost Sheet. 🚀🔥 Here’s how it helps: 1️⃣ Calculate

See More

DIVYANSHU MHATRE

Work on your ideas • 1y

Meet farza the founder of buildspace the largest place to find ppl building cool stuff he started his entrepreneurial journey at the age of 13 selling blank dvds and reaching 100k in profit by 15 now he runs a builders community called buildspace his

See More

Rohan Saha

Founder - Burn Inves... • 1y

Ola Electric investors, how are you all? As soon as the lock-in period ended, the company’s share price dropped. To justify a valuation of ₹39,000 crore, at least ₹3,000 crore in revenue and a profit of ₹50 crore or ₹100 crore will be needed. Then, m

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)