Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

Ever wondered what your business is really worth? 🤔 Many business owners grapple with this question, unsure if valuation hinges on the balance sheet or profit, or even how to value a company with no sales or profit. ❓️What Company Valuation Is (and Isn't): Valuation isn't simply about the amount of investment you need and the equity you're willing to give away. 😂 Don't make the mistake of thinking, "I need ₹20 lakh and I'm comfortable giving 10%, so my company is worth ₹2 crore" - that's the wrong way to calculate it. 😅 ❌️ It's also not solely based on current profit or turnover, although these are definitely factors. Valuation is often a multiple of these, but the multiplier varies. Crucially, valuation depends on a company's future earning potential. This is why companies like Ola, Oyo, and Paytm, despite not always being profitable, can still command multi-billion dollar valuations. ❓️ How to Calculate Valuation (Financial Factors): ✅️ There are two primary financial approaches: 🚀 Based on Past Data: This involves calculating the company's net worth (assets – liabilities). For established companies with a history, the valuation often becomes a negotiation between buyer and seller, frequently a multiple of the net worth to account for goodwill, established business, and brand reputation. 🚀 Based on Future Projections: This method is used for newer companies or those undergoing significant changes. It requires creating a detailed financial projection for the next 5 years. This includes outlining growth plans for customer acquisition, market reach, product development, and sales. Investors will carefully examine these projections to determine the company's potential future earnings and negotiate the valuation accordingly. ✅️ Beyond the Numbers: Non-Financial Factors: These elements can significantly boost your company's valuation: 🚀The Team: A strong team with relevant experience and expertise (e.g.,backgrounds, strong skills in marketing, finance, or technology) is a major asset. 🚀Network - A well-established network of distributors, vendors, and the reach of your product (eg - number of stores) increases value. 🚀Uniqueness - Proprietary products, technologies, or patents that provide a competitive edge are highly valuable. 🚀Subscriber Base - A large and engaged existing customer base is a significant positive factor.( eg - Medial constant growing premium subscriber base) 🚀Timing - Being in a trending or high-demand sector (e.g., electric vehicles) can favorably influence valuation. 🚀Need/Urgency- If a buyer has a strong need to acquire your company (eg - to eliminate competition), they might be willing to pay a premium. ❓️Who Can Perform a Company Valuation? ✅️ You, the Business Owner: You can certainly undertake your own valuation. ✅️ Professionals: Chartered Accountants (CA) and registered valuers are qualified to perform valuations. However, remember that even professionals rely on the data and future projections you provide. Their role is to formalize this information and calculate a figure.

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

How to calculate your Total Addressable Market (TAM)❓️ Market Size: 9 out of 10 Startups are doing it wrong 😐 It is not: ❌️ The total size of the problem ❌️ The TAM of your competitors ❌️ The size of the entire industry Example: Wrong Marke

See More

Himanshu Dodani

Start now what you j... • 8m

Kya Scen H Ajj Ka? Just Pick 3 Filters And Boom Your Perfect Hangout Spot For Today Is Ready! Cafe | Restaurant | Sports | Entertainment | Findouts1 ... 🚀We're LIVE in Raipur! Say hello to Discover Find Out - your ultimate food discovery platform

See MoreHimanshu Dodani

Start now what you j... • 8m

🚀We're LIVE in Raipur! Say hello to Discover Find Out - your ultimate food discovery platform 10 Finding the perfect place to eat just got smarter ✅️ Filter by cuisine, budget, ratings, or vibe ✅️ Uncover hidden gems tucked away in ✅️ Raipur's

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Looking to Buy, Sell, or Invest in a Business? Discover SMERGERS. 🚀🔥 SMERGERS is an online investment banking platform that connects small and medium-sized enterprises (SMEs), startups, and franchise brands with investors, buyers, lenders, and M&A

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

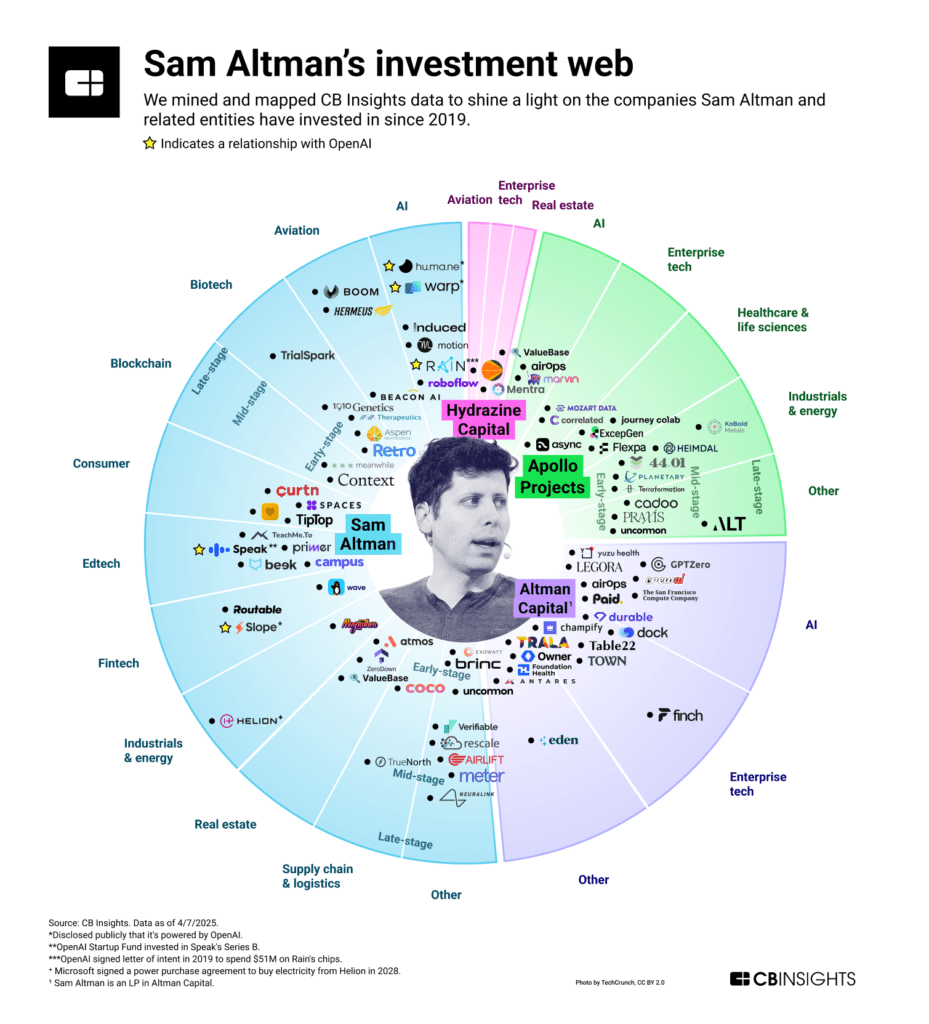

Sam Altman Investment Web 🕸 Sam Altman isn’t just leading the AI revolution. He’s quietly shaping the future across industries. 🚀 Since 2019, Altman and his funds- Hydrazine Capital, Apollo Projects, and Altman Capital have made bold investments

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Zudio: The Silent Billion-Dollar Disruptor ❌️ No ads. ❌️ No app. ❌️ No luxury branding. Yet, Zudio is winning the market- quietly but powerfully. Owned by Trent Ltd (a Tata Group company), Zudio has crossed: 📈 400+ stores (200+ incoming) 📈

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)