Back

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 28d

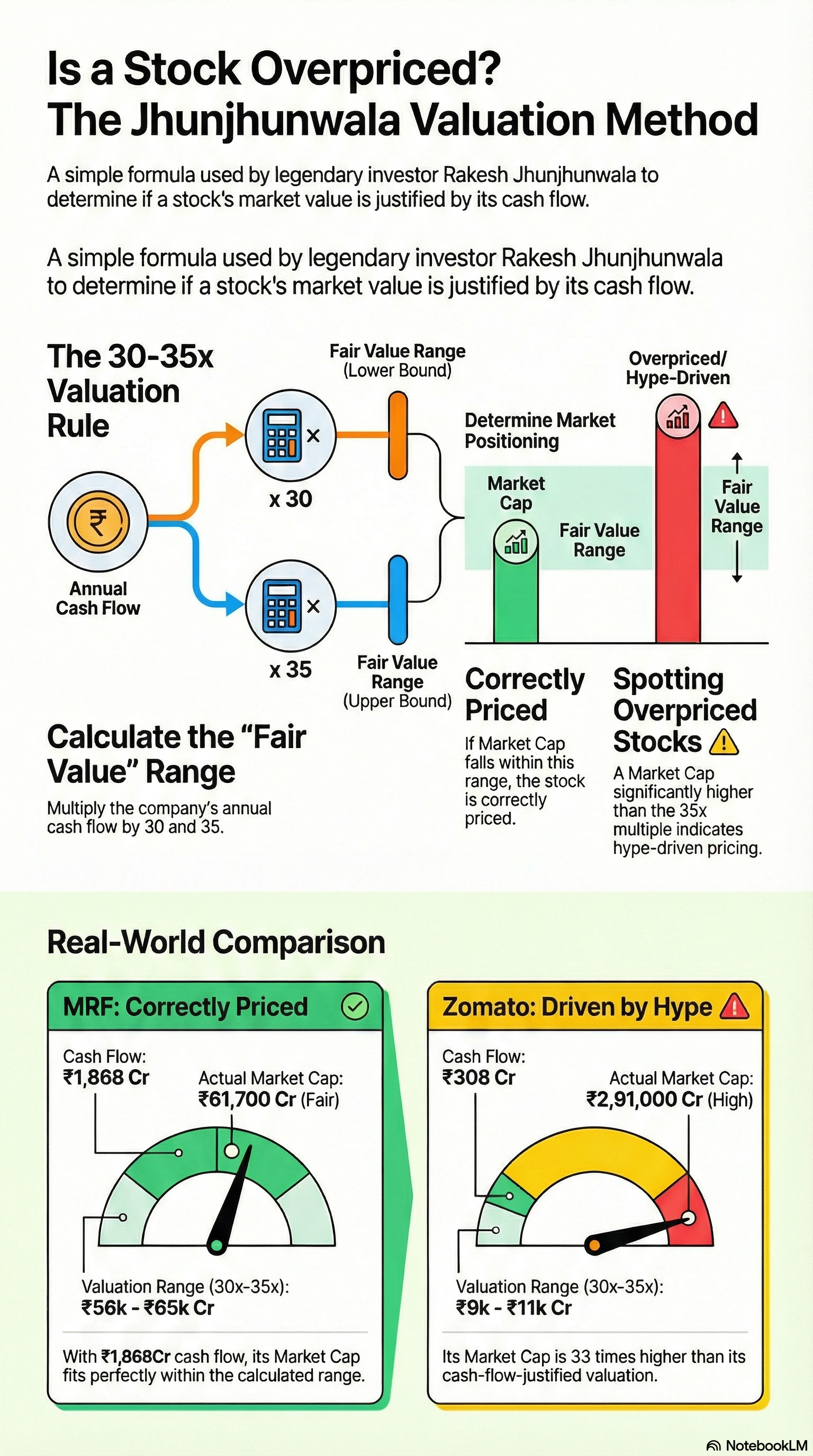

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Vansh Khandelwal

Full Stack Web Devel... • 4m

Tapzo, once an ambitious all-in-one app, failed from frequent pivots that eroded trust and an unclear value proposition; persistent negative cash flow and inability to raise follow-on funding; neglect of customer feedback and prioritizing fame over u

See MoreAccount Deleted

Hey I am on Medial • 1y

Hello Guys, I am starting one series of content regarding to the Finance, Startups, Venture Capital Firms and Investment Banking etc.📈💭🚀 Let's Discuss with How VC's determine the valuation of startup 🤩🚀💯❓ •TAM : See the Total Addressable Mark

See More

Tushar Aher Patil

Trying to do better • 1y

Day 7 About Basic Finance and Accounting Concepts Here's Some New Concepts 8. Liquid Assets Easily convertible into cash without a significant loss in value. Examples: cash, cash equivalents, and accounts receivable. 9. Illiquid Assets Assets

See More

Only Buziness

Everything about Mar... • 1y

Why Do Startups Fail? The blog explores the reasons behind startup failures and Key insights include: 1. Ideation Stage: Lack of market research can lead to product-market mismatch 2. Launch Stage: An ineffective business model can hinder scal

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)