Back

Vivek Joshi

Director & CEO @ Exc... • 8m

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present (hard for early stage). Market Multiples: Comparing to similar companies (finding true peers is tough). VC Method: Works backward from target exit valuation, considering desired returns. Traction/Growth: For early stages, relies heavily on MRR, customer growth, market size, and team experience. Scenario: InnovateTech AI Pre-seed AI analytics platform with MVP. Current: ~$5k MRR (3 months), 15 pilot customers (3 new/week). Team: 3 experienced co-founders. Market: $50B+ global, distinct AI advantage. Previous Funding: $100k angel (convertible note) Ask: Series A for scaling. Poll: What Series A valuation for InnovateTech AI? A) $5M - $10M B) $10M - $20M C) $20M - $30M D) Other (comment!) Cast your vote! What factors do you prioritize?

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 10m

#Big week in U.S. funding: 1) SandboxAQ raises $450M (Series E) 2) Turbine Finance bags $13M (Series A) 3) restor3d secures $38M for 3D-printed ortho implants 4) RayThera lands $110M (Series A) for biotech trials 5) Raxio Data Centres gets $100M

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

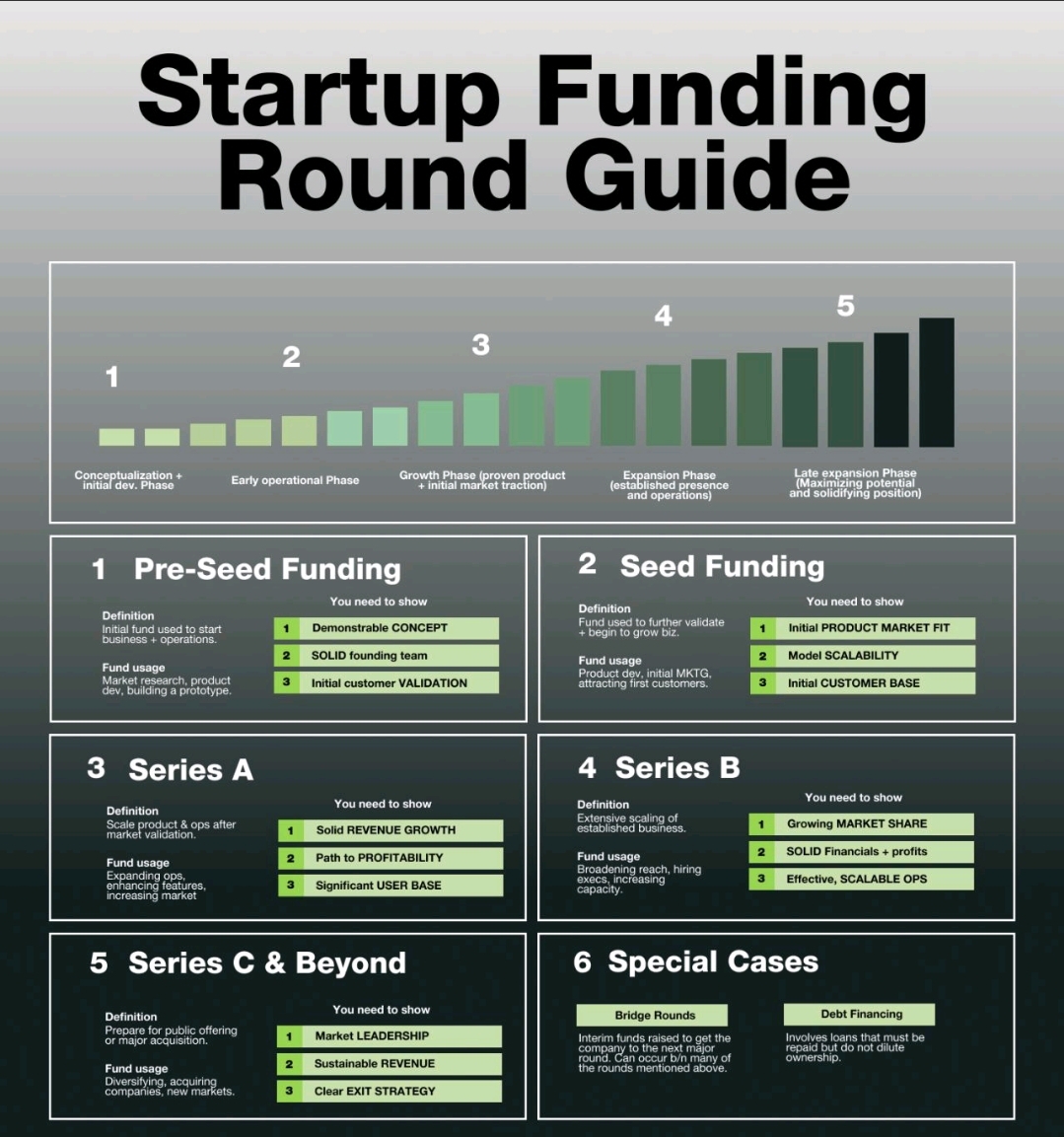

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Mohammed Zaid

building hatchup.ai • 8m

Cluely, the controversial San Francisco-based AI startup that markets itself as an undetectable" assistant for cheating on job interviews and exams, has secured $15 million in Series A funding led by Andreessen Horowitz, bringing its estimated valuat

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)