Back

Tushar Aher Patil

Trying to do better • 9m

Exploring Share Buybacks: What are they and why do companies do them? A share buyback (also known as a share repurchase) is when a company buys back its own outstanding stock shares from the open market. This action reduces the total number of shares available. Why might a company do this? • Increasing Share Value: By reducing the supply of shares, companies often aim to increase the value of the remaining shares. This can lead to an increase in earnings per share (EPS), as the same earnings are spread over fewer shares. If the price-to-earnings (P/E) ratio stays constant, this can cause the stock price to rise. • Investing in Themselves: Buybacks allow companies to invest in their own value. • Signalling Financial Health: A share repurchase can signal to investors that the business has sufficient cash reserves and is not likely to face economic troubles. • Shareholder Return: It can be a way to reward shareholders. The net economic effect to investors, tax considerations aside, can be similar to paying out dividends. • Compensation: Shares bought back can be used for employee and executive stock compensation, helping to avoid diluting existing shareholders. • Preventing Takeovers: A buyback can help prevent a major shareholder from acquiring a controlling stake. • Undervalued Shares: Companies might buy back shares if they believe their stock is undervalued in the market. How are buybacks done? Companies might issue a tender offer to shareholders at a premium, or purchase shares on the open market over time. They can be funded with cash on hand, cash flow, or by taking on debt. While seen positively by many investors, buybacks aren't without criticism. Some argue they can artificially inflate share prices or suggest the company lacks profitable growth opportunities. Buybacks also consume cash reserves, potentially putting a business in a difficult spot during an economic downturn. Understanding buybacks is key to understanding corporate finance and stock market dynamics! #Buybacks #ShareRepurchases #StockMarket #CorporateFinance #Investing ________________________________________

More like this

Recommendations from Medial

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Dividends When a company makes a profit, it can choose to share a portion of the profit with its shareholders as a reward for their investment. This "reward" given by the company to it's shareholders is called a dividend Di

See MoreMohd Rihan

Student| Passionate ... • 11m

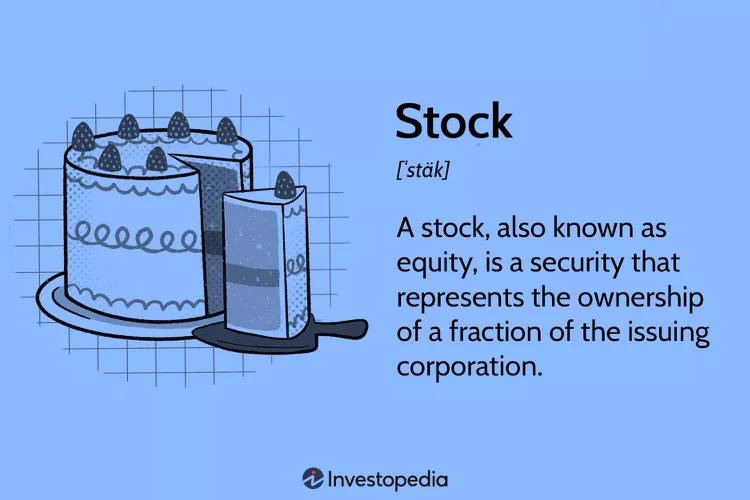

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

Account Deleted

Hey I am on Medial • 11m

The stock market is a marketplace where investors buy and sell shares of publicly traded companies. It enables companies to raise capital by issuing stocks, while investors can profit through price appreciation and dividends. Stock exchanges, like th

See MoreDIVYANSHU MHATRE

Work on your ideas • 1y

Nvidia CEO Jensen Huang's net worth has surged from $3 billion to $90 billion in the past five years, primarily due to the soaring value of Nvidia shares. On Thursday, Nvidia's stock reached a record high, boosting Huang's stake value by $7.7 billio

See MoreHemanth Varma

''Money can't buy ha... • 1y

what are stocks ? A stock, also known as equity, is a security that represents the ownership of a fraction of the issuing corporation. Units of stock are called shares, which entitle the owner to a proportion of the corporation’s assets and profits

See More

Account Deleted

Hey I am on Medial • 1y

• What is An IPO and What is the eligibility Criteria: An Initial Public Offering (IPO) is the process where a private company first sells shares of its stock to the public on a stock exchange. This allows the company to raise money from investors

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 8m

Zuckerberg just have15% Stake in meta, But Controls 100% - Here’s How 🤔 Yes, it’s true. Mark Zuckerberg holds less than 15% shares in Meta, but has full control over the company. How is that possible? 🧠 Because Meta has a dual share system: -

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)