Back

Anirudh Gupta

CA Aspirant|Content ... • 8m

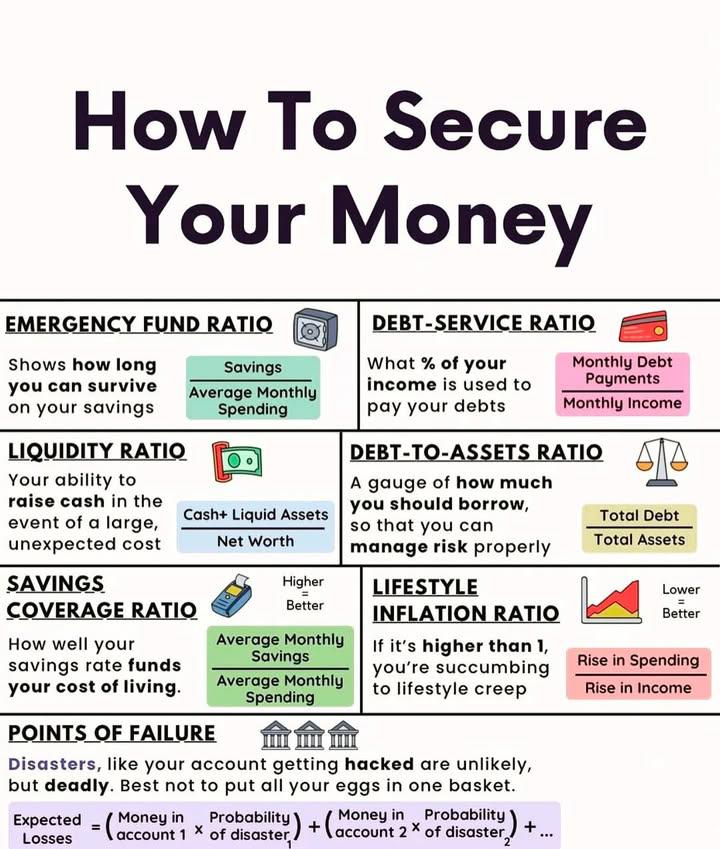

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Creditors can understand whether -the company is financially stable and -to evaluate the company’s ability to repay debts and cover their interest expenses. Investors can decide -whether the start-up is either more debt funded or equity funded. -(Investors are always willing to put their money in a equity funded company) Ideal Ratio: Less than or upto 1, -is a preferable financial ratio -Investors and creditors=Mein khush hun bhaai,achase dhandha karo😄 More than 1, -not preferable ratio -High risk, indicates more debt is being used to maintain operations -Investors and creditors=Who are you bhaai🏃🏻♂️🏃🏻♂️ -May cast their doubts on the company’s well being and consider pulling back their money. Learning Each ratio a day, makes you financially brave. Follow for more!

Replies (13)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreVIJAY PANJWANI

Learning is a key to... • 5m

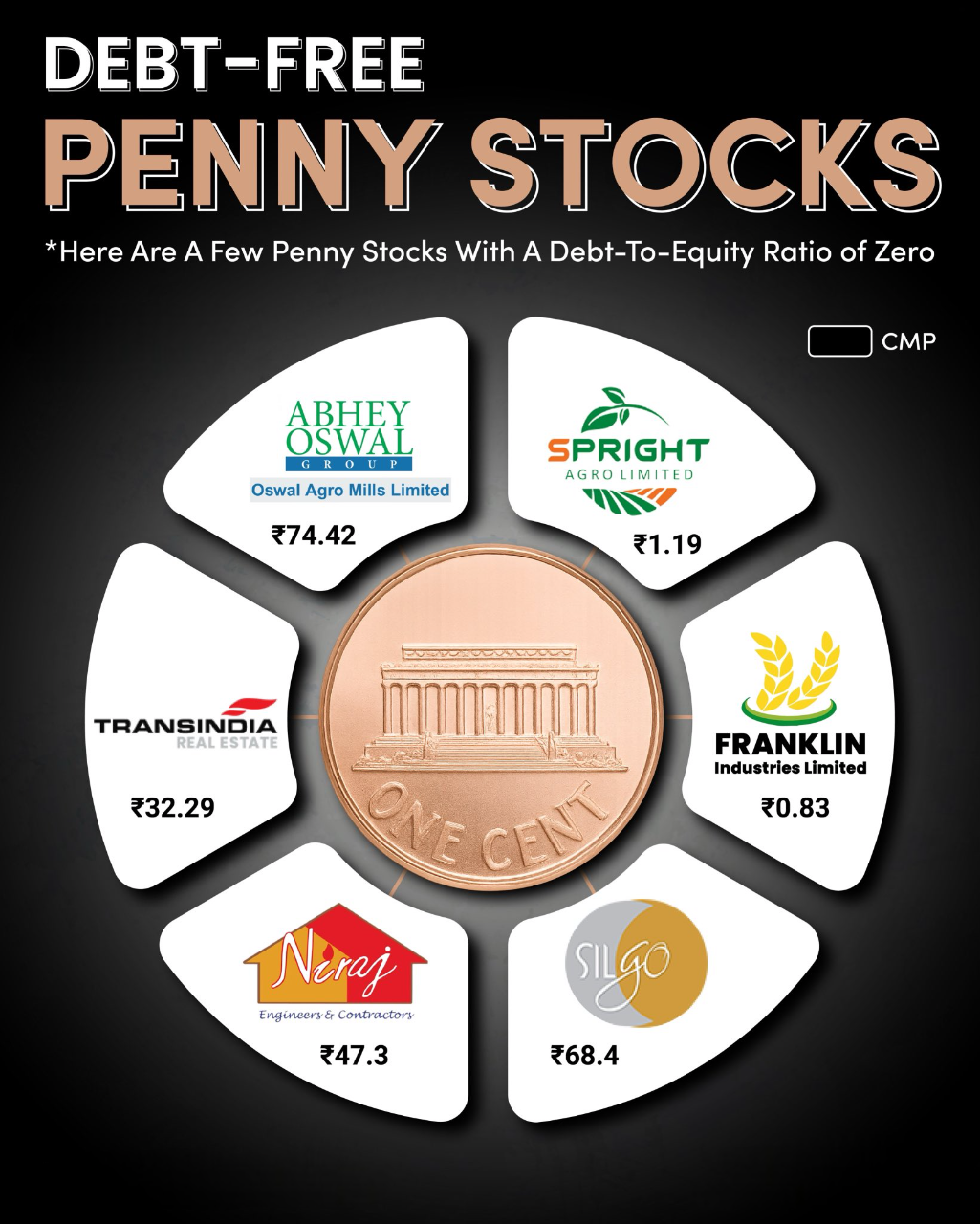

Debt-Free Penny Stocks to Watch in 2025 When it comes to penny stocks, financial health matters the most. One strong indicator is the Debt-to-Equity Ratio – and a zero debt ratio signals a company with no debt burden. Here are a few debt-free penn

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

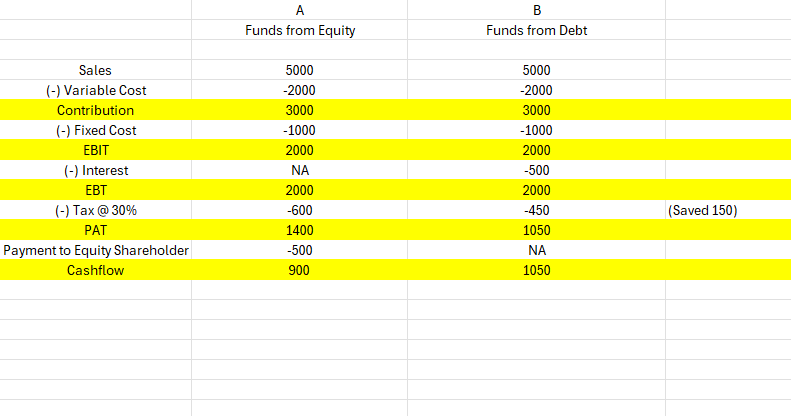

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Equity Equity, in simple terms, is the money that is returned to all the shareholders of a company, if all the company's assets are liquidated and liablities are paid off. It is also a measure of the financial health of a c

See MoreOmkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)