Back

Anonymous 2

Hey I am on Medial • 8m

Investors prefer equity funded companies" - tell that to every PE firm doing leveraged buyouts. Debt is cheaper than equity when interest rates are low. This oversimplified advice could make people miss good investment opportunities.

Replies (1)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

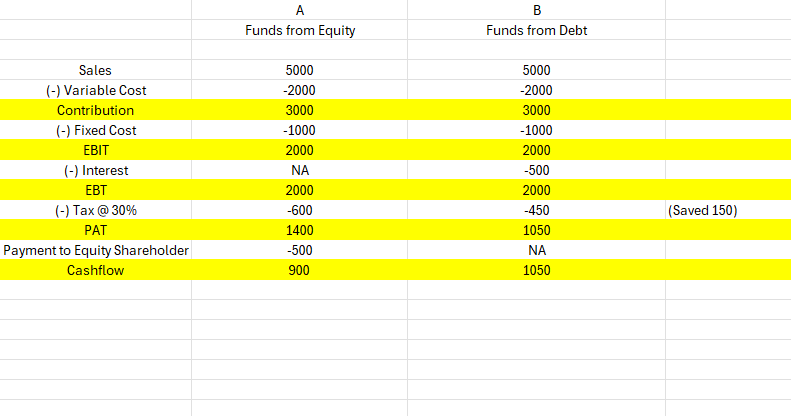

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Aryan Kapur

Director at PEMD Ltd... • 1y

I run a private equity firm in London with my dad, PEMD Ltd. part of the PLMD Group, plmd group manages over £23M worth of properties/assets and now we want to make our name in private equity, perhaps having capital, we prefer to work with investors

See MoreVivek Joshi

Director & CEO @ Exc... • 1m

🚨 Seeking Investment-Ready Solar Platforms in India 🇮🇳 Excess Edge Experts is connecting Solar Power companies with VC, PE, and Infrastructure funds. We are looking for platforms specializing in OPEX/RESCO and CAPEX models for C&I and Government s

See More

Vivek Joshi

Director & CEO @ Exc... • 1m

🚨 Seeking Investment-Ready Solar Platforms in India 🇮🇳 Excess Edge Experts is connecting Solar Power companies with VC, PE, and Infrastructure funds. We are looking for platforms specializing in OPEX/RESCO and CAPEX models for C&I and Government s

See More

Vamshi Yadav

•

SucSEED Ventures • 9m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)